Once again the market rubs my nose in it.

Mark my words, we probably get a 5 to 10% bump tomorrow just because it's not September anymore.

In any case...

I'm expecting October to be an okay month for crypto.

Let's take a look at where we were at 4 years ago.

Bitcoin Oct 2016

Pretty much a gradual ascent upward to the end of Q4, as we've seen many times.

I don't expect things to play out exactly the same, but I do expect we will start trading higher than the doubling curve this month.

2020 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $6933 | $7467 | $8000 | $8533 | $9067 | $9600 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $10133 | $10667 | $11200 | $11733 | $12267 | $12800 |

Where does that put us?

BTC 'should' be trading above $12k by the end of the month. Pretty good considering how fearful the market is at this point.

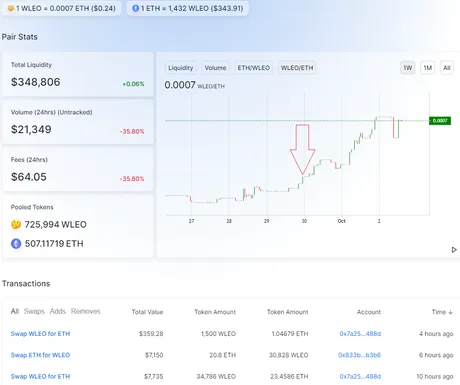

ETH dip forces wLEO dip.

If we look at the wLEO market, the price of ETH is largely irrelevant in terms of dumping. We are a community of zealot holders, and ETH going up in value is not going to spur much more selling pressure than we already have. This will become an ideal scenario if ETH does what I think it's going to do (x3 over 3 months).

If ETH does indeed pump/dump x3 for COVID Christmas, that will automatically bump up wLEO x3 as well. Again, I don't think selling pressure will increase for LEO just because we got a USD bump vicariously from ETH.

wLEO is turning into real money.

Yesterday I tipped one day's worth of blogging/curation rewards to @whatsup and @geekgirl due to a random interchange on Twitter. I do that from time to time, but normally 100 LEO is a very small amount... usually $2-$4...

Now it's $25... what!?

For a scrapper like me who's been broke as a joke their whole life to be able to burn $50 like that is actually a pretty big milestone for me. I think it's money well spent as the whales of LEO attempt to generate more hype going forward.

Generating hype.

So if I can earn 100 coins a day in pure inflation alone... $25 a day... $750 a month... really? This is no longer a pet project. I can straight up pay rent right now with LEO blogging rewards and still have money left over. That is bonkers.

Considering I live in one of the most expensive places to live in the world (San Francisco Bay Area), it gets even crazier knowing the value of these borderless tokens is far more valuable elsewhere. How much is $750 a month worth in a developing nation? Anyone can earn these tokens in any place that has internet access. Cost of living matters. Simple as that.

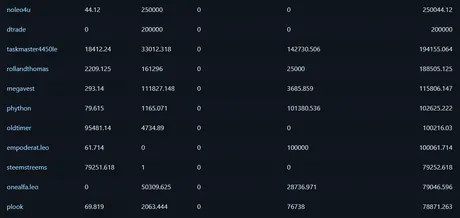

@taskmaster4450 and @taskmaster4450le

When I heard that Task would just be powering everything up and not providing liquidity to the wLEO pool I was slightly confused and annoyed. Doesn't he want to support this community as the top stake holder? Isn't the 300k bounty a good enough incentive?

Contemplating it more though...

It's actually quite a good strategy. Everyone has their part to play. As we onboard users from ETH what are they going to see?

Are we seeing a pattern yet?

@taskmaster is positioning himself for maximum exposure to the social side of the community. He's decentralizing the coin by upvoting accounts that don't get a lot of upvotes. How much is that worth going forward? Probably quite a bit.

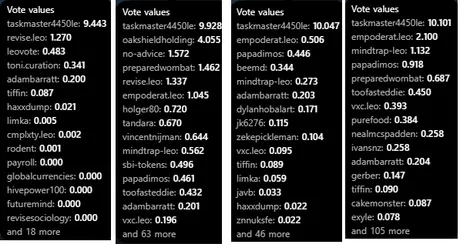

These are 30% upvotes

When a single upvote is worth over 30 coins and a coin is trading for a quarter... that's no joke; already $75+ a day. What happens if LEO is trading for $1? All of a sudden we may start approaching that "life changing money" status.

So yeah, in the short term one might be able to yield farm a good amount of LEO from the Uniswap pool, but at what cost?

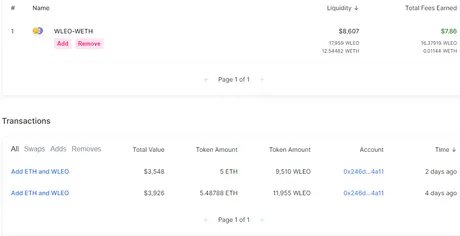

Exhibit A

Take a look at my yield farm... notice anything? I put 21,465 LEO into this pool but I can only currently pull 18k out. This is the nature of providing liquidity. If wLEO moons it means wLEO is being taken out of the pool (my wLEO!) and being replaced with ETH. I only put 10.5 ETH into the pool but I can now remove 12.5 ETH. In essence 2 ETH has been traded for 3.5k LEO; at these prices that means I sold 3500 LEO for an average of 20 cents. Seeing as LEO is currently trading for 25 cents I've obviously lost money.

Also, think about the tax implications. You own two assets that automatically change in size based on the actions of other people paired with an algorithm? Wow, the IRS sure is in for some serious confusion going forward.

So am I mad that I've "lost" money on this trade? Not really. We'll have to see how it pans out over the next three months and add in the 300k bounty before I make any real judgements on the matter.

There's also the issue of Bitcoin reserves.

See the red arrow? That's where I bought the buy-wall at a 1.2 ratio to Hive.

LEO: Prepare for moon!

When I bought that wall I used Bitcoin reserves, and I became extremely unbalanced in terms of my holdings. I took a HUGE risk with LEO because I saw unstoppable upward action.

Therefore, the more LEO that gets transferred into ETH automatically from providing liquidity actually anchors me more to reality and lowers my risk in the market. I'm pretty happy with how it's turned out thus far.

Still, if you're an ultra-mega-bull on LEO you'd be pretty mad if LEO mooned and you thought you were farming the pool only to realize you had less LEO then when you started. Something to consider.

That being said, if the Total Liquidity doesn't increase much higher I'll get a good yield on the bounty and stand to farm around 10k LEO (a full whale's share). Not too shabby. As long as the bounty provides me with more LEO than gets drained from the pool, it will be a net gain all around. Big if, honestly... wLEO still shows no signs of slowing down... and we haven't even gotten to November yet.

Conclusion

LEO is being sold to a yield farming community via wLEO and everything is going swell. When everything is said and done, many of these ETH yield-farmers may come to realize that LEO is one of the best farming coins out there. With @taskmaster4450 and the other whales out there dropping huge upvotes on new users, we can still stand to generate a massive amount of hype going forward. This run is far from over.

Return from Market Watch: October to edicted's Web3 Blog