Bitcoin is entering another period of low volatility, hovering right below all time highs. As we've all seen time and time again, the lower Bitcoin volatility gets for an extended period of time, the higher of a chance it has to explode in one direction or another.

When Bitcoin begins to stabilize but volume is low, the market tends to panic. Often price will fall without enough volume to justify it, especially when volatility is low. However, we are in the exact opposite scenario.

Bitcoin volume is actually quite high at the moment. Volume on Coinbase is usually around 10k BTC per day. For the last week their volume has been at least 50% higher than that hovering between 15k-30k BTC per day. This is extremely bullish.

I consider Coinbase a good metric because they are a highly regulated and popular exchange that plays by the rules. While other exchanges have absolutely absurd volume numbers due to wash trading, Coinbase does not lie to prop themselves up on the list.

Volume is high but volatility is low.

The implication here is that there a lot of buyers and sellers at this level. Liquidity is high. Demand is high, and supply is high as well. These are all healthy developments for a thriving free-market.

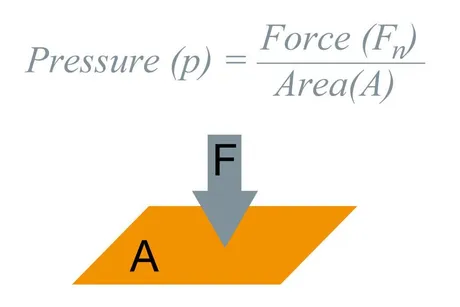

However, this situation is not going to last for long. Imagine two pressure plates pushing against one another. One plate is at $19k pushing upward (demand) while another plate is pushing downward from all time highs at $20k. At some point, one of these plates is going to win out over the other, and either the longs or shorts are going to get squeezed as the price explodes out of this narrow band.

Obviously I believe demand is going to win out for various reasons. Supply is going to run out at this level and the price will explode past all time highs. The longer we sit at this level, the more pressure builds and the bigger the explosion.

Why bullish?

Not only is December normally a good time for Bitcoin, but also the stock market has performed well 100% of the time when November does quite well like it has this time around. Bitcoin volume and velocity are quite high at the moment. There's no reason to think that everything is going to crash into the mountain when all signals flash greed green.

Corporations are starting to realize that holding USD is a fool's errand when compared to gains in Bitcoin. Every year that goes by Bitcoin will capture more and more value. Eventually it will stop capturing value and be generating all that wealth from within. Every year it is getting more and more stable but the gains it makes become more consistent.

Central banks have been leeching value from corporations for over a hundred years. Now corporations have the tools to be like, "You know what? I think I'll just hold my value in Bitcoin." And unlike gold that simply stores value, Bitcoin is generating value by absurd unicorn levels of x2 per year. On top of that corporations can transfer this value anywhere in the world for what essentially rounds down to a 0% fee given a big enough transaction. It's truly a no brainer.

BUT ATH THOUGH!

We can see in the market and via testimonials, many many long time holders are betting against this level and selling here. Everyone who wanted to sell at all time highs but never got the chance are being given their opportunity right now. Everyone who thinks we are going to skim off ATH and crash from here is turning bearish. However, as I stated 12 days ago, when the market overwhelmingly seems to think something is going to happen, it rarely ever does.

There is simply way way way too much volume and low volatility to be anything other than super bullish right now.

Mind the gap

So we see there is a big supply and demand level in this $19k-$20k area. However, $20k-$21k is completely no-man's-land in my opinion. As soon as we push off higher from here we'll likely spend very little time in the area right above $20k.

Why is that?

Because everyone who is betting against the market and assuming we are going to dip from here is still a long-term Bitcoin bull. Most people are assuming that Bitcoin is going to run quite high in 2021. When Bitcoin pushes past $20k all of those people who sold thinking that wasn't going to happen are going to panic.

FOMO

Once we push above $20k where is the resistance? Nobody knows. We have to find it. It stands to reason a huge percent of holders who were gambling on the market will capitulate and FOMO back in at a loss. Such a rush could easily push us into the $25k range in less than 24 hours. The short squeeze is real.

Conclusion

I'm expecting a very big flag up in a matter of days or less. The trendlines are still overwhelmingly bullish, and if they go from linear to parabolic in December we should get the instability and blow-off top I was looking for that will signal the market needs to deflate for a few months.

Of course this is all gross speculation and all that, once again, but I really thought it was noteworthy to mention the volume of Bitcoin. Volume is high, but price isn't going anywhere. Everyone who's dumping is having that BTC scooped up by 'someone' else instantly.

Personally I'm still holding out for $50k Bitcoin before the end of the month.

Obviously for that to happen we're going to need to see some seriously explosive moves in the near future. Perhaps that prediction is coloring this particular post. You decide. However, I'm still seeing no evidence to suggest that this bull run is even close to over.

Posted Using LeoFinance Beta

Return from Mind the Gap: Pressure is building. to edicted's Web3 Blog