Bitcoin has been in a very awkward state ever since the FED meeting. Bears dumped a ton of coins. Volume was about as high as it gets, but volatility was surprisingly low. The price only dipped like 5%, which I thought was pretty impressive considering the numbers. We very well may be at a rock-bottom level in which 30% dips aren't even possible anymore. There's are simply too many deep pockets out there looking to buy cheap and waiting for the volume to come to them rather than needlessly pumping the price during such uncertain times.

Shweet deal.

Many think this wedge is significant.

I'm not convinced because the timeline is so small. Candles can be tricky when the TA doesn't show the information.

ZOOM OUT!

This is the wedge everyone is making a fuss about.

The coiled snake. I don't know... looks like a big nothing-burger to me, honestly. Just not enough time to work with in such a volatile market. I'm sure we could pass right through it with nothing happening.

What does Goddess Moon have to say about that?

Ah well it is a New Moon today, so maybe that plays into it.

Normally we would see some kind of top around this time.

And nothing has happened for a while so... up?

Permabulls gonna permabull.

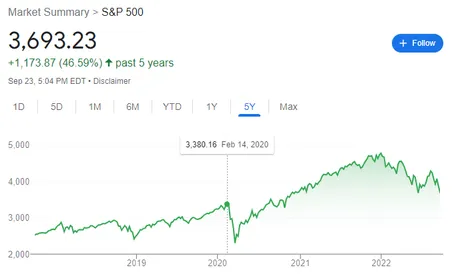

LOL @ 5 years for less than 50% gain.

Crypto is life.

LOL @ 5 years for less than 50% gain.

Crypto is life.

8% dip on stonks left?

STONKS! If the stock-market dips another 8%, we're right back were we started right before the COVID crash in March 2020. This is a significant level that I've been talking about for a while, and it's crazy that we are so close to it already. An 8% dip in the stock market would likely be at least a 10% dip on Bitcoin. With Bitcoin at $19k we can round up that number to a $2000 loss down to $17k. Maybe even $16500.

Interestingly enough, $16k-$17k is a support that literally nobody talks about. In fact, even I have stated that a drop below $17500 is extreme danger zone, and many others would interpret it the same way as well. But that's what the market loves to do, doesn't it? Psychic energy vampire trying to panic everyone into selling the bottom. This very well could be the ultimate local bottom before we start ripping up.

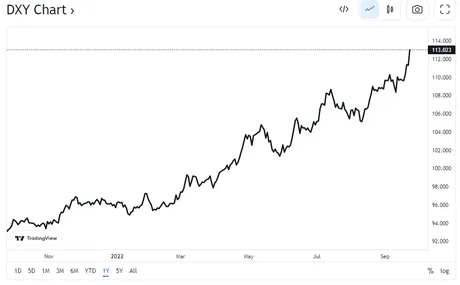

Another thing we need to be looking at is the relative strength of the dollar. The inflation narrative is a farce, and it should be obvious that increasing rates makes the dollar more valuable. This is a big reason why crypto and stonks are suppressed. The dollar has gone parabolic. When this parabolic run ends and the dollars starts losing relative value, once again crypto and stocks will rip.

Personally I think the CPI for next month is going to be 7.something, which means that inflation from September to October has dropped by some amount from 8.3%. If this ends up being the case the FED may chill out for a bit. Everyone assumes they will taper (50 point hike then maybe 25 later) but if they leave it alone for a month we should get some kind of rally going, even if short lived. I think the stated goal was to get to something 4% by the end of the year, and we're only 2 hikes away from that level.

Why would you want to raise your cholesterol?

So I can lower it. ---Dwight Schrute

For anyone who's read my really old commentary on this topic... you'll know that I'm actually quite surprised we've made it this high without everything completely crashing into the mountain. Sure, stocks and crypto are down... but also that suppression inevitably creates a spring-loaded run later whenever that pressure is removed. Considering how oversold Bitcoin is as a whole, I think we are looking for a repeat of the COVID crash in March 2020, except this time we get a U-shaped recovery instead of the V-shape that was created by the exact opposite response from the FED and the government. The rally has been delayed until the war against "inflation" is won. Although it's also hard to see the CPI going down with all these food and gas processing plants spontaneously combusting all over the world. What are the odds?

