Almost there...

September is never a fun month, friends. Go back and find me a single September on the Bitcoin chart where number went up. It doesn't exist. This time around it's even worse because the legacy economy is weaker now than any other year over the last decade. Q3 is always a quarter of licking one's wounds and resting up for the mad dash of liquidity that is Q4. All the stops get pulled out during the end of the fiscal year and Christmas and New Years and whatever else.

There are many other reasons to be excited for Q4 as well.

First off Bitcoin is still on its 4-year cycle as far as we know.

- Bull Market

- Bear Market.

- Maximalist Market

- Transitions & New Narratives

Right now in 2023 we find ourselves in the maximalist market, which says we should of stacked more Bitcoin, which most of us did not do and now we regret it. Oops! Better luck next cycle. However 2024 will be a transitional market where some alts will outperform Bitcoin and several shiny new products will moon x100 and remind everyone that this casino is still very much still in business. What will the new narrative be? In 2016 it was ICO. In 2020 it was DEFI. Interestingly enough, it looks like Ethereum and EVM devs are the ones who determine what this new narrative will be.

Obviously I'm rooting for decentralized social media to be the next big hype cycle because it would be impossible for Hive to not gain at least something during that scenario, while going x100 would also be quite doable. There are many signals that DESO will be the next narrative including:

- Musk's takeover of Twitter

- Jack Dorsey and Bluesky

- NOSTR and other maximalist versions of DESO.

- Most recently Friend.Tech, a fad that lasted all but a week before crashing into the mountain, just like I said it would.

We also have to consider the hype around the next halving cycle, which is hugely overblown and set to happen in April. I can almost guarantee this will turn into a buy the rumor sell the news situation just like it did in both 2016 and 2020. Traditionally events like these reach a peak buildup a couple months before the event happens. 3 months is pretty standard, which would imply that January 2024 might be a local peak of sorts, which seems to match many other timelines. I think that November 2023 to January 2024 are going to be a VERY good time for crypto. But until then it's going to be max pain. All the non-believers need to be flushed out of the market.

Most recently the hype of a Bitcoin EFT sent this market spiking 7% in like an hour on the news that Grayscale "won" their lawsuit with the SEC. The market FOMOed in hard, seemingly not realizing that "winning" was just another opportunity for the SEC to say 'no' or simply delay the process all over again. There was some speculation that perhaps magically this would catalyze the SEC to approve the upcoming Blackrock ETF, but I just now Googled that and it was delayed 11 hours ago, which seems to have fully completed the Bart Simpson pattern and left Bitcoin right where it was before the Grayscale hype began. A little lower even, with alts predictably doing even worse due to the maximalist consolidation cycle.

The market is not done bleeding.

Rectember just started and there is a clear and obvious target for Bitcoin to hit in order to flush out all the leveraged longs and instill the maximum amount of fear inside the heart of the hodler. That number is something like $23500 BTC. Maybe even down to $22k. Definitely below unit bias support of $25k.

As much as I want to sell more crypto and bet on this outcome I just can't seem to bring myself to do it. It's simply not a big enough move and I don't want to trade on leverage. In fact my strategy is just to do what I did last time and max out credit cards as a way to go proxy-long in a slow DCA manner into the end of the year. Turns out putting debt on a credit card doesn't have a liquidation target, and the APR is better than centralized exchanges as well. I plan on paying back this debt between November-January accordingly.

On a side-note the banks seemed to be impressed with this strategy as well.

My credit score has ripped to all-time-highs recently by slowly stacking up debt over several months and then paying it all off in one lump sum. Go figure. That must be atypical behavior that their algorithm interprets as safe-debt. Makes sense.

More News: Mandala & Uniswap Updates

First off Mandala's new platform launched, but it may be a complete bust as I was not able to actually use it. Said I needed to complete KYC in order to deposit funds, which I appreciate because shady platforms like KuCoin have been known to allow deposits and then prevent withdrawals without KYC.

