Market looking pretty sexy...

Hive has been trading in between all the Moving Averages for the last week. I take this as a good sign. It also looks like we are going to narrowly avoid the painful death-cross between the MA(25) and the MA(200). If not we will likely death-cross and then immediately golden-cross, so it's pretty much a bounce off the MA(200) in either scenario.

Seriously though, look at this trading action.

It's very obvious that moving averages are very very important to Hive speculation. We are constantly trading around these lines. First we were trying to hold support at the MA(100), then we broke under MA(200). Then the MA(200) was batting us down for 5 days. Then we spiked up to the MA(25) twice. Then we spiked up to the MA(50) three times. It's been pretty wild to see how significant the moving averages have been lately.

The goal now is to trade above all the averages.

To get a fresh round of golden-crosses we need to be trading higher than the MA(100) at $1.35. Of course if we keep trading within this band for a while all the averages will begin to narrow/converge and we'll have to fight our way out of them. This is what I expect to happen; the calm before the storm.

On the fundamental side of things, Hive is looking madly bullish. I know for a fact that the market is undervaluing us even after the massive pump up from 10 cents brought us to where we are today. I maintain that we at least belong in the top 50, which means we basically need to get back to Steem's all time highs ($8) before this network is even reasonably valued at its intrinsic worth. Hopefully one of my other bags moons first so that I can get a bigger stack before that happens. Looking at you LEO/CUB. Get crackin.

Speaking of LEO

It's been such a long time since I've sold LEO. I've been stacking it for so long it's hard to remember a time when I wasn't stacking it. Last thing I remember was selling LEO into Hive at 3:1. Ah, those were the days. I sold down to 40k LEO and technically lost my "leader of the pack" status on Discord (of course no one actually changed it). Now I have 200k LEO powered up... and 40k in the LP paired to just as much BNB. Looking at my wallet I've already farmed 3k more just by posting and curation. I guess I'll be throwing that into pCUB when it launches sooner™.

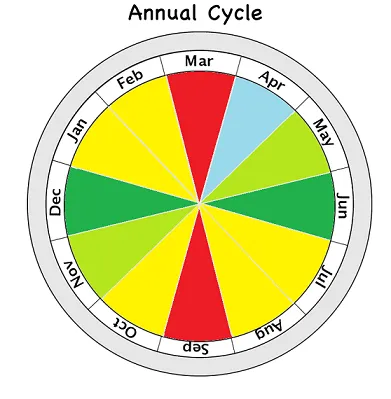

On the Bitcoin side of things volume is healthy (and currently increasing) and we are breaking above $45k during the bearish new moon cycle, which is pretty awesome. Given the local bottom confirmation at $33k and a full moon incoming on the 17th, I have to conclude that, like all February's before it, this one is going to be bullish for at least the first 3 weeks, and even more likely the entire month. Deflating since November in terms of time and momentum has done us a lot of favors on this bounce.

That being said I think the market is going to get absolutely CRUSHED during the first two or three weeks of March, as is often the case. Tax season is not pretty, and this global economy is on life support something fierce.

In fact, if March is actually bullish, I'm going to start losing my shit because that would signal to me that we are still in the middle of a super cycle and the 18-month bull market pattern could turn into a delayed mega-bull run; the one we were expecting in December. It's still possible because we never actually deflated to the doubling curve logarithmic trendline. However, more realistically I think March will do what March always does, which is sideways at best and down at worst. Definitely be ready to buy the dip in March... even if it doesn't happen we should still be ready for it (if only a little bit). Hedge your bets.

Matter of national security.

The Biden Administration has yet to reveal what their executive order regarding crypto regulation and "national security" is. Given their history most people are thinking it can't be anything good. Yet, we know exactly how corrupt government is. We know there are big-money players insider trading this market who know exactly what the president is going to say about cryptocurrency.

So what are these insider traders doing?

I mean call me crazy but it looks like they are buying and longing Bitcoin. This signals to me that the upcoming announcement is either a completely irrelevant non-event or it is actually bullish to the market, and will provide regulatory clarity for institutions that allows them to dump more money into the system.

In all likelihood it's going to be a non-event and is simply all part of the stupid peacocking dance against "Russian Aggression". As if Russia is the ultimate imperialist nation of this world . Gotta love those manipulators. Great work, fellas. Russia moves to regulate crypto so now Biden has to counter by executing a meaningless order that has little relevance. "We have to make sure we don't stifle innovation or we will fall behind China!" Business as usual.

Seems to be a constant theme that every government wants to ban crypto but they can't ban crypto because it is the greatest technology humanity has ever invented. Crypto makes the Internet whole. The Internet of today was supposed to be what the Internet was in the 1970's. Only now after solving the Byzantine General's Problem has the puzzle been completed.

The transition away from all of the corrupted centralized systems we created to fill that hole is going to hit hard. It is unavoidable, and government doesn't seem to understand this yet, and instead choose to ban/unban/ban/unban crypto in an endless loop. "Does not compute! We must maintain control!" Yeah, well, wish in one hand and shit in the other, government. You lose.

Conclusion

At this point it doesn't really matter what the market does, but it's fun to guess anyway. There's so much actually development going down that even if price doesn't reflect value we can still rest easy knowing that the recovery will be swift and epic.

November and December and January were bearish. This gives us a ton of dry powder to bounce in Feb, even if it's a dead bounce that's doomed to deflate in March, the rest of Feb should still be pretty damn good. Even if we retest $40k in the next week I still expect that we'll see at least see $50k and perhaps even $55k by the end of the month. But again, I'm not going to make any big trades based on this prediction. Balanced and hedged positions are definitely the way to go. Be ready for anything. Easier said than done.

Posted Using LeoFinance Beta

Return from Market Watch: OVER THE LINE! to edicted's Web3 Blog