The regulatory campaign against crypto in 2023 is well underway, just as predicted in 2022. I shouldn't be surprised, but honestly I am a little surprised. They are really going hard right now and just pummeling crypto left and right with everything they have.

At this point it feels purposeful, like they actually coordinated this attack to make sure all the blows fell right around the same time. Of course this assumes that the onslaught will pause and that a bull market will result from the wake of that quiet time. I've always enjoyed the conspiracy theory that the establishment attacks crypto so they can buy more and then exploit a pump, so let's go with that.

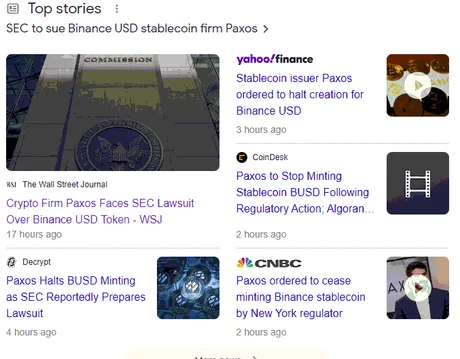

Say what? Wall Street Journal eh?

Wall Street Journal: Crypto Firm Paxos Faces SEC Lawsuit Over Binance USD Token

The Securities and Exchange Commission has told crypto firm Paxos Trust Co. that it plans to sue the company for violating investor protection laws, according to people familiar with the matter, the latest move in the agency’s escalating campaign in crypto enforcement.

The SEC’s enforcement staff issued a letter to Paxos known as a Wells notice, which the agency uses to inform companies and individuals of a possible enforcement action, according to the people.

The notice alleges that Binance USD, a digital asset that Paxos issues and lists, is an unregistered security, according to the people.

BUSD is a Binance-branded stablecoin pegged to the dollar on a one-to-one ratio. Binance and Paxos announced the partnership to launch it in 2019. The Paxos-run digital asset exchange, itBit, also lists BUSD. Many other exchanges also list BUSD.

It couldn’t be determined if the SEC notice is specifically related to Paxos’ issuing of the coin, the listing of the coin or both.

“Paxos is not commenting on any individual matter,” said a Paxos company spokeswoman.

Binance said BUSD is issued and owned by Paxos, and it only licenses its brand. “We will continue to monitor the situation,” it said in a statement.

The SEC didn’t respond to requests for comment.

Firms that receive Wells notices are allowed to respond in writing and tell the SEC why it shouldn’t proceed with a lawsuit. Wells notices aren’t a final indication that the SEC will take enforcement action. The agency’s five commissioners must vote to authorize any enforcement settlement or litigation.

The SEC has been intensifying its crypto enforcement against major market participants. Last week, Payward Inc.’s Kraken platform agreed to stop offering crypto staking services in the U.S. and pay $30 million in penalties to the SEC. Staking allows investors to earn a yield by temporarily handing their crypto tokens over to either an intermediary or a cryptocurrency network.

The SEC hasn’t previously taken enforcement action against a major stablecoin issuer. But when the agency last year expanded its special enforcement unit devoted to the crypto market, it said that stablecoins would be an area of focus.

Stablecoin issuers run a lucrative business by investing user deposits in cash and cash-equivalent assets such as short-duration U.S. Treasurys. BUSD has grown to become the world’s third-largest stablecoin, with the market cap of BUSD standing at over $16 billion as of Sunday, according to data provider CoinGecko. Paxos also issues its own stablecoin called Pax Dollar, which has a market cap of around $897 million, per CoinGecko data.

SEC Chairman Gary Gensler has said stablecoins can resemble bank deposits or money-market mutual funds. A panel of regulators led by the Treasury Department said in November 2021 that stablecoins should have a specific regulatory framework and their issuance should be limited to banks. Congress hasn’t passed such legislation, giving regulators more discretion to police the market.

The SEC has over the past six years taken enforcement action against dozens of digital tokens. The agency alleged those assets were the type of investments that must be registered with the SEC before they can be sold to the public. Registration typically involves issuing detailed financial and risk disclosures that investors can use to weigh the pros and cons of an investment.

Write to Vicky Ge Huang at [email protected], Patricia Kowsmann at [email protected] and Dave Michaels at [email protected]

I copy/pasted the WSJ article in case it's behind a paywall.