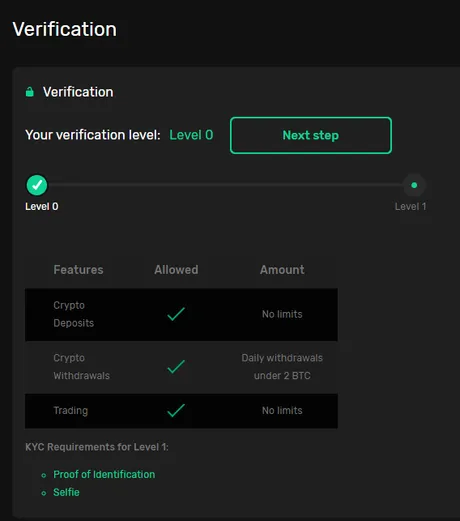

However, when I actually click on the KYC verification tab it claims that level 0 verification (which I have) is good for infinite deposits and withdrawals up to 2 BTC, which has been the standard for years now. So it's possible that they'll change the rules and let me use the platform after they get everything set up. I'll have to do a follow-up post about this in a month or whatever just to make sure.

Unfortunately even if Mandala does allow me to use their services it might all be for nothing because they don't currently have a Hive listing. They've lost access to the Binance Cloud liquidity pools and the chance that they don't relist Hive is quite high. After all it is a pretty low liquid market and they are very much on the backfoot here. Again it will be worth an update later but for now it feels like RIP Mandala. I'll have to find a new liquidity pool to use after this inevitable disaster.

https://cointelegraph.com/news/uniswap-class-action-suit-judge-says-ether-is-commodity

https://www.coindesk.com/policy/2023/08/31/us-court-calls-eth-a-commodity-while-tossing-investor-suit-against-uniswap/

In other news a judge outright just threw away the class-action lawsuit against Uniswap claiming that they were responsible for all the scam tokens bought and sold on the network. This one didn't even go to trial and was dismissed immediately. The judge even went so far as to call Ethereum a 'commodity', even though legally this does not set precedence or imply that ETH is actually a commodity. But it is nice to hear.

Failla said she wasn’t convinced by an argument that Uniswap’s token sales were subject to the Exchange Act.

But Wednesday's ruling to scrap the suit before it goes to trial stated the true defendants of the case were the issuers of the "scam tokens" in question and not Uniswap.

The decentralized nature of the Uniswap Protocol made identifying scam token issuers "unknown and unknowable," leaving no "identifiable defendant" in the case, Judge Polk Failla said in the opinion following Wednesday's order.

The court also shot down the plaintiffs' argument that Uniswap was like the manufacturer of a self-driving car and that the protocol and its creators caused harm by creating a system that allowed for scam tokens.

"Indeed, this is less like a manufacturing defect, and more like a suit attempting to hold an application like Venmo or Zelle liable for a drug deal that used the platform to facilitate a fund transfer," the opinion read.

Citing an absence of relevant regulation, the court concluded that the investors' concerns "are better addressed to Congress than to this Court."

It's very nice to see that the judges on these crypto cases seem to be really doing their homework on how all this stuff works. Many were very worried when this class-action lawsuit was initially filed, as something like this taken seriously would destroy entire business models on networks like Ethereum.

All of a sudden it would not legally be possible to host a DEX and all DEX devs would have to remain anonymous forever just like the scam-token issuers. Luckily that didn't happen. Not only did it not happen, it didn't even go to trial, which again is uplifting to get such a definitive instant ruling like that in our favor.

Conclusion

Everything is stacking up in crypto's favor, we just have to get past Q3 and into Q4 to realize some of these gains. September is never a good month and the best we should hope for is sideways price action, but I suspect the market-vampire will take this opportunity to scare the hell out of the speculators by dipping slightly below the obvious support lines. Again my target is somewhere between $22k and $23.5k, which unfortunately puts Hive at something like 20-22 cents. Ew. Too bad I only have a couple thousand dollars to pump back into the market even if I'm right. Maybe one day I'll learn my lesson and have more balanced positions. Until then it is what it is.

Return from Max Pain: One more dump to Moon. to edicted's Web3 Blog