Looks like I was right about the volcano blowing it's top. The dump last night is clear evidence that this market has become wholly unstable. Expect the rest of January to trade in an extremely volatile and unpredictable manner.

As long as institutions are buying these dumps, the dips will continue to get bought out quick... but soon they are going to realize that if they just stop buying the price is going to crash and they can start buying again at a cheaper level. That cheaper level is obviously $20k.

A 30% retracement from all time highs at $34k takes us down to $24k. Coincidentally enough, this is a support a lot of technical analysists, including Willy Woo, have been talking about in terms of very very strong support. We may never go lower than $24k ever again, but I personally think we will see $20k in the summertime.

I better sell some BITCOIN!

My aggressive trading has caught the eye of Binance, and they've decided to destroy my account. If I'm being honest, I'm not surprised... I should have been using a VPN the entire time.

That being said, the only thing you need to create a Binance Mafia account is an email address, so creating another account won't be hard. I'll just have to be more stealthy about it next time around.

When you really think about it, the fact that anyone in the world can now boot up an online bank account without any KYC is pretty crazy. It's only going to become easier to pull maneuvers like this in the future, much to the dismay of regulators and the traditional banking system. Disruption is here.

This entire situation has somewhat taken the trading game out of me... and I might just hold during this inevitable crash.

Much Ado

The thing is though: who cares about a 30% loss? I'm still targeting $300k at the end of the year... that's basically 10x from the current price. Who cares about trying to capitalize on a 30% gain when the 1000% gain is still on the table? Trading during the mega-bubble year is probably a bad idea.

DCA

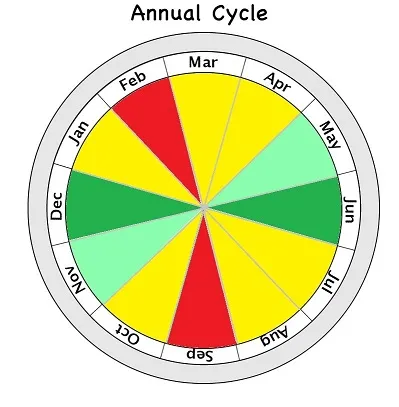

Once again, if you want to make money on these cycles, the only way to do it is to buy and sell small amounts during the good and bad months over time. In my opinion, at least 50% of everyone's stack should be held and never gambled on. That leaves more than enough wiggle room to trade on the big up and down swings in the market.

In my opinion it would be very bullish if the price of Bitcoin can return to the doubling curve at $20k by the summer time. This would allow the mega-bubble to ramp into high gear during Q4. It's hard to get momentum when you're not standing on solid ground.

Conclusion

There is no reason to panic, and there isn't much reason to trade this market at the moment either. We still have insane volume as we trade at all time highs during an insanely volatile month during a regime change.

History has shown that once the market becomes unstable like this we have quite a while before it actually fully deflates. That deflationary moment comes when volume drops and the price stabilizes. Coinbase currently has 46k BTC per day volume. We'll be having another conversation when it hits 10k or less.

As @theycallmedan often emphasizes, it's very hard to focus during a bull market. It's very hard to build and keep your head down when there is so much noise. Perhaps it would be best for everyone's psychology if we just ignored the price for now and just HODL. We are in the mega-bubble year, after all, and it's only just begun.

Posted Using LeoFinance Beta

Return from Much Ado About Nothing to edicted's Web3 Blog