Let's take a moment to enjoy how silly that is. The subscription model is so WEB1, and data can be transferred freely during the Age of Information. However, let's imagine WSJ tried to send me a cease and desist order.

What would happen?

They might make the claim that I made money off of their copyright material and I owe them everything I made plus I need to remove the material from my post. Really imagine it... there are so many flaws in that logic.

I literally can't comply.

I can't take down the content. It's on the blockchain forever. What's done is done there's nothing I can do.

And then there is the matter of the money...

A frontend might show that I made $40 on this post.

So then a lawyer tells me I owe them $40.

Showcasing their ignorance that I only made $20.

So the lawyer tells me I owe them $20.

But the value is stored as Hive and Hive just went x10.

So do I owe them $200 now?

Oh wait the $200 is actually stored as VESTS which are untradeable.

So I owe $0 now?

There are so many ways in which WEB3 simply does not mix with legacy.

Moving on.

The Securities and Exchange Commission has told crypto firm Paxos Trust Co. that it plans to sue the company for violating investor protection laws, according to people familiar with the matter, the latest move in the agency’s escalating campaign in crypto enforcement.

So right off the bat I find this a bit interesting.

People on Crypto Twitter are asking how in the world a stable coin could be prosecuted as a security and a breach of investment contracts. After all, there is no expectation of profit on a stable coin, which is a primary foundation of the Howey Test.

If the WSJ is to be believed, "investor protection laws" might be the answer to this. The lawsuit may have nothing to do with the Howey Test or Securities. We'll have to see how that plays out. Perhaps the Securities Exchange Commission has the ability to operate outside the bounds of Securities law? I have no idea, but then again they've been in regulatory-overreach mode for quite some time so it fits the theme.

The notice alleges that Binance USD, a digital asset that Paxos issues and lists, is an unregistered security, according to the people.

I guess I spoke too soon? lol

Yeah it's clearly not a security though so.... very weird. Gotta love how the SEC legally speaks for "the people".

Binance and Paxos announced the partnership to launch it in 2019.

I honestly didn't even realize that BUSD is a Paxos product. So weird.

You might be asking why BUSD isn't breaking to the downside. That's the funny part. This FUD makes it easier for Binance to maintain the peg, not harder. The only threat is that more BUSD won't be minted, which means the coin is only in danger of breaking to the upside, not the downside. However I think we have to assume that Binance will find a solution to this problem before any of this becomes an issue.

It couldn’t be determined if the SEC notice is specifically related to Paxos’ issuing of the coin, the listing of the coin or both.

Regulation by enforcement hard at work.

Why offer companies proper counseling when you can just slap them around on a whim?

Firms that receive Wells notices are allowed to respond in writing and tell the SEC why it shouldn’t proceed with a lawsuit. Wells notices aren’t a final indication that the SEC will take enforcement action. The agency’s five commissioners must vote to authorize any enforcement settlement or litigation.

So again we see that this could be complete vapor, which would actually make sense. What if this story just vanishes and the lawsuit never happens, and then a summer bull run occurred and we find out that people in high places were buying the dip the whole time? Wouldn't surprise me. Gotta keep the momentum of that insider-trading conspiracy alive, ya know what I'm sayin?

SEC Chairman Gary Gensler has said stablecoins can resemble bank deposits or money-market mutual funds. A panel of regulators led by the Treasury Department said in November 2021 that stablecoins should have a specific regulatory framework and

their issuance should be limited to banks.Congress hasn’t passed such legislation, giving regulators more discretion to police the market.

So so curious how they will approach algo stables

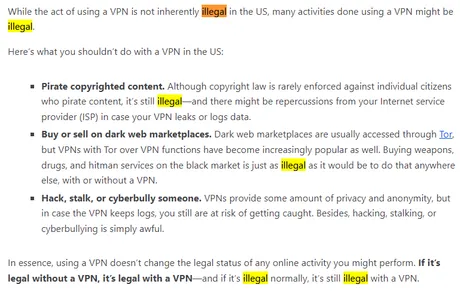

I really do think we have to assume that this entire thing is just a way to fire shots across Binance and CZ. I think regulators are pissed that CZ can just run around offering worldwide financial services to the entire planet using shadow-exchanges like Mandala as a cover, even though Mandala uses Binance-Cloud and is basically just a subsidiary of Binance (shielded by LLC law and agressive IP-blocking). As we all know, the IP-blocks are meaningless and are trivially subverted with a VPN.

