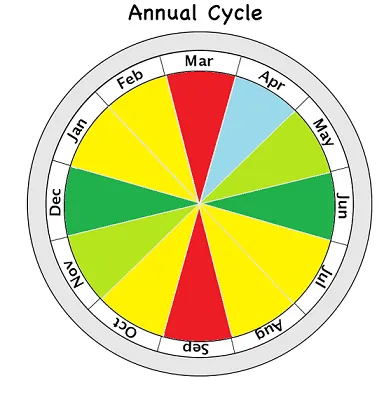

As predicted, Bitcoin is continuing to bottom out near the $55k level. Early April is always very boring. That's one of the reasons why it's the absolute best time to buy out of the entire year. It's almost a sure thing that this market will do nothing but ascend during the entire month of May. Like everyone else out there, I grow impatient and greedy.

There are so many weird variables this time around. COVID is obviously the biggest one. Millions of people are getting their vaccines right now and this summer will be the first time in over a year that many will feel that they have permission to take a vacation and travel around.

There's an extreme level of emotional pressure world-wide that's been building up for over a year. People are stircrazy. June has always been a good month for Bitcoin, and with all these other variables at play we are approaching a time period of EXTREME emotional and irrational money velocity. People are being given the greenlight to go nuts, and that's exactly what they are going to do.

On the other side of that coin is the rational money spending. Those who capitalize on other people's emotions are going to put that capital where it serves them best. Sharks gonna shark. In many cases this value is going to pour directly into Bitcoin by the billions.

Grease the wheels.

The results are in: corporations are on a mad dash to acquire as much Bitcoin as possible. Sports teams are taking their salaries in Bitcoin. Corporate adoption has never been higher and primed to accelerate. The FOMO hasn't even started yet. $60k Bitcoin is still a fair price.

Oakland A’s sell MLB’s first crypto-purchased ticket, a suite for 1 Bitcoin.

Elon Musk says people can now buy a Tesla with bitcoin

Corporations want your Bitcoin now, and they want it bad. They want it so bad they are building systems that allow you to send them Bitcoin directly, and there is no evidence to suggest they are going to sell the Bitcoin. A corporate blackhole has opened up, and the Bitcoin that gets sucked in is never coming out. They will simply use their new magical unicorn asset as leverage to get whatever they want.

This is just the beginning.

By the end of the year there will be dozens more companies who buy into Bitcoin and allow direct transactions. There will probably be several ETFs as well. Even Grayscale is trying to modify their fund to a direct exchange traded fund to secure the peg and build more trust.

Sup with Hive?

As always, Hive continues to trend down after a big pump. It's been just over a week since we spiked to higher than $1, and already we've almost crashed back to 50 cents as users who started their powerdown a week ago sell the unlocked funds.

Over the next couple weeks will likely be a good time to stack some more Hive as the price continues to crash. However, we have no idea when another pump will come. Wait too long and you could miss out, buy in now and it could still crash to 40 cents.

Hive is a completely unpredictable animal, that's why I was so aggressively accumulating in the obvious 10-15 cent range. Now I don't have to worry about acquiring more, and my blog payouts are dwarfing my day-job income. Like ya do. Everything is looking up.

Sup with LEO & CUB?

I just had a LEO powerdown unlock. I've to ported it to bLEO to provide liquidity in the bLEO/BNB pool. It's been stated multiple times that bLEO needs more liquidity for the incoming bridge, and the ROI return on the bLEO LP is still magnitudes greater than upvotes on the core blogging site. Users like @yabapmatt are doing the same, which is where I got the idea.

Sellers beware

Their are many problems with powering down my LEO. My primary concern is losing voting power. My voting power is my reputation. It's essentially free advertising and free networking on the Hive ecosystem. It boosts my brand identity and gets more eyeballs looking my way, whereas money in an LP gets none of those advantages.

Entering the bLEO/BNB pool carries the same risks as any LP pool: your LEO is for sale in the LP and can suffer impermanent loss and quite possibly forever lose the LEO. If LEO vastly outperforms BNB (which it easily could) my LEO will be sold to the buyers on BSC, and getting it back could be extremely difficult in the event that LEO does something crazy like go x100.

The reason to keep LEO on the main chain is the same reason users stack CUB in the den: those coins are not for sale. Even if the ROI return is theoretically lower, you'll make more money in the event these these micro-caps moon. During a mega-bubble year is when micro-caps moon, so the LPs are incredibly risky when we hit the peak of the mega-bubble. It's all but guaranteed that I will exit these LP pools during the beginning of Q4 to avoid massive impermanent loss. Micro-caps get pumped to the moon during mega-bubble peaks. I'm talking x100-x1000. It's going to be insane.

Matching BNB

I've wrapped 9562 LEO to bLEO, and I'm not looking to sell any. On the contrary, I'd like to get my 70k powered up stack back ASAP on the main chain.

So what I've done is removed 22.22 BNB from the CUB/BNB LP pool in order to match my LEO powerdown. That's just enough to enter the LP with bLEO/BNB. Using the extra CUB, I'm shoving 2800 CUB into the den because I don't want to sell that either. CUB has fallen sub $3 and we are bottoming out pretty hard. I'm thinking we hit rock bottom somewhere in the $2.50-$2.80 range. Once that happens I'll shove even more coins into the den, as my BNB stack is already larger than I want it to be.

It's interesting that I was able to pull all these LP moves off without having to sell a single asset.

DeFi Stronk

That being said I think BNB will get to at least $1000 by the end of Q2. Easy money. Hopefully BNB will continue to outperform CUB and LEO so I can continue to stack more of my favorite coins in the LP while still farming a ton of CUB.

Added bonus

The BSC network has cut fees in half today from 10 GWEI to 5 GWEI. We see that the BSC network will continue to dominate ETH fees in this regard because the POS network can likely reduce the fees to the minimum of 1 GWEI as BNB spikes during the mega bubble.

Meanwhile, don't be surprised when a single Ethereum operation costs $1000 or more (same goes with BTC). A flood of users will rage-quit ETH and hop over to BSC. There is a zero percent chance that ETH 2.0 will come into play by the time the mega-bubble hits. They will not be able to scale up in time. Hopefully the LEO bridge gets some action and notoriety during that time.

Also be ready for Litecoin to make huge moves.

This darkhorse is going to take a lot of people by surprise. Security on Litecoin is high. It's the second oldest crypto in history. Everyone who understands Bitcoin also understands Litecoin, and the fees are x1000 times cheaper. LTC will moon for the same reason BNB and BSC network is going to moon. People hate fees and love scaling. Yet another reason to own more Hive as well.

Conclusion

Early April is last call for everyone looking to fill up their bags cheaply.

This is it: piss or get off the pot.

You've been warned: don't FOMO in during a June peak.

Posted Using LeoFinance Beta

Return from Market Watch: Very Near The Bottom to edicted's Web3 Blog