June moon soon.

It's been a weird wild ride.

We got the consolidation we were looking for during January to May, but that consolidation was at a jacked up bubbled level that got shorted into the dirt. Now everyone is still terrified that the party is over. The party is... not over.

However, fear reigns supreme.

Somehow I highly doubt that this market is going to make an instant recovery in such a short period of time. The sharks will take every opportunity to capitalize on this fear they've instilled in retail.

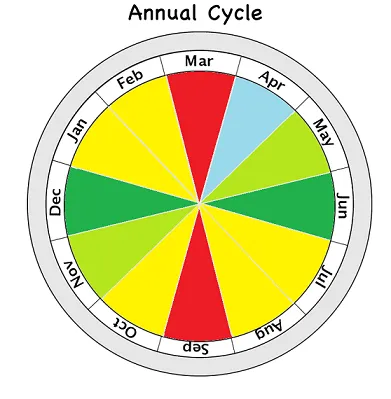

The chart posted above is an extreme rule of thumb that depends on the current circumstances of the market. However, we have yet to see a summer that didn't trade bullish (or at least flat). Considering this a mega bubble year (2013, 2017, 2021) I have to assume that we will see some pretty nice gains over the next few months.

While the cyclical chart remains open to extreme interpretation, the one metric that hasn't failed me yet is the doubling curve. Even when COVID struck and sent us tumbling 50% lower, that crash only lasted three weeks, and then we traveled on the curve for 5 months after that to the letter.

2021 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $13867 | $14933 | $16000 | $17067 | $18133 | $19200 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $20267 | $21333 | $22400 | $23467 | $24533 | $25600 |

On a certain level it just blows my mind that Bitcoin just keeps consistently doubling in value every year and literally no one talks about it (except me). How is that even possible? I guess once the mainstream catches on it won't work anymore. As soon as the market knows these things it has a way of trading around it.

But until then...

I remember when BTC was $50k and I was warning everyone that it was only worth $20k. I practically got laughed at. People just assuming that it's never coming back down to earth. My how the emotions rage. Now that everyone is in extreme fear I say the same shit and no one disagrees. But I would still be really surprised if we returned to the doubling curve this summer.

Why's that?

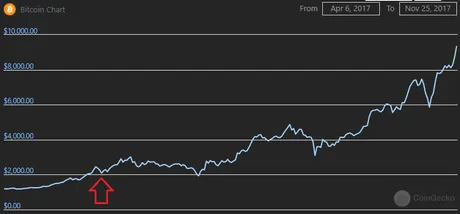

Because we are legit right where we were last time in 2017.

Back then BTC was x1.75 to x2 higher than the curve. And that's the same range that we find ourselves in today. The only difference is that the market tried to price in the mega-bubble way way way too early and that bubbled just crashed back to exactly where it should be.

If we see a repeat of 2017, August is going to be a pretty amazing month. Sure, we might get a local peak in June and a crash in July. There's still plenty of fear left in the market to make that happen. However, a lot of that fear may be gone come August.

I am, however, still predicting a nice crash in September as that is one of the most predictable months for a crash it seems (out of the entire year). Where will we crash to in late September? In 2017 it was x2.2 above the doubling curve. At todays prices that's $50k, which is the perfect support line if we get a sick summer run up to $70k-$100k.

$70k BTC would make more sense in August if we are expecting a standard 30% retracement. Unfortunately, you never know what institutions will do with their newfound powers. It's pretty obvious they are going to manipulate these markets and constantly dominate retail just like they always do. If I see BTC get up to $100k in August I'm going to expect another massive wave of FUD and short-selling in September that brings us back to $50k.

Speaking of $50k...

We are still trapped in a range-bound wedge, and time is running out. Will we break to the upside or downside? Considering the circumstances, I have to guess upside. But again $20k is always on the table should shit hit the fan. Considering this institutional adoption I highly doubt it. All the longs that were gonna get squeezed already did. Another round of FUD would have extremely diminished returns.

So, assuming we break to the upside that still leaves that terrifying $50k resistance line in the way. And, if I'm being honest, that's just way too good of an opportunity to capitalize on all this fear and go short (even if only for a week). If we had enough momentum to break past that barrier in the short-term I'd be extremely bullish. Eh who am I kidding I'm always extremely bullish. How can you not with an asset doubling in value every year?

So once we break out of this local wedge to the upside I think there's an even better chance that we will get suck in the bigger wedge between $40k-$50k. However the gap is narrowing quickly. If we break to the upside again after that the sky is the limit.

2017

Looking at the rest of 2017, we see that there was a 20% dip in November that would have been pretty much impossible to predict or make any money off of, then from there it was up up up up mega-bubble into the 2018 bust. Still seems like we are in line for the same thing to go down this time around.

What about alts?

Summer is normally pretty good for alts because the market is less volatile than winter. When Bitcoin consolidates at various price points people get bored and move out to alts. I don't expect that pattern to change. Lower caps, higher risk, higher reward. As long as BTC stays above $30k until the end of the year alts will continue to climb furiously.

In fact, I think Hive is due for another crazy 10x. Our support lines recently have been nothing but legendary. Looking to DCA from $1.90 to $5.00 Hive. Not looking to sell a whole lot but obviously if we reach those prices I can buy the fuckin dip like a champ. I feel like it goes without saying that if we 10x to $5 there will be an automatic crash that will likely last months. Happens every time. No need to be surprised by it. There's so much going on with Hive there's bound to be a fresh wave of hype sooner or later.

There's also the possibility that liquidity from alts gets sucked back into Bitcoin as it begins making all time highs again. If alts start performing poorly against Bitcoin as it ascends above $64k we'll know. Honestly I'm quite curious to see if this happens. I don't think it will but it's certainly possible considering that BTC dominance is only at 40%.

At this rate I think the BTC dominance will drop all the way to 25% or less during the peak of the mega-bubble. I'm also half expecting Ethereum to flip Bitcoin for a week or two. When crazy shit like that starts happening it's DEFINITELY time to start dollar cost average selling. We do not want to be caught up in extreme greed as this mega-bubble inflates.

Conclusion

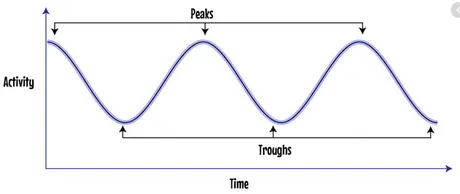

Speculation is always a constant process of refactoring the information we've been given. It's impossible to time the peaks and the troughs, but we can capitalize on rough generalizations. Successful trading only requires a 5% edge. We only have to be right 55% of the time. To put that into perspective, we can lose 45% of the time and still be professional gamblers. It's all about taking measured bets, being willing to take losses, and dollar cost average to reduce volatility. One of these days I'll figure it out for real.

Posted Using LeoFinance Beta

Return from Market Watch: Time to refactor. to edicted's Web3 Blog