Because the vast majority of regulations are designed with a top-down approach, it is way more illegal for Mandala/Binance to provide Americans with service than it is for Americans to subvert the IP-block and receive said services. In fact, I'm pretty certain that subverting the IP-block and using Mandala isn't illegal for citizens at all, but I'm hesitant to say that outright because I'm not a lawyer and I wouldn't want anyone to get in trouble because of something I said. Needless to say I do this all the time, and I do it openly and no one has ever told me I can't; especially not in any official capacity.

At the end of the day at worst it will turn into something like illegal torrenting. Only the top worst offenders will be prosecuted (if that) and even then it's only to make an example of them to scare everybody else in line. With this much money at stake, no one is going to care, and bottom-up enforcement is guaranteed to be an abysmal failure even worse than illegal pirating of copyright data due to the money at stake (which was never the case with movie pirating for free).

The SEC has over the past six years taken enforcement action against dozens of digital tokens. The agency alleged those assets were the type of investments that must be registered with the SEC before they can be sold to the public. Registration typically involves issuing detailed financial and risk disclosures that investors can use to weigh the pros and cons of an investment.

So funny

As if the public is going to do any more or less research if these investment risks are made clear. Regulators treat fully formed adults like children, right down to the way that they speak. Gary Gensler is the ultimate example of such happenstances. It is painfully obvious that the SEC will not protect us from any of the insolvencies that occur every single bear market.

How will the SEC stop another FTX from happening? Explain it to me. FTX was a highly regulated exchange and they were easily able to get away with comingling assets in the worst ways imaginable. Nothing the SEC does can help the situation. They are only another burden to be added on top of the flaming pile of centralization. Nothing more.

Interestingly enough all this seems to be pretty damn good news for HBD.

Before BUSD came under attack like this, there was a 0% chance that Binance would ever dream of listing HBD. Now they might be forced to think about listing legitimate algo stable coins that can't be fucked with like Paxos and BUSD. Of course this probably still won't happen, and that's fine. The Hive grind will continue on no matter what.

I'm actually kind of glad HBD has no listings in America at this point. The only legitimate HBD listing in the world is basically UpBit, and only South Korea has access to it. This is good, because getting delisted because of a regulatory onslaught would cripple Hive in the short term, and now we don't have to worry about that timeline as the possibility is non-existent.

To be fair we obviously do have to assume that we will have a fight on our hands once the regulators finally realize there is nothing they can do about HBD. I anxiously look forward to that moment. Things are going to get awkward for sure. But if we have to continue to build completely outside the system so be it. That path is the better long term outcome anyway.

Feeling good about Hive right now.

I'm glad I abandoned the crusade at the MA(200) and didn't let the psychic-vampire get into my head yesterday when we pumped slightly above it for a short time. Perhaps I'm getting better at this. The dump was pretty obvious IMO and the MA(25) got shattered immediately just like I said it would.

Is this a good price to buy?

40 cents has a little support, but not much. I'm still targeting that 35-37 cent level with my stack. I'm actually a bit annoyed because of this:

https://hivedex.io/

Last night as I slept HBD pumped again... and my limit orders JUST BARELY didn't get filled. lol damn it! It crashed all the way down to 0.375. So close, no cigar. Oh well, better luck next time. I get the feeling that "next time" could happen at any moment, so no worries. The 34-37 cent range is looking like a pretty epic support hopefully more of you will join me in defending it.

Conclusion

This whole regulatory crusade against crypto is so seemingly choreographed at the moment. Why is the SEC piling on threat after threat all at once in such a short period of time? Because government is such a well oiled machine? It's weird.

At the end of the day I think all this FUD is meaningless nonsense compared to the actual bear market we just suffered all the systemic failures therein. Yes, Bitcoin will probably confirm $20k as support, but that's still bullish. Onward and upward.

Posted Using LeoFinance Beta

Return from More FUD: BUSD + PAXOS to edicted's Web3 Blog