Drip Drip Drip

Volume on Coinbase Pro has never been lower. At least I've never seen it lower than it is right now (6.5BTC/24h). Not a good sign. Some attribute this to it being a holiday weekend. 4th of July is one of the most laid back federal holidays ever. There will be zero traffic tomorrow. Everyone will be cooking BBQ and watching sports... or whatever it is normal people do on Independence Day.

In addition to zero car traffic this weekend it also seems as though there is very little crypto traffic as well. The market is still in this weird precarious state. We got another false breakout out of this wedge, then a crash back into it, and now another breakout but with the lowest volume I have ever seen. Up is down and down is up.

I'm expecting to get fully rejected here at $35k, at least in the extremely short term. I've balanced my positions a bit more just in case. Again, I think the market needs to increase volume and volatility quite a bit if we are going to stay above $30k, but the nice thing is that Bitcoin can still stomp on the alt-market a bit more to maintain $30k should we test that level for the TENTH time.

Death Kneel

Again, it's going to be painfully obvious if $30k is about to crack. Support there is so solid that price should just sit at $30k as volume gets lower and lower. That's when we start getting to extreme danger zone levels as far as the market crashing.

In this event, I think it's highly likely that Q4 isn't going to be that great, and any potential mega bubble will be pushed back, making the lengthening cycle theory much more credible. This would be in line with this new pattern of bull markets happening once every 18 months. We had bull runs in Q4 2017, Q2 2019, and Q4 2020. According to this pattern the next one is Q2 2022. I guess we'll see.

Unit Bias.

$100k Bitcoin has been hyped into the dirt. Everyone on crypto Twitter literally has laser eyes to signify this unit-bias. If Bitcoin gets close to $100k a LOT of people are going to sell there. Huge resistance at $100k, but that's nowhere near the mega-bubble level, meaning that once all the weak hands dump down 30% to $70k we might have a crazy rally that goes much higher than $100k. My target has always been $250k.

Blah blah blah making stuff up is fun.

On the non-speculative side of things, there is a lot of actual news to report on.

Privacy is a crime

Illinois Democrat: Many in Congress see bitcoin users as ‘de-facto participant in a criminal conspiracy’

Democratic Rep. Bill Foster of Illinois, co-chair of the House blockchain caucus, said Tuesday that laws must be passed to allow federal courts to identify digital-asset holders and then reverse transactions in bitcoin BTCUSD, and other digital currencies.

How can you call yourself a democrat and be so pro-authoritarian? I guess democrats are the fascists now. Super fun how they call themselves anti-fascists. Is that really all it takes to trick people? Just say the opposite and that makes it true? Sad.

These dinosaurs still don't get that the entire point of Bitcoin is that they CAN'T control it. They are stuck on an endless loop of, "but we have to control it". Truly a sight to behold, but not even nearly as ugly as this statement:

“We’re going to have to establish a law between the legal and illegal regimes here,” Foster said. “There’s a significant sentiment, increasing sentiment, in Congress that if you’re participating in an anonymous crypto transaction that you’re a de-facto participant in a criminal conspiracy.”

This statement is unconstitutional treason. Congratulations Bill Foster, you are officially a terrorist. This statement implies that not only that privacy is illegal, but also that you are guilty until proven innocent. Basically he speaks against two of the inalienable rights granted to United States citizens in the Constitution in favor of the police state. Good job, ass.

As someone who leans left on a lot of issues, it is disgusting to see someone with the "democratic" moniker spew this utter bullshit. This is exactly why the Bill of Rights was drafted in the first place. When the government breaks its own rules you know it's time for a regime change. Who could of ever guessed that regime change could be based on non-violent self-regulating computer networks? Truly mind blowing. We live in the future.

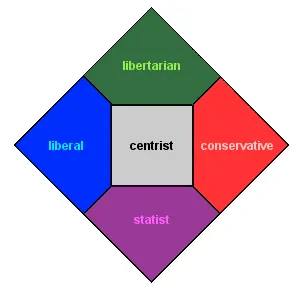

Day after day I realize that left vs right is a complete farce. All that matters these days is freedom vs tyranny, but they have everyone running around arguing about the pointless issues at the children's table. This divide and conquer approach is still doing quite well, but I wonder how long that will last in the face of it only serving the elite's agendas. I guess we'll find out.

Michael Burry

I used to have a lot of respect for this guy. He's the famous money manager who shorted the housing market in 2008. His focus after that was (and still is) acquiring water rights and growing food. He's straight up betting on very harsh times in the future, as do most doomsayers. I think the big problem is that once these guys get it right one time they get way too self-important and start rambling off nonsense.

However, Michael Burry, who garnered fame for his crisis-era bets on the housing market in 2008-’09, might say that he forewarned investors who had become hyped on meme stocks and crypto in 2021.

Meme stocks AND crypto? lol c'mon man!

It's one thing to claim that meme stocks will crash. They obviously will, it's only a matter of time. But then to lump meme stocks in with crypto in the same breath? That's just embarrassing.

Once again it shows that someone who guessed right that one time gets surrounded by yes-men that just hang onto his every word. He's rich! He got it right that one time! He must be right about everything. Please. It's like someone at the casino winning a jackpot and asking them what slot-machine you should play on for the next jackpot. Truly foolhardy behavior is at play right now.

When you lump in crypto with meme stocks like that it just showcases the shear ignorance of the person making the statement. We now know that Michael Burry doesn't have the slightest clue about Byzantine Fault Tolerance, and the fact that Bitcoin solved a nearly impossible networking problem that had stumped the world's greatest minds for three decades.

Crypto and meme stocks are one and the same. Crypto and the Dot Com bubble are one and the same. Crypto and Tulip Mania are one and the same. Crypto is the same as Beanie Babies! Everyone spouting this garbage today is going to look like a damn fool in 10 years, then we'll see how much attention they get.

These people simply do not know what they are talking about. They do zero research, and use their past legacy-economy experience to wrongfully project their warped view onto a technology they know nothing about, never admitting they've done zero research on the topic in the first place. It's pretty wild when you think about it.

No, there is no crypto winter.

So much fear is still out there that a multi-year bear market is upon us. When you look at the numbers, this 2020/2021 bull market was exactly the same as the run in summer 2019: x3 above the doubling curve. Except this time around because we broke all time highs everyone is worried about a bear market. It's quite foolish and fear-based nonsense.

Plain and simple, we can't enter a bear market until a mega bubble hits. The absolute worst that can happen is that BTC crashes to the doubling curve at $20k. If that happens it's just free money, as we'll be fully back in a bull market, guaranteed. There simply isn't enough runway to the downside for a "crypto winter" because we never went high enough in the first place. This is what every ounce of history tells us, but no one seems to anchor their predictions to reality. It's all fear porn, in both directions.

Conclusion

BTC volume is the lowest I have ever seen it. The moon cycle is still in play and according to that we are bullish for another week, but it's hard to imagine breaking resistances with so little volume on a holiday weekend. People aren't paying attention to the market for once. Perhaps come Tuesday we'll start making moves.

It's a good time to reflect just how early in the game we are. Crypto is super complicated. So much so that the "experts" do zero research and then equate it to Beanie Babies. This ignorance can be exploited. Their loss is our gain. Trade accordingly.

Posted Using LeoFinance Beta

Return from Market Watch: Volume Matters to edicted's Web3 Blog