Oh the fact-checkers said no... cool my bad.

I trust these guys. I mean it keeps happening over and over but whatever. These things happen. Because if it was on purpose I'm sure these guys would blow that story wide open. Right? lol. god.

Conspiracy hour has ended. Or has it?

Why does the government refuse to provide regulatory clarity for crypto? Because they have no idea what to do. The previous head of the SEC stated that BTC and ETH were not securities. Now the SEC says that was just his opinion and are rolling back the argument. Part of this has to do with the Ripple case.

Brad Garlinghouse wants to show that legally XRP is not that different than BTC and ETH, and he's right. The only difference are the percentages of the premines. That's a very difficult point to argue, so rather than try to do that the SEC rolls back the previous statements and keeps the regulatory clarity in the opaque state.

The reason to do this is simple. If they don't provide clarity they can just make the rules up as they go and say whatever they want. If they do provide clarity they know that devs and founders will swiftly navigate around the rules and hide behind the laws provided, making it impossible for the SEC to contest them. If someone makes something the SEC doesn't like, they can simply claim that's against the rules. With regulatory clarity in place, this is impossible for projects that follow the rules but still manage to create things that the SEC doesn't like.

This is a strategy that very well may blow up in the SEC's face. We already see that the Judge in the Ripple lawsuit has been borderline enraged by the SEC's actions and refusal to provide information that was order to be surrendered to the court. Amazing that the hypocrisy is so well documented that the SEC must go to great lengths to hide all the paperwork from a court that demands it. Sooner or later it will be determined that the SEC has overstepped their authority and they will get put back in their place, hopefully sooner rather than later.

Treating a DAO like a full-liability corporation.

Many other lawsuits are coming into play that show just ridiculous the application of the law has become when dealing with tech that is simultaneously money, community, and government. Just like it was impossible to control torrents and illegal downloads, so to is it impossible to control a DAO and treat it like a corporation. They will try to force individuals to vote a certain way or change the way the system works, and that request will be denied, not because the person in question doesn't want to comply, but because the request is impossible.

Circling back to price action.

It's interesting to see how the crypto market keeps bleeding by no fault of its own. Every dip at this point is created by selloffs in tech and risk-on assets. That can only last so much longer until all the fat has been trimmed and nothing remains but the grizzled holders of diehard communities.

7-day wedge is irrelevant.

This is the wedge that actually matters. The four-month wedge. My gut feeling would tell me that we are in extreme danger, sitting on support with dwindling volume. Good thing my gut feeling is wrong so often.

You know what else is kind of weird?

6 planets are in retrograde right now.

The big one is Mercury, which ends in early October.

If you're into the whole astrology thing.

Which I'm not but it's still fun to play along.

Perhaps the stars will align to give us a rally?

Hugging support like we are doesn't inspire a ton of confidence though.

But hey, the next full moon is the "Hunter's Moon" on October 9th.

Sounds promising, right!?! Send it.

The CPI report will be on October 13th, maybe we get lucky. Maybe not.

But honestly it doesn't matter unless you're selling... which I'm not. Yeah, it hurts to suffer a bear market. It will continue to hurt until we start taking gains off the table during the bull market instead of opting to go full glass-cannon greed. How many times must we learn the hard lesson? I'm learning, albeit slowly.

Conclusion

Lot's of data to absorb here. Just remember that long timelines trump short timelines. The overarching resistance is declining quickly and will be at $20k in a few weeks. We'll see how that works out. Hopefully the stock market can hold at the March 2020 levels after dipping 8% more. Mercury retrograde is ending on Oct 2. DXY is still ripping upward as the FED increases rates. The 'inflation' narrative is a distraction. USD is gaining value and debt is losing demand. That's why markets are bleeding.

Most importantly, try to pay attention to how much is getting built during the bear. The bear market is not a time to despair; it's a time to get shit done. We got a really badass hardfork coming down the line (hopefully Oct 10). Splinterlands is making moves. LEO is doing its thing. So much going on it's hard to keep up. If you ever need a distraction because of number-go-down, just look around. All the projects I'm interested in haven't been crippled by the bear market; they are more determined than ever. That's a very good sign.

Posted Using LeoFinance Beta

Return from Market Watch: The Snake is Coiled and Ready to Strike. to edicted's Web3 Blog