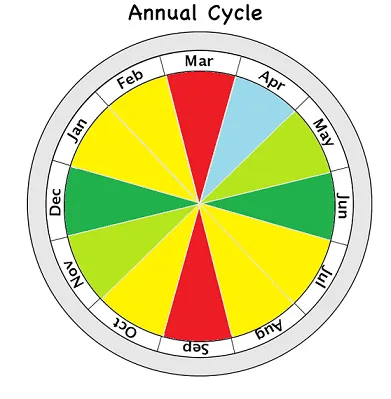

The bullish full moon cycle is coming to a close and this one did not disappoint. We broke that super annoying $45k resistance and now I hope/expect that $45k will will hold during the new moon to the next full moon (April 1 to April 16th). Interesting enough, this also coincides with with the deadline to file taxes in the USA (April 18th). I'm expecting one last bump in the road until this market goes onward and upward into summer.

Again... April has never been a bad month... ever... for the last ten years. At worst it trades sideways, and at best it is slightly up. This time around it's been 3 years since the last summer bull run in 2019. Let's take a look at what the price did then:

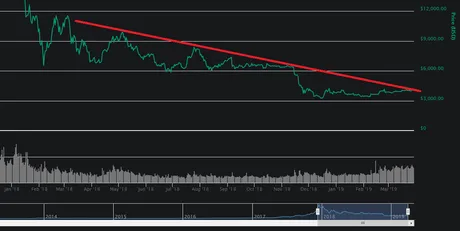

Right when the 'unbreakable' resistance line of the 2018 bear market was crushed by the doubling curve, the price immediately spiked from $4000 to $5000 in early April. Anyone who was around during this time remembers how exciting it was... we were finally out of the bear market.

Resistance Crushed: Official End of Bear Market

Too bad my picture links on this post are broken... Let me redraw the line... Oh look I found one from March 28th 2019 days before it happened.

Just another example how the doubling curve log trendline has crushed it every single time.

In any case...

We are headed into another April, and it looks like we are due for another one of those 18-month bull markets. Last one was in Q4 2020, and we haven't seen a summer one since way back then. I think we will see the same thing happen. Random pump up at some point in April but for the most part boring and flat. The real crazy stuff doesn't usually happen till May.

I'd advise never taking gains in May or November, but that's been terrible advice last November and last May. It's possible we are back on track with the more predictable market cycle... but who knows. When the price goes up, just DCA sell 5% blocks at a time and we'll do just fine.

Price go up how much?

Normally a regular bull run takes us x2.5 to x3 the doubling curve. With the curve at $36k in May that's something like $90k-$108k. Clearly $100k is one of those crazy unit bias levels that everyone is looking at. Very unclear whether bears will allow it to get that high before taking gains, so obviously I'd start DCA selling at like $80k or something with the intention of spreading out those orders over three or four weeks. Or the price won't be that high at that time and none of this is relevant and I have to come up with an entirely new strategy.

Hive

Hive has crushed all the metrics. If it can hold above all the moving averages we are primed to dominate the next 3 months of alt season. This will create a new wave of golden crosses and bullish action.

Hive is scrappy, and $1.20+ seems like a great place to be, and of course we are all thankful to not be trading below the empty shell corporation that is Steem. At the same time, a #183 rank on the market cap is still wildly oversold. There is so much going on here and we quietly grind forward. Looking at the top 100, it's quite clear that the token price can 10x and we still wouldn't be overbought (even though an 10x has never held support and we would almost certainly crash at least 50%). Where ever we end up it's very nice to have the gigantic bag that I have, especially now that I bought back everything that I sold at $1.40 during the double airdrop snapshot.

Polycub

Five days ago I said within the week we'd be testing 50 cents, guaranteed, even though we were already at all time lows after crashing 90% from $5. That was my conservative estimate because I wanted to make sure I was right... now the price is slightly under 40 cents. Yikes. Like I said I want to buy back in and I think the tech has great promise, but my buying target still remains in the 10-20 cent level. I also think that while yield is aggressively declining it's not really possible for the price to go up.

Looking to re-enter in May/June when the rest of the market is peaking. I think there's a good chance that people are rage-quitting pCUB right when the market is peaking and selling right at the worst time. If it goes down like that I'll be using it as entrance liquidity to buy back my stack... hopefully at something like 10 cents (which will be less than $1M market cap).

Conclusion

Tax season is almost over. Surely most of the selling pressure from taxes have already happened but I still expect $45k to be tested, especially because there is a CME futures gap there and those things fill like 90% of the time. Once we get past early April I think we are bullish for a good 6 weeks in a row, so that will be nice if it plays out.

Posted Using LeoFinance Beta

Return from Market Watch: Tax Season Crunchtime to edicted's Web3 Blog