Coinbase Delisting XRP

I mean obviously we all saw this coming a mile away, but seeing it actually play out is still surreal for me. Of course, none of us are surprised by this. I'm not sure if any of my dear readers are even bullish on XRP. I have always broadcasted that it is a centralized piece of garbage that deserves what it gets. It's very clearly a security via Ripple Labs.

However, none of this makes me feel any better about the situation. In fact, I feel kinda bad for the XRP Army now. Everyone on Hive knows what it's like to deal with crippling adversity, and now the regulators are bringing the pain down on XRP investors for literally no other reason than to fund their own for-profit red-tape machine. Make no mistake, the SEC doesn't care about protecting XRP investors and is actively doing them harm by allowing this to continue for seven years without any kind of clarification or warnings.

RIP?

It doesn't matter what my opinion is, and it doesn't matter what the rest of the cryptosphere thinks either. XRP is here to stay. They might have a toxic and aggressive community, sure. Perhaps they are even downright delusional. But damn it! They are zealous as hell! And zealous communities can not get taken out so easily. Just ask Hive.

Time is the great equalizer

That's the real kicker. Every year that goes by. Every XRP coin that Ripple Labs sells into the market: makes XRP more decentralized. Yes, 100% of all XRP might have been premined and under the control of centralized entities, making it a security. However, that's how almost every crypto starts: 100% centralized. That's the entire point of ICOs and the like: coin/wealth distribution.

What many people don't seem to understand is that crypto makes currency impossible to counterfeit. Yeah, it might start out centralized, but it's not like central banking where they are literally just allowed to print to infinity with zero oversight. Even the companies listed on the stock market are allowed to print more stock in the same fashion. You can't get away with that in crypto; the network does not allow it.

In this context it becomes obvious that even XRP is superior to fiat and the stock market: there will only ever be 100B tokens. Fiat can't compete with that even if the initial distribution was unfair. It becomes more and more fair over time. Even now, XRP is likely more decentralized than what any new project could ever hope to achieve without existing for years and years.

LEO?

Some might say that LEO is extremely centralized as well, and yes it is. It's easy to look at an account like @onealfa and think, "Hey... isn't it bad that this one guy owns more than 10% of the entire network?"

Is it?

The difference is obvious: all those tokens were 100% bought off the open market. The price of LEO has gone x10 and then x10 again for a reason. So what do you want? Higher token price or more decentralization? Because it's not very easy to get both at the same time. Many seem to forget that, which is why I'm still pretty bullish on Hive's low token price. Enjoy it while it lasts.

Also, decentralization only matters in the context of trust. We have to look at the distribution of a given network and ask ourselves: "Do I trust the big stakeholders?" My answer is a resounding 'yes'. I think LEO has one of the best distribution of tokens ever for a relatively new network. I alone own 1%, so it gives me a lot of incentive to build value here for everyone, including yours truly.

#BITCOIN

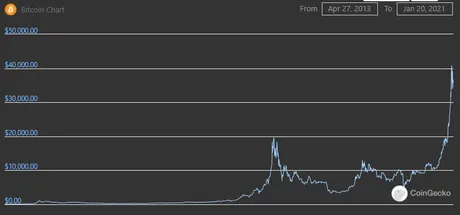

The inauguration has come and gone. Volume has increased to pretty good levels at 25k per day and the price continues to equalize around the $35k level.

Personally, I think the Biden Administration is tipping their hand quite a bit as we see anti-crypto sentiment start to leak back out into the news. The same tired arguments of terrorist funding and energy waste are back on the table. Increased taxes across the board are a given.

Q1

Quarter one has always been a bad time for Bitcoin, especially when trading significantly above the doubling curve.

2021 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $13867 | $14933 | $16000 | $17067 | $18133 | $19200 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $20267 | $21333 | $22400 | $23467 | $24533 | $25600 |

Yeah, remember the doubling curve?

Some of you seem to think that Bitcoin is now magically more than doubling in value every year now that we've bubbled up. I'm here to remind you that you're sorely mistaken. The value of one BTC is still less than $14k. Remember that.

Of course I believe that many corporations are honor-bound to defend the $20k level until we make it to summer and that level stands on its own. That still leaves us with a 40% drop to contend with over the next 3-5 months. I urge extreme caution trading these markets, no matter what decisions we ultimately make.

DCA ONLY!

Again, I think if we don't hit all time highs by the end of the month the rally is pretty much over for a while, and at this point even if we do break all time highs in my opinion that will be the top for the next few months.

No reason to panic...

In fact, I haven't really exited the market at all. Essentially I'm waiting for a much more obvious sign that the market will crash, which I think will end up revealing itself as a massive drop in volatility/volume as we continue to hover around this $35k equalizer.

Basically if we drop to like 12k BTC per day on Coinbase, half of what we are seeing today, I'll be worried. From there, 10k is alarming and 8k is a red-flag for an imminent drop. I believe such a drop will be around 30% as per usual, bringing us from $35k to the obvious $24k-$25k support line.

From this $25k support I obviously think we will eventually dip again to $20k where we get the hardcore institutional support. I think we'd only dip down to the $15k-$16k doubling curve in March given a pretty epic Black Swan event... obviously this could easily happen seeing as the economy is in shambles and the Biden Administration is not going to be crypto friendly during a severe economic crisis.

