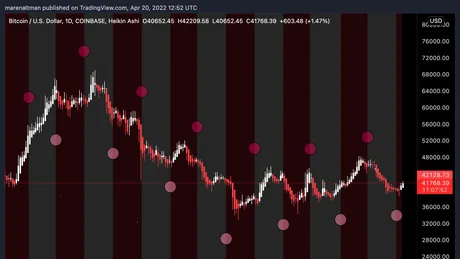

Look... at... that...

Crystals girls rejoice!

It's just silly.

The correlation is comically undeniable.

2022 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $27733 | $29867 | $32,000 | $34133 | $36267 | $38400 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $40533 | $42667 | $44800 | $46933 | $49067 | $51200 |

Doubling 'curve' strong.

Of course when you chart it on a logarithmic graph the doubling curve is just a straight line up. This is something I've been talking about for years, but others are finally talking about it as well. Good thing too, because it's painfully obvious and it's weird that no one was talking about it in the first place.

We can see that we've only really traveled underneath the curve for a long period between the 2013 and 2017 bull runs. That makes sense because the gains Bitcoin made from 2009 to 2013 were even more than double every year. The 2013 run did a 10x and 2012 did a 10x as well, so grinding under the curve for 3 years shouldn't be too shocking.

That being said, look at the chart.

If we buy Bitcoin when it hits the support line, we basically can't lose. I was telling everyone to buy in March 2020 right before COVID tanked the market 50%. Still, it didn't matter as we recovered within a matter of weeks. Also during the period of 2013 to 2017 we see that anyone who bought the curve was also in the green after a matter of months no matter where they bought in. Doubling curve stronk.

- Summer 2016

- Winter 2017

- Summer 2019

- Winter 2020

- Summer 2022?

The last 4 bull runs have been 18 months apart, and we are heading into the 18 month since our last run in Q4 2022. Will the pattern repeat itself? I think it will. Also my predictions as of late have been surprisingly accurate. A broken clock is right twice a day.

By my calculations the curve sits around $34k at the moment. Combined with the current price action, that makes $35k support essentially uncrackable except in the case of complete financial meltdown. Truth be told, I hope that meltdown happens soon, because I want to know if Bitcoin can perform in a legacy bear market like I think it can.

How would it perform?

Much like it did from 2013 to 2017.

- We'd be grinding under the curve hard.

- Many altcoins would bleed out into Bitcoin.

- This greatly increases Bitcoin dominance.

- It is also a great opportunity to eventually trade BTC back to alts.

- Just like I did to acquire my Hive bags in Q4 2020.

At this level, it doesn't really matter what Bitcoin does. It either crashes to or slightly under the doubling curve, or it moons x2-x3 higher than the curve during a traditional bull run.

What about mega-bull run?

As I've stated previously, I think the days of mega-runs for Bitcoin are over. The institutions are involved, and they are steady handed sharks that know how to DCA and short the market accordingly. Retail no longer has the power to choke liquidity and send it too the moon. Liquidity is too deep and the players are too careful and have too much at stake to take the same risks that were taken in 2013 and 2017.

That being said, there is one possible way Bitcoin can mega-bubble once more (not that this is a good thing as mega-bubbles are essentially money attacks via centralized agents). Basically most governments, banks, and corporations in the world would have to start aggressively competing to own more. Could it happen? Sure. But that kind of one-off mainstream-adoption event isn't going to line up with any of these market cycles. It will be totally random and pop up whenever given the geo-political economic climate.

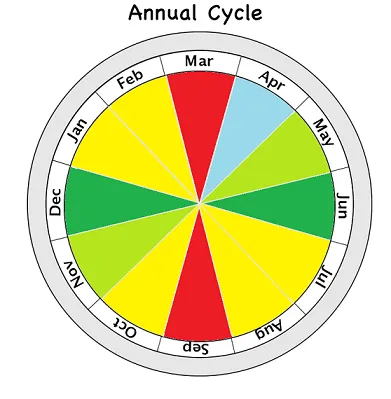

The cycle chart is playing out nicely this year.

While not nearly as accurate as the doubling curve, the annual cycle chart seems to be in play. JAN/FEB/MARCH/APRIL have all been predictable consolidation months. We just keep making higher and higher lows without being trapped in an ascending wedge, and that's great news. May and June are primed to be really really good months, but at the same time that probably means that the end of the year is going to be complete hammered dogshit. Don't forget that the chance of getting 2 green cycles in a row in the same year is... not historically accurate. A bull market in summer largely implies a bear market at the end of the year (unless we crash all the way down to the doubling curve in September or end up getting that mega-bubble after all).

Again, we can't go wrong buying on the curve, and Bitcoin is close enough to the curve right now to buy. If we crashed back down to $35k I'd go long for the first time in years... or perhaps not seeing as this house of cards we call an economy can topple over at any time from supply chain failure. The real moment to go long is when the next recession happens and Bitcoin flash-crashes 50% below the doubling curve like it did in MARCH 2020. That's just free money right there.

conclusion

Everything about this market looks bullish. Unfortunately it is a fleeting bullishness and we will need to take gains DCA style during late May and June in order to actually realize the value being spun up. I'm still targeting the $90k-$115k range for BTC, and it's anyone's guess as to how crazy the altmarket will be, but I assume alts will easily outperform BTC during this time. Also, let's hope that Ripple wins their court case against the Securities Exchange Commission, because that would be absolute insanity.

Return from Moon cycles still embarrassingly accurate. to edicted's Web3 Blog