Hive is a very volatile currency so usually I don't even try to speculate. Lately I've been giving it a whirl because the moving averages seem to be pretty significant most of the time. I'm tracking the 25, 50, 100, and 200 day moving average. Yes, my graph is very busy, but I think each one of these averages has a story to tell.

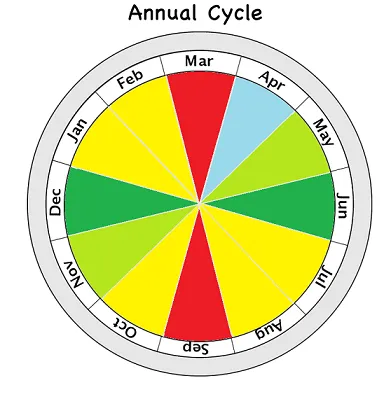

Above I've marked the death-crosses in the red boxes and the golden crosses in light blue (should I have used gold?). Ever since we peaked at Thanksgiving during that insane run up to $3.40 we've been getting hit pretty hard on the downswing. That being said, November was quite a while ago, and we've had so many death-crosses that all we can do from here is basically golden cross. This setup right before a potentially bullish summer looks pretty good to me.

Hive gets a lot of blow-off tops.

Normally they would look like that. We get dead-cat bounce after dead cat bounce until the price stabilizes, then we get one last final devastating dumb right when we think we are safe. The most recent pump and dump signals to me that we very well might be back on the way up, as volatility has increased over the last few weeks, not decreased. We are also forging higher and higher lows, and there are tons of developments happening on the network.

20% HBD yield.

While I'm not the biggest fan of this move, I also don't necessarily disagree, especially in the short term. It's going to be a fun little experiment. Also it's the kind of mechanic that will almost certainly push up the price today and we won't have to pay for it until later when a significant amount of HBD has been printed and demand for it starts to go down. Something like that can't happen in the next couple months, so in the short-mid term there's every reason to be bullish on Hive.

MA(200) is my favorite.

Just look at that monster. It hasn't even started going down yet even though we've been trading under it for a while. Hopefully this line will flip support and we get a fresh round of hyper-bullish golden-crosses. In a world of crazy volatility, the MA(200) certainly is a nice anchor that doesn't move around a whole lot. It does average more than half a year's price action, after all.

7, 25, and 100 are the defaults.

At least they are on Binance/Mandala. I feel like there is probably some self-fulfilling prophecy going on here. Golden/Death crosses between the MA(25) and MA(100) seem to be very significant because everyone looking at Binance pairs sees them by default. I stopped tracking the 7 because it's largely worthless IMO and added the 50 and 200. And wouldn't you know it, we are basically golden crossing today, with the MA(25) moving higher than the MA(100).

Considering where we are in the market right now this seems highly bullish. The bearish 2-week cycle is ending soon. Taxes are due on the 18th. By all accounts I expect that late April will regain most of not all of the losses we've sustained so far this month. That's what April does: it trades sideways and is usually a great month to buy in (unless Elon Musk and Michael Saylor are manipulating the market like last April... and even then it was still basically sideways as the crash didn't come until May).

Tight Band

While Hive's price is coloring outside the lines, the difference between theses lines has narrowed quite a bit over the last 5 months. Certainly this is to be expected after the blow off top that we got, but it seems bullish that the lowest one MA(50) is still at $0.97 while the highest MA(200) is rocking $1.12. That's only a 17% gap. Could this be the calm before the storm? Again, with this setup all we can pretty much do is golden cross right before a potential 18-month bull market the likes of which we haven't seen since late 2020. Exciting times (maybe).

Other projects.

We have Ragnarok coming out that will act as an HBD sink (claimdrop incoming April 20th (420 bro). We got the SPEAK network doing it's thing (I bought some miners for cheap). We got Polycub leveraging the HBD yield into an actual liquidity pool paired to USDC on Polygon. We've got HAF coming out soon. We've got RC delegations coming soon. We got dLux, we got psyberX sci-fi first person shooter... like... god damn... there is a lot of stuff going on at Hive and there's a bunch of stuff going down that I don't even know about. I maintain that we are still grossly oversold. I'm mad bullish right now.

Will I play it? I dun know... but it certainly can't hurt that it's connected to Hive in a big way.

80 cents still the ultimate support.

And by "ultimate support" I mean the support we get if we don't get that last final dump at the end of our blow-off top shindig. More conservatively our real ultimate support appears to be 50 cents, which obviously would suck but it's hard to complain when you bought most of your stack in the 10-20 cent range.

Selling targets

There's still heavy heavy resistance in the $3-$10 range. Tis a big range, which is why we DCA. Price goes to $3, sell 5%. Price goes to $4? Sell 5% more. $5? 5%? So on and so forth. It's actually really hard to make bad trades in crypto when you DCA because the biggest danger in crypto is the volatility. DCA defeats volatility, making trading the market much much easier, and less stressful as well.

Not only does DCA defeat volatility, but it also provides a desperately needed service to the network itself: adding liquidity to the market. It's no secret that Hive liquidity is notoriously low and it's difficult for whales to enter and exit without incurring quite a bit of slippage. By DCA selling when the price goes up we provide coins to those who want to buy the peaks, and buying the dip allows users to sell the lows. Buy low sell high... this is a lot easier to accomplish when one isn't trying to time the market perfectly and is constantly shoving all in to one direction or the other. Just DCA... it's not hard (until you actually try to force yourself to do it and you get greedy).

Mile Markers

It would be very bullish to be trading above the MA(200) by the end of the month. Then if the dip bounces off the MA(200) as support I think we can expect crazy things to happen come summertime. On the contrary, if Hive price gets less and less volatile over the next 2-4 weeks we should be worried about that one last flash crash before we can start to rebuild. We'll need to refactor in two weeks after we've been in the bullish 2-week cycle for a while.

Conclusion

Many traders trade around the moving averages. Is it legitimate technical analysis, or is it self-fulfilling prophecy. Does it matter? Number go up.

But more than just price speculation, there are over a dozen exciting fundamental developments coming down the pipe for this network. Hold on to your seats, it's gonna be a wild one.

Posted Using LeoFinance Beta

Return from Market Watch: Looking at Hive's Moving Averages. to edicted's Web3 Blog