So we broke out of the triangle like I was talking about a couple days ago. Then bears tried to aggressively cause a panic and squeeze the longs. Looks like it didn't work very well. All this happened within the last couple hours with a mini-flash crash to $28k and then an aggressive pump back up.

It's key to accept that the Bitcoin market has now completely decoupled from the stock market, and that's a great thing. The stock market has been recovering lately, and Bitcoin has underperformed on every single recovery in the stock market.

Looking at the S&P 500, Dow Jones, and Bitcoin markets over the last 30 days, what do we see? There was kinda sorta a correlation during the first half but as soon as BTC started trading below the doubling curve trendline that correlation completely went away.

This is something I've talked about extensively, that there really is zero correlation between the stock market and Bitcoin. Or rather, the correlation that we see is completely useless information. This should be obvious for an asset that is literally doubling in value on average every year. How could that possibly be correlated to the stock market in a way that is useful to us?

Devil is in the details.

Bitcoin could be "correlated" for 364 days out of the year, then the one day that it wasn't correlated is where it made an x2 gain. That's how crypto works, if you try to time the market you'll often miss out and do worse than the people that simply hold through the bad times.

But again I'd like to reemphasize that when BTC is trading under the curve like this, it becomes extremely uncorrelated. That's because once we are scraping the bottom below the curve many of the risk-on traders from the stock market that are capitulating and transitioning to risk-off investments.

That means most of the institutional investors involved in Bitcoin have already dumped pretty much all they are going to dump at this level. Now the market is back in Wild-West territory. We are in a position of extreme consolidation, and this flash dump down to $28k and immediate recovery shows there is massive support here, which should have been obvious before hand because we are grinding below the doubling curve. This just further proves it to be the case.

https://www.zerohedge.com/markets/did-fed-just-signal-when-rate-hikes-will-end

Zerohedge analysis (BOLO September)

This guy seems to have a very good beat on the finer details of the global economy. Many people have been talking about the FED possibly backing off on raising rate in September, and I wasn't exactly sure why because I don't follow that stuff very closely.

while most Fed officials agreed that the central bank would continue to tighten in 50bps increments over the next couple of meetings, continuing an aggressive set of moves that would leave policy makers with flexibility to shift gears later if needed, it may not last long at all.

And, as Cignarella concludes referring to the Fed's updated PCE forecast (which ends 2022 at 4.3% but then drops to 2.5% in 2023 and 2.1% in 2024), "if their forecast is accurate, it would imply the next expected three half-point rate hikes would be the end of the current tightening cycle and set the stage for a major risk rally into second half of 2022."

So we are hoping the FED is right about something?

Hm yeah kinda, but they can still be right for the wrong reasons. When we assume that most of this "inflation" is actually the result of deflation of goods and supply-chain issues, then yeah, "inflation" is going to go down, not because the FED has been doing a good job by raising rates, but because corporations hate losing money and they are figuring their shit out and pivoting around all the supply chain bullshit that's happened because of COVID and sanctions against Russia.

So yes, the data very may well show that the FED is "doing a good job" when in fact the recovery happened because of completely different variables that weren't even considered. What happens then? The exact thing I've been talking about this entire time: the market is oversold because it was foolishly trying to price in a recession. OOPS!

it would imply the next expected three half-point rate hikes would be the end of the current tightening cycle and set the stage for a major risk rally into second half of 2022.”

Again I've been talking about how it would be nice if it happened this summer, but many people out there seem to think this is too early. I'm not so sure. I think those 3 rate hikes might be already priced in and the current recovery in the market shows it. You know what hasn't recovered yet? Bitcoin... which kind of blows my mind. It's so hilariously oversold right now and everyone is talking about a crash to $20k. Nice try.

Of course a crash to $20k could happen if some disastrously unforeseen event happens that cripples the market, but it's not possible to trade the market with something like that in mind. Personally I'm more than willing to be all in here, ride Bitcoin down to $20k in the worst-case scenario, and then leverage long into the inevitable recovery. Perhaps I'm beating a dead horse by constantly reiterating this strategy. Certainly not being all-in is also an option, but degens like me gotta degen. Gamble gamble.

I think it is unlikely we see the Fed pivot at this stage in the tightening cycle." After all, Powell said that he and the Fed need to see material evidence of slowing inflation. So, with "the September Fed meeting one where we could see a pivot, that essentially leaves 3 more CPI prints to prove the case (the release date for August CPI is Sept 13 which falls within the Fed blackout period)." This may explain why earlier this week Bostic also hinted that the Fed could pause in

September.

This is why people are talking about September.

They expect the FED to do what they said they were gonna do and then regroup in September when the data comes out that shows if inflation has been slowed down or not. I think inflation will have slowed down, and I think that slowdown isn't going to have anything to do with raised rates. Or rather, the raised rates will have helped a tiny bit but the real issue is corporations figuring their shit out with the supply lines.

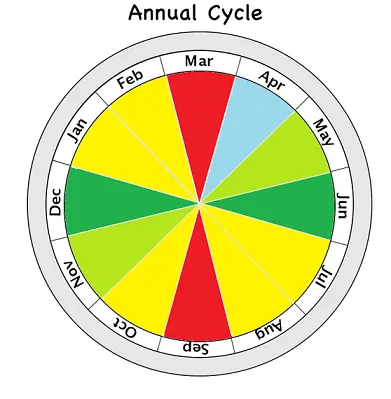

September eh? Interesting.

As far as market cycles go, September is usually a nice bottom to buy in anyway. Now with the possibility of September being the moment when the FED comes forward and declares victory over inflation and they will stop raising rates? Hm, that's interesting. That's very interesting.

At the same time it's very difficult to imagine that Bitcoin is trading much lower than this during June/July/August. Meaning in my highly unprofessional opinion now is still the obvious time to buy and go all in (on Bitcoin anyway). Alts are still risky as hell. No promises there.

I think this is a very reasonable expectation.

And again, it really falls in line with my predictions perfectly. Market tried to price in a recession, market failed miserably like it always does. Now we are oversold until the actual recession hits. I still think we have one bull market left before this all crashes into the mountain. Someone remind me to take gains when we're all riding high on that drug we call FOMO.

Posted Using LeoFinance Beta

Return from Market Watch: PSYCH! to edicted's Web3 Blog