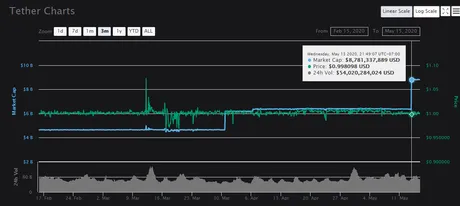

Billions more Tether were printed yesterday morning.

From 6.4B to 8.8B overnight!

How do I interpret this information?

As extremely bullish.

Billions of dollars are sitting on the sidelines just waiting for the opportunity to jump into the market.

What could they possibly be waiting for?

There are three answers on that front.

1. Halving History

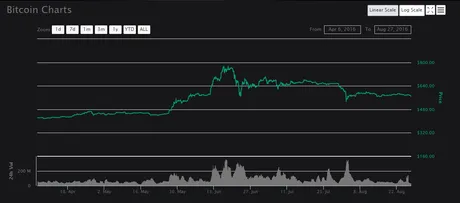

Many speculators are betting on one last dip before the meteoric bull run that we normally see after the halving event. They are betting on it happening this way because that's the way it happened last time, and so far the pattern is pretty identical.

This is what the halving event did to Bitcoin 4 years ago.

Here's where we are now.

Personally I won't be betting on it doing the same thing it did before. This market is completely different than 4 years ago, and I think we are starting to see that divergence in the graph (more support and volatility and volume). Going bearish here is extremely risky in my opinion. Yeah sure, you might miss out on a 10%-20% gain by shorting the market, but you also might miss out on a ridiculous spike caused by reason #2.

2. Reopening Economy

This is the main reason why so much money is scared to enter here. Wouldn't you be? Say you run a business and have no idea if you can afford to put money into a risk-on asset like Bitcoin right now. A lot of Bitcoin investors usually know what their profit margins are going to be like a few months in advance. Nobody has that information anymore given this unprecedented situation. Therefore, it becomes obvious that the safe play is to simply wait for the news about when the economy is to reopen.

Even Bitcoin investors that don't run a business still need to speculate on the fact that a bunch of other investors are in the dark. Personally I would get in now (I did) before the rush. The safer play is to wait so we know that retail won't dump on us again.

There is a lot of volume right now.

A lot of money is changing hands. Many are betting on a dip, and many are taking the other side of that bet. From my point of view it does not look like the market is going to calm down any time soon like it did four years ago. There is no reason to remain calm in this situation, and I feel like Tether minting those 2.4B coins overnight is proof that a lot of money is just passively-aggressively waiting on the sidelines right now. Don't forget, there are plenty of billions more just sitting in USD on the exchanges that we don't even know about.

3. Stock Market Decoupling

Let's be honest, the stock market is probably in a world of shit for the next two years at least. That's how long legacy bull markets last. Meanwhile, Bitcoin lost half its value on day one and has already recovered all of that lost value a month later. It's honestly pretty incredible.

When investors realize that Bitcoin is going up and stocks are going down, what do you think is going to happen? If even 1% of the money from the stock market gets pumped into Bitcoin, we are going straight to the moon. That is a fact. Look at how many trillions of dollars the Fed has printed in the wake of this shitstorm. Meanwhile, Bitcoin's market cap currently sits at $173B.

If you remember the lessons I've done on liquidity, pumping $200B into Bitcoin would not raise the market cap by $200B. In all likelihood, liquidity would get drained very fast and push the market cap up several factors higher than the actual amount of money that was put in (even as high as x10). The only thing that determines market cap is what price holders are willing to sell at. If no one is selling anymore then there must be price discovery to a higher price to tempt bulls into turning bearish.

Let's not forget that real Bitcoin bears are actually still long-term bulls. You can't be a real Bitcoin bear unless you actually have a shit-ton of Bitcoin and you think it's overpriced. The only bears that matter are the whales that control Bitcoin. Every year that goes by, more of their stockpiles are going to get slowly bought out by the rising tide of price action. Bitcoin will become more stable as more entities start holding and valuing it as the extremely scarce asset that it is.

Conclusion

This market is heating up, and it's only a matter of time before it boils over. The only thing I'm worried about is a "double-bubble" situation caused by this failing economy that would cause me to turn bearish too early. More on that later.

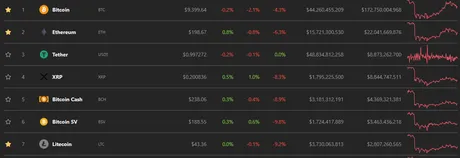

You know something is up when TETHER is the #3 coin on the market cap list.

That is EXTREMELY TELLING.

Stay frosty.

Return from Market Watch May 15: Tether Flips XRP to edicted's Web3 Blog