This illusion that Bitcoin can moon while the legacy economy bleeds is a bit absurd. Money flows like water, and when the river runs dry everyone will suffer except those who shorted the market. If the Nile doesn't flood, there will be a famine. Better store up enough surplus in those granaries to make it through the hard times.

It's also important to note that I'm usually wrong and every technical analyst seems to think we are still in a bullish channel. Honestly the overwhelming consensus that we are going up is just another reason why I think the market is going to crash. I've seen this happen plenty of times.

Reactive Reasoning For Bitcoin Crash

When Bitcoin crashes, people freak out and flip shit. Everyone is looking for a reason for why the market crashed after the fact. Spoiler alert: the reason the market crashed is because it crashed. There isn't a rhyme or reason, it was just bubbled, as the doubling curve shows us time and time again.

Reason #1: Chinese New Year

Ironically, this year is the Year of the Bull (ox). So while we kick off the new year that is literally symbolic with the market going up... I think the market is going to crash... lol.

2021 is a year of the Ox, starting from February 12th, 2021 (Chinese lunar New Year Day) and lasting until January 30th, 2022. It will be a Metal Ox year. The recent zodiac years of Ox sign are: 1961, 1973, 1985, 1997, 2009, 2021, 2033… An Ox year occurs every 12 years.

Hm... what's a 'metal' ox?

Types of Oxes Metal Ox: Hardworking, active, always busy, and popular among friends.

Water Ox: Hardworking, ambitious, tenacious, and able to endure hardship, with strong sense of justice and keen observational abilities.

Wood Ox: Restless, decisive, straightforward, and always ready to defend the weak and helpless.

Fire Ox: Short-sighted, selfish, narrow-minded, impersonal, but practical.

Earth Ox: Honest and prudentive, with a strong sense of responsibility.

https://www.the-sun.com/lifestyle/1546071/chinese-zodiac-signs-metal-ox-what-year-is-it/

Wow... look at that!

Barak Obama & Carrol Baskin are Metal Ox... yikes! lol... 1961 was a BAD YEAR :D It only comes around once every 60 years.

Now that you mention it...

This is actually connected to my Pentaskill dapp that I never completed. Heh, someone already introduced me to this concept... totally forgot about that. Checking... files...

Metal and wood instead of lightning and wind... close enough.

The point here is that Chinese New Years always gets blamed for the dump in February.

So what do people blame the dump in March on?

Taxes, of course... happens every time. February and March are bad months for crypto, and there's no reason to believe this time is going to be any different, especially with how bad the economy is doing.

But what about dat inflation doe?

As @taskmaster4450 spells out pretty clearly: there isn't going to be any inflation, at least not at first. Inflation occurs when money enters circulation and inevitably floods it. Even in the face of obscene money printing this isn't going to happen because not only are people afraid to spend their money because the future is uncertain, but also we are facing obvious lockdowns due to the COVID... threat. I struggled to not put quotes around that.

So what do we get?

Yeah, there's going to be money printing, but the velocity of money is going to continue bottoming out. Very little money will actually enter the economy and be circulated throughout it, and in all likelihood this economically devastating trend of deflation will continue, increasing the value of a dollar... which decreases the perceived value of Bitcoin and crypto.

Combine deflation with potentially crippling regulations on centralized exchanges, increased taxes, and an administration that's breathing life back into the tired "domestic terrorist" argument, and we have a recipe for a very poorly performing Q1, something that was expected anyway without all the ominous signs being stacked on top.

Conclusion

It is such a bittersweet victory to see XRP falling from the ranks of the market cap (now down to #5 from #3). It was supposed to fail because of unsound practices and centralization, not because regulators decided to attack the low-hanging fruit under the guise of "protecting investors". Seriously though, who do they think they are fooling? What a laughable notion that they are protecting investors by attacking the devs and getting it widespread delisted from exchanges. What a joke. I am offended.

There is no reason to think that Bitcoin is going to continue running up all time highs after being in a bull run for 4 months straight. The standard timeframe for even the strongest bull runs is 3-4 months. We are already on borrowed time on that front and have already defied all the odds. Regardless, I think the next week will be very telling. I expect volume to drop and signal the crash, but certainly won't complain if I'm wrong.

Anyone who thinks Bitcoin can go up while the stock market bleeds is kidding themselves. I would only believe in that scenario if we were trading at doubling-curve support. Instead we find ourselves bubbled x2.7 higher than that. We have plenty of room to drop while still maintaining unicorn status (doubling in value every year). Assuming otherwise is greedy and foolish.

It's also important to note that Bitcoin has always come back to the doubling curve at least once every 13 months, and we were traveling directly on it for more than half of the entire year of 2020. Bitcoin is becoming more and more consistent and less volatile over time...

So do we think that this trend will be broken for the first time ever and we'll just magically float far above the curve for the entire mega-bubble year? I am very skeptical on that front. It would mean we wouldn't return to the curve until pretty much Q1 2023. Somehow I doubt it. Two years is a damn long time to be bubbled when one year is the standard.

Get ready for all manner of crying when Chinese New Year and tax season rolls around.

Think I'm wrong like I always am? Eh, well... time will tell, and if I had one piece of advice it would be to watch volume and volatility very closely over the next couple weeks. A drop in both is an obvious Death-Cross.

Posted Using LeoFinance Beta

Return from Market Watch: RIP XRP ARMY to edicted's Web3 Blog