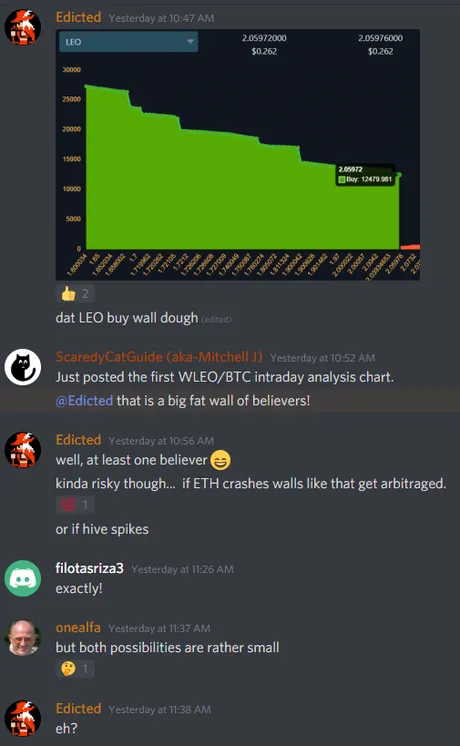

Today Hive spiked up 10% giving the opportunity for @fbslo and someone else to arbitrage this buy wall and pump it into the ETH market.

It's a bit hard to wrap my head around logistically, but when Hive spikes now derelict Hive on HiveEngine will get pumped into Eth which in turn gets pumped into the wLEO pool.

Before we had the wLEO pool Hive spiking tended to simply lower the value of LEO (or just keep the USD value stable). Now that money gets pumped into the market if there are large buy orders on HiveEngine, pretty crazy.

HiveEngine may have zero trading fees, but this person essentially paid arbitragers like $100 to move the money around for him. Let that be a lesson to anyone who'd put up big buy walls on HiveEngine. They need to be monitored by a bot to make sure they aren't exploited. It's much safer to provide liquidity to HiveEngine using small orders that are spaced out. This way gas fees get in the way of arbitrage.

Hive vs LEO

There's somewhat of a healthy rivalry going on here... LEO is doing very well while Hive is lagging during a bull market. We've attracted a lot of attention, and for good reasons. Once again, I'd like to remind everyone that Leo is built on Hive. Same team, fam.

Imagine building a house and trying to explain to someone:

Yeah this location is amazing and the value of this house is going to 100x in the future... too bad the foundation that I built it on is such garbage.

That is obviously a nonsense statement, yet it seems to be the consensus across dozens of community members. Hive and Leo are not competitors, they are linked at the hip. The same is true about the vast majority of the cryptosphere. This ship sinks or swims together. Projecting the legacy economy's ingrained vulture capitalism onto an emergent cooperative open-source economy is a huge blunder. 100% of LEO's decentralized features currently depend on the Hive ecosystem.

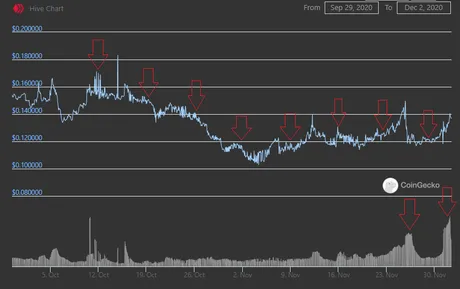

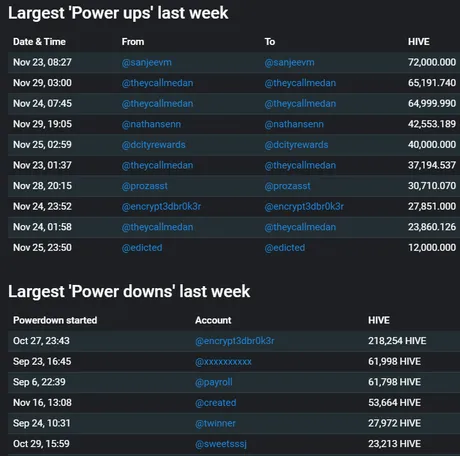

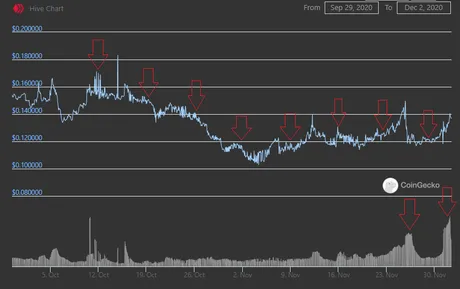

Looking at Hive's recent price action during this time shows an interesting story. Aggressive volatile dumping is going on, as is to be expected when the general market is doing so well but Hive is floundering. A couple whales are using this opportunity to dump their stake during this time when they can do so without suffering from massive slippage. Unfortunately I haven't created my own analysis for this kind of thing but @penguinpablo does a pretty decent job for all around statistics.

