For the last five days Bitcoin has been consolidating at the level it spiked to the day it was announced that Tesla added $1.5B to the corporate balance sheet. The market seems a bit confused and anxious while finding itself in this extremely uncertain state.

On Feb 7th we see that spike up to $47k and again we are consolidating at that same level. The market is panicking because the market has the memory of a goldfish.

Before Feb 7th, I maintained that trading above $35k was bullish, and trading above $40k was very bullish. Three weeks later and we've been trading well above $40k this entire time. We are clearly just at the beginning of this mega-bull cycle with little signs of resistance on the medium-term.

This isn't to say that March can't be a complete bloodbath. If the stock market crashes certainly Bitcoin won't be able to hold these levels as the panic sets in. Again Q1 is often one of the worst quarters of the year. Sure, we have the halving event and corporate adoption to back us up, but we've already bubbled quite a bit due to those events. A Black Swan in March could take us back to $20k, but I really can't imagine it going lower than that, ever.

Again, hodlers don't have to worry about any of this. Just hold till the end of the year. Keep those diamond hands shiny. If we 'know' that Bitcoin is going $250k+ by Q4 then attempting to trade this market incurs quite an unnecessary level of risk.

This is especially true considering tech companies could start dropping like dominoes at any time and start competing to get more Bitcoin. Forget about simply putting it on the corporate balance sheet. When there is this much money flying around institutions can FOMO just as hard as anyone else. As always, we can expect them to try and frontrun retail and ride up the wave like everyone else. We ain't seen nothin yet.

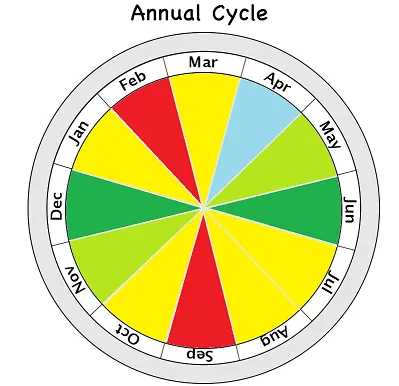

For those wondering when to buy in: April 1st is only a month away. Looking back the last decade this has always been an amazing day to buy. I think we can expect some kind of dump to happen in March, but that dump could be a higher level that we are at even now. I wouldn't be surprised if we spiked to $70k and crashed all the way back down to $50k over the next month. I also wouldn't be surprised to test $35k or even $30k again. The name of this game is volatility. However, looking back at history, April Fools has always ironically been a good day to buy. I'm saving up till then.

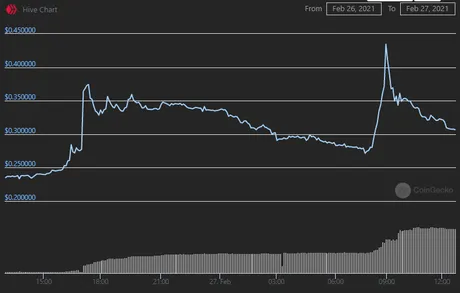

Of course I would be remiss if I didn't include all the crazy price action Hive has been subject to over the last 24 hours. From 24 cents to 37 cents to 27 cents to 43 cents to 30 cents. Wow, we are just all over the place.

This is a classic example of emotional trading in combination with thin liquidity. Honestly, Hive bulls need to chill out and post more limit buy orders and stop pushing the price up like madmen. Stop wasting your money and buy more coins over time, gentlemen. Ah who am I kidding: this market can't be tamed so easily.

In any case, I still maintain that even though Hive might look volatile and unstable right now like everything else we've seen... we've been scraping the bottom of the barrel for months now; this is what hardcore support looks like.

We dug a deep hole and hit rock-bottom, and now we are slowly clawing our way out of the hole. The three-month moving average is still only 15 cents a coin, and there appears to be massive support near these longer moving averages.

Lot's of people out there have been pretty salty about Hive's price action for a long long time. Not me: it's just been a longer accumulation phase for me to build up my stack. Many are even going so far as to say Hive is only being lifted up by the rest of the market and this recent price action has nothing to do with fundamental values.

Personally, I still feel like we are still well under our intrinsic fundamental value. I've always thought 80 cents was a fair price for Hive when that seemed like support during 2017/2018. Anything less is just a discount, and my my my hasn't this discount been epic if I end up being right.

I hate to be a broken record, but every coin I want to buy these days is basically trading at all time highs, whereas Hive is the one token still trading much closer to all time lows (x3) than it is to all time highs (x26). Once we moon it's pretty much game-over for me in terms of buying more.

How could I possibly buy Hive at $8 (or even $1) when I had all the opportunity in the world to stack at 10-30 cents? At some point I'll have to quit stacking Hive and retreat back to granddaddy Bitcoin where the volatility is much safer. I learned my lesson the first time: thanks 2018 for the lovely face-melting experience. Only pressure and time can turn these lumps of coal into diamonds.

Conclusion

A lot of people bought the news when the SEC announced Telsa's Bitcoin acquisition. Was this a mistake? Aren't we supposed to buy the rumor and sell the news? Perhaps March is doomed to be a bad month as is often the case. Perhaps not.

One thing I do know with absolute certainty: people love airdrops. Everyone seems to lose their mind with an airdrop on the horizon. Hive is still cheap and LEO has an airdrop coming very soon™. Not to mention the 3speak airdrop and potentially even another from blocktrades. This network looks like a no-brainer at the moment.

A broken clock is still correct twice a day. The fundamentals of this network will catch up to speculation sooner or later. Count on it.

Posted Using LeoFinance Beta

Return from Market Watch: TELSA buy in holding stronk to edicted's Web3 Blog