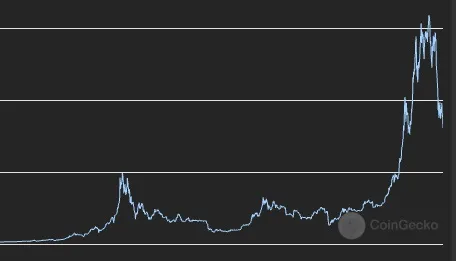

So here we are again retesting support at $30k.

How strong is $30k support? I don't know. Nobody knows for sure. Testing support is like walking out onto the ice and hoping you don't fall in.

I have a few reasons to believe that the ice is pretty thick, but the more we test it, the thinner it gets (usually). Once support is thin enough it will shatter and we'd likely crash down to the real support near $20k over the coming months.

My cyclical chart doesn't mean much right now.

It all depends on if we are still in a mega-bubble cycle or not, which I believe we are. We simply had a pre-run before the real run. If this was any other year but a mega-bubble year (every 4 years) I'd say that we were guaranteed to return to the doubling curve soon. The chance of getting back to back runs in a non mega-bubble year is basically zero. We usually require a long cooldown period before things can start to move up again. History shows we would normally get a nice bull run every 18 months.

But there are a lot of good signs out there. Multiple countries talking about embracing Bitcoin and turning it into a full fledged legal currency (and in turn: a foreign currency elsewhere). Outflows away from exchanges are at record highs. The longs are starting to reforge their positions. All we need is a nice short-squeeze from here.

Bitcoin dominance is also very low (40%) and many alts are outperforming the big dawg. 2021 is a great year for alts, and they are popping up like wildfire trying to scoop up that liquidity.

In fact, everything is looking pretty damn good except for the chart and the short-term price. If we're being honest with ourselves, perhaps we just need to zoom out and look and what actually just happened.

If this is a head-and-shoulders pattern, we are pretty much guaranteed to return to $20k this summer... which is fine. Once that happens I'll be quite comfortable going extremely long. That's right where the doubling curve is, after all.

2021 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $13867 | $14933 | $16000 | $17067 | $18133 | $19200 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $20267 | $21333 | $22400 | $23467 | $24533 | $25600 |

The range of Bitcoin this summer could go anywhere from $20k to $100k (more likely $70k max). Crazy stuff. Not that it matters. My target has always been Q4. If Q2 needs to be a dud so we can get that mega-bubble at the end of the year, so be it... but I would be pretty surprised if that happened considering the action we've seen during 2013 and 2017. By all accounts 2021 should be even crazier considering everything that's going on in the world and with Bitcoin. In fact, it already has been. 6 straight months of upward action. That's nuts. That's already record breaking.

It's hard to imagine that this summer would be poor performing when it comes to the economy and the markets. By all accounts, stir-crazy citizens should be running around spending money like crazy after a year of lockdowns. That increases the velocity of money, and with all this bullish adoption surely a good chunk of that money should make its way to crypto. Obviously, the sharks are still buying in droves, as we can see when the price tanks but all the Bitcoin seems to be flowing to self-hosted wallets.

But, as we all know, the market does the opposite of what I say out of spite, so anything could happen. I was able to call this crash pretty easily. We sat for 3 days on a support line with garbage volume. It was almost guaranteed that we would crash again, so it's nice that I'm starting to learn a little bit better when to turn bearish.

For now volume is good now that the price is lower and the bulls are starting to wake up again to a newfound dip. Again, if volume gets slashed in half at this level and we haven't moved up, I'm worried that the ice will break and we'll see fresh local lows below this mythical support line.

Again, when it really comes down to it, if you could go back in time 9 months and tell yourself the price was $30k you'd be pretty happy about that. It's usually best to take a long term approach to these things. We can't see the forest from the trees.

Return from Market Watch: Thin Ice! to edicted's Web3 Blog