https://peakd.com/hive-133987/@penguinpablo/weekly-hive-stats-report-monday-november-30-2020

Why are they dumping? Don't know, don't care, and neither should you. Just have faith that this network has already proven time and time again that we are largely decoupled from the market. Just because the market is doing well now and we aren't isn't any reason to panic. Hive can go x10 in a week pretty easily and the market could be trading totally flat at that time. Focus more on potential and actualization.

https://www.stateofthedapps.com/rankings

Looking at a data aggregator like stateofthedapps, we see that 95% of the highest ranked applications exist on Ethereum and Hive. Sure, there are other aggregators out there where Hive is not featured nearly as prominently (or at all) but Spliterlands is kind of a big deal if you haven't realized by now. It's also hard to imagine that it's going anyway. Dapps like Splinterlands are only going to become more popular over time.

The scaling issue still exists. If Bitcoin does what everyone thinks it's going to over the next year, Ethereum is going to be completely clogged full and gas fees are going to be sky high. Call me crazy, but that's gonna be a prime time to be checking out networks like Hive who's fees are currently zero.

Speaking of x10 Hive.

Remember when we spiked from 10 cents to a dollar in April? Sure ya do. How do we think that happened? We had just gotten out of the most toxic relationship of our lives. Steemit Inc leadership was already hot garbage before it got bought out by a vulture.

In the wake of complete uncertainty, Hive got a flood of exchange listings. This created a buying FOMO frenzy from established Hive whales. How many of these whales burnt themselves out on that run up?

Then what happened?

Binance opened the floodgates and "someone" started dumping Hive consistently under market value for days on end. See what happened there? Hive whales transferred their value from their own pockets to our sworn enemy... not... smart. Emotions ran high and we got burned.

We airdropped a ton of accounts that wanted nothing to do with our network, yet we bitch and moan that the price isn't mooning? Get real. It has nothing to do with tokenomics and everything to do with our controversial history combined with extreme FOMO that fleeced value from the strongest members of this community.

A hardfork featuring an 'Airdrop'?! Are you serious? .......tHIeVES!!!

lol really? this again?

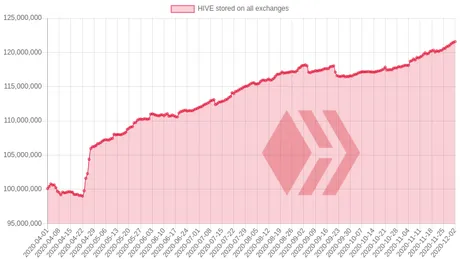

However, take a look at the graph. The weekly powerdown pressure is slowing down and the volume is spiking like mad. We'll come out of these woods eventually; it's only a matter of time.

https://peakd.com/hive-133987/@penguinpablo/weekly-report-how-much-hive-is-stored-on-the-exchanges-december-2-2020

More stats.

Upbit Korean exchange and Bithumb have quite a bit of Hive. Can someone remind me of what happened with the biggest Korean community on Steem before the fork? Yeah... so maybe "fixing" our 8% APR inflation "problem" is not the issue, hm? So much stake is on the exchanges it's out of control.

And climbing.

Need I remind everyone that Hive always has a snapback feedback effect during bull markets. Price is going up, incentivizing users to power it up to control inflation, reducing stake on the exchanges, pushing the prices up, and further incentivizing powering up even more. Seriously so many of you are going to get caught with your pants down. Such is crypto. It wouldn't work the way it works otherwise.

Obviously it stings to see Steem outperforming Hive so dominantly. Honestly, that's what we get for not knowing how to play the long-game. Even more absurd, SBD is trading for over $3 at the moment, and 98% of the volume is on Upbit. They are pumping a stable coin again... lol... some people never learn.

Fortunately, in the long run, there is really no way for the development happening on that chain to keep up with what we have going. If any two chains are competing, it's these two. But again, I think a win for one is a win for the other.

Think about how easy it would be to port a dapp from Steem to Hive and vice versa. Might as well add Blurt into the mix at that point. These are opt-in governance models. There is no competition. People choose the governance that they want, and that's that. End of story.

As much as we'd like to posture that Steem governance is invalid, that idea ironically is itself invalid. Any network with at least 2 participants is a valid one. It doesn't matter what the legacy economy has to say about it either. The courts of country XYZ need not apply. These are borderless systems. All we can do is keep building and showcasing our own governance model to the world so we can attain more support. Nuff said.

Posted Using LeoFinance Beta

Return from Market Watch: Steem vs Hive vs Leo to edicted's Web3 Blog