Everything is up today.

- Bitcoin has broken $50k to the upside.

- Ethereum approaches $4000.

- Litecoin is above $210.

- Hive spiked above 70 cents.

- BNB is reclaiming $500

Hmmmmm, Yep!

Things are looking pretty good on the speculative side of the equation. Resistance at $50k was a lot more than I anticipated. Luckily, it appears as though supply shock has once again kicked in at a higher level of $47k. However, this local bottom wasn't nearly as convincing as $44k so the chance that we return to this range is high in my opinion ($45k-$50k).

Point of guaranteed return.

This $50k level for BTC is highly significant, because the doubling curve will be at this level at the end of 2022, which is exactly where I think BTC will crash to once the mega-bubble has deflated and we return back to Earth. Selling here could cause one to miss out on massive gains, but at the same time the price is almost guaranteed to return to $50k when this is all over, so selling isn't that risky in this regard. Always maintain balanced positions and you'll never be worried about what the price does.

As far as September is concerned, it's never been a particularly good time for the market. If Bitcoin continues on these moon cycles the market should be fully bottomed out around September 24th as has often proven the case in many other years as well.

At the same time, we've also seen how badly this chart has performed during the current run. Elon Musk really threw a wrench in the cycle when Tesla bought in during February, causing three entire extra months of FOMO buying before the inevitable crash we got in May. It's quite possible that the two months of consolidation we had is all this mega-bubble needs to continue upward till the end of the year, although that's not what I expect will happen.

At this point I find it way too risky to gamble on the market in its current state. $100k Bitcoin is the level everyone is looking for. I'll surely sell a bit once we get close to that target, as there are thousands of bulls that will turn bearish and take gains during that time.

HIVE!

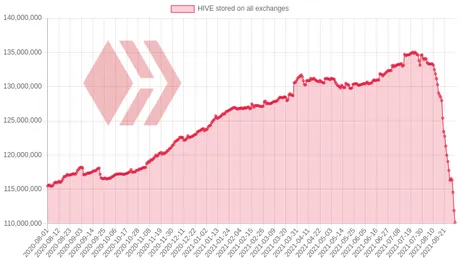

On-chain technical analysis for Hive is getting quite out of control.

- Splinterlands gives us a lot of legitimate data volume.

- HBD trading over $1.05 gives constant deflationary pressure.

- Millions upon millions of tokens are being pulled off exchanges.

The number of tokens on exchanges has been going up since before Hive even forked away from Steem. To see it drop this quickly is just about the best sign we can get. Seeing my stack get deeper and deeper into the 6-figures range is quite surreal. To me, that money isn't real, and in a certain sense this is true. My HivePower is tied to my vote and the very core of my reputation here. HivePower is worth more than money, and more and more users are beginning to realize that fact as the price gets more volatile.

Ethereum x2 away from Bitcoin.

I find it hilarious that if Ethereum went x2 right now it would essentially have the same market cap as Bitcoin. The maximalists think this is an impossibility. Their brains are going to break when Bitcoin gets flipped. Judging by historic patterns this should happen during the peak of the next mega bubble.

At the end of the day Ethereum has a thousand times the functionality and potential of Bitcoin, as Bitcoin at its core is simply a niche asset based on security alone. No one cares about security when crypto isn't under attack. Bitcoin will only be able to regain the #1 spot from Ethereum once the regulators come in to pop the mega-bubble and crypto finds itself under attack once more from the legacy system.

Conclusion

Market looks great today but the 2-week bullish cycle is coming to a close within the week. I'm not bullish on September whatsoever and I think at best we trade flat in between one of these unit bias ranges (either $50k-$55k or $45k-$50k).

At the same time all of this speculation assumes that there will be a mega-bubble at the end of the year, but their are some timelines that place it in October. All I know is that I won't be worried about selling any crypto until we hit the laser-eyes unit-bias level of $100k. Until then I'll be holding and only gambling with very small amount.

Posted Using LeoFinance Beta

Return from Market Watch: September to edicted's Web3 Blog