So it's been exactly one month.

BTC has been consolidating under $60k for exactly one month, but of course everyone is looking for a reason for this sudden bump. I've said it before and I'll say it again: the news does not affect price. The news is simply a catalyst for where the price was gonna go anyway.

Coinbase is unlike any market debut Wall Street has ever seen

Coinbase is poised to command an astronomical valuation when the digital currency exchange goes public on Wednesday. But ask 10 market experts how the company should be valued, and you’ll likely get 10 different answers.

That’s because Coinbase’s current business — the one that produced a whopping $1.8 billion of estimated revenue in the first quarter and up to $800 million in net income — is built almost entirely on the performance of bitcoin and ethereum.

Should Coinbase hit the public market around its latest private market valuation of $100 billion, taking into account a fully diluted share count, it would instantly be one of the 85 most valuable U.S. companies.

Mega-bubbles gonna Mega-bubble.

Surely, Michael Saylor has also increased the valuation of Coinbase due to his incessant corporate crusade to get everyone to list BTC as a reserve asset on institutional balance sheets. Saylor has been teaching all these bigwigs how to use bots to buy BTC off of Coinbase Pro slowly, as to not spike the price or create massive buy walls.

This has led to the price of Bitcoin going up over time in addition to massive volumes on Coinbase, forcing arbitrage traders to send BTC from all the other exchanges to Coinbase to bridge the premium gap.

Q2 is just getting started.

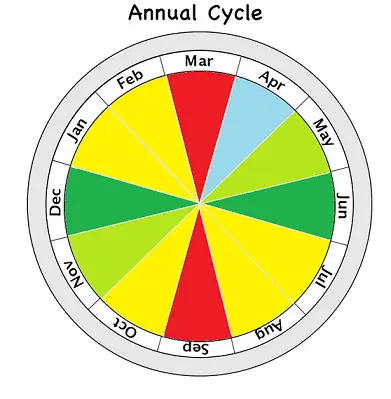

This is just the beginning. By my count, BTC should basically just go up for another 2 months straight as we approach summertime.

This pattern pretty much mimics what we saw back on December 15th when BTC was consolidating below $20k for a month straight. Once we broke that resistance the pressure built up just kept mooning till we hit that temporary blow-off top around $40k.

If we end up spiking to $120k relatively quickly I expect the same thing to happen. Might be a good time to swing trade the dip. I'll circle back to that scenario if it actually happens. In reality Q2 ramps up a bit lower than Q4 spikes, so I think this run up will be a bit more gradual. I'll be on the lookout again to determine when the market becomes unstable, as we usually see a peak about a week after the first significant flash-crash. Hopefully this happens sometime in June... likely early June considering we've started this run a little early.

Again my target for the end of the year is $250k-$400k, so I'll be a little worried if we get up to $200k this summer. That could either signal that we've reached the real peak and the bear market is about to start, or that this is the biggest mega-bubble of all time. I lean toward biggest mega-bubble, but at the same time I'll selloff 5% just to hedge to the downside. Better safe than sorry.

BNB

Hopefully BNB chills out for a while and consolidates here. It definitely got a head start on this run and I expect sideways action for at least a week before we can move up again. I'd be very surprised if BNB crashed lower than $475. Even at these jacked up prices no one seems to be worried about buying these all time highs. The fundamental gains from BSC haven't even come close to being fully realized, and the market knows it.

LTC

As BTC and ETH fees skyrocket, many will ragequit to LTC and BNB. LTC still hasn't hit all time highs, and it's last halving event was August 2019, an event that I believe still hasn't been priced in. This summer could be huge for Litcoin fans. I really need to get some of my stack back ASAP, as I dumped it all for the CUB farm at launch.

Cub Kingdoms

That contract collected the LP rewards on other platforms and utilizes it to reinvest in the base pool assets. Cub Finance also adds a small multiplier to the contract which means that users earn both the LP incentives that other platforms pay and then earn CUB on top of that APY.

This is something I wasn't fully understanding before. Cub Kingdoms are going to be double-dipping on farm rewards. Not only will they earn CUB, but apparently they will also be farming other contracts on the BSC network.

https://peakd.com/hive-167922/@leofinance/cub-finance-audit-is-live-or-usd20m-tvl-kingdoms-update-and-leobridge

- Pool capital (BTC, ETH, DOT, BNB) in a Kingdom vault

- Kingdom smart contract pools on another BSC platform (i.e. Goose or PCS)

- Kingdom contract earns EGG or CAKE LP rewards

- Kingdom autosells EGG or CAKE for the base asset (BTC, ETH, DOT, BNB) and compounds it in the user's pool position

- Kingdom contract also earns CUB rewards and sends to the user's wallet to harvest

- User is earning APR in the base asset + CUB

I did not realize the kind of synergy and incentives we were going to be getting out of these contracts. All I was hearing before was the auto-compounding aspect, which is pretty boring when you take it by itself. This gives us yet another way to reach out to other communities on BSC and lay down even more roots that suck up liquidity on the platform.

Pretty... awesomesauce.

Not to mention every bit of development CUBdefi cranks out is yet more proof that we are here for the long-haul and can be trusted not to pull any funny business. The audits are in, and CUB has been deemed one of the safest assets on BSC by CertiK: pretty good.

https://www.certik.org/projects/cubfinance

One piece of advice that CertiK gave CUB was to add timelock contracts: which we did. This makes it so that major changes are not allowed to go through without a 24 hour wait period. Theoretically even if the LEO dev team tried to rugpull, the network would know about it 24 hours in advance. Little changes in security like this can be a big deal for deep pockets.

And let's not forget all these developments bleed into LEO and the main Hive chain. So much synergy: so little time. Who knows how many eyes we get looking our way as everything moons.

Conclusion

Yeah, the world might be going to shit, but at least we're going out in style! Number go up, amirite? The mega-bubble continues, and it seems like every network is absolutely unstoppable. All good things must come to an end, but I believe we still have a good 9 months of crazy left before this thing crashes into the mountain. Enjoy the 4-year cycle while you can, friends. We don't get another one till 2025.

Posted Using LeoFinance Beta

Return from Market Watch: Q2 Bull Run Officially Begins Today to edicted's Web3 Blog