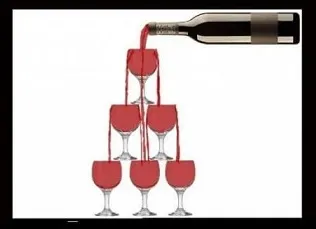

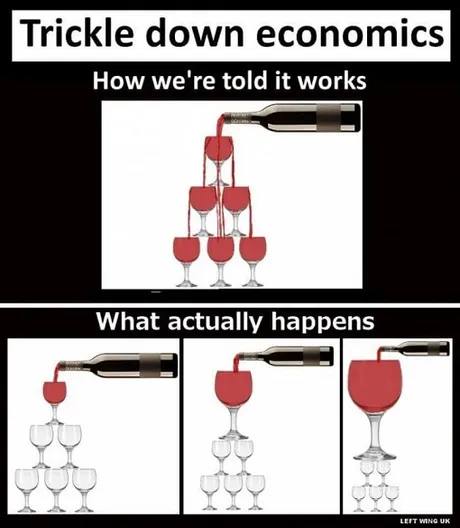

Trickle-Down Economics is a concept that revolves around giving money to the rich so they invest in infrastructure and business. The idea is if you give rich people money they will use it to make investments that will help everyone. It was made famous by Ronald Reagan and often referred to as "Reaganomics".

Unsurprisingly, this monetary policy did not have the effect it was supposed to. The idea that money would somehow roll down the pyramid is a laughable one. Money flows one way: up. Money that gets dumped on the top stays there. At least if you give money to the bottom it works its way up over time instead of just appearing there instantly.

However, we are now entering a new age; an age where Trickle-Down policy makes total sense and will work wonderfully. Crypto is the perfect model for this kind of distribution.

We've already seen this in action. It happens naturally in the cryptosphere. Decentralization is inefficient and difficult to scale. This is the cost of trust by consensus. What happens when Bitcoin becomes bloated with money and transaction fees go through the roof? It loses dominance and all the other coins gain massive velocity spikes.

Even if Bitcoin was able to scale to accommodate all transactions on the planet money would still trickle down. To give an exaggerated example: If Bitcoin goes 10x and nothing else has moved investors are going to feel like they are wasting their money. There's going to be speculation that other projects go up as well. If another coin can do the same job as Bitcoin, why not buy into it when Bitcoin is extremely overbought? This happens all the time.

It's easy to look at the market and think: "There's no way 2000 cryptocurrencies can all survive in competition." However, they aren't in competition. Many of them actually compliment each other. Bitcoin and Ethereum aren't scaling very well, but they are more tried, true, and trustworthy. Coins like Steem, EOS, Tron, and Lisk are faster and have more throughput, but it's yet to be seen if they can survive the test of time. Every project will have a chance at greatness. It will be up to the individual communities whether they sink or swim.

To say that open-source projects compete shows a complete lack of understanding of this movement. There are hundreds of versions of the Linux operating system. None of them compete. There is nothing to compete for. This isn't king of the hill. The architecture is flat and non-hierarchical.

Having a lot of coins increases decentralization. Having a lot of coins increases throughput and helps the entire sphere scale. Having a lot of coins means there will be some failures, but there will also be huge successes that nobody saw coming because they didn't have to ask for permission to innovate. Most of the projects in the top 100 market cap are pretty solid. There are many interesting projects in the top 200. After that it's very hard for me to tell. There's just too much information out there to sift through. My rule of thumb is: a coin is only as solid as its community.

.jpg)

.jpg)

Shut up about Dot Com already.

Now more than ever I see the crypto-news circuit mention the Dot Com bubble and how applicable it is to the situation we are in right now. Nothing could be further from the truth. We should have already lost 90% of the startups. Steem should be bankrupt. Dozens of the top ERC-20 tokens should be no more. We are all still here, and no one will admit they are wrong.

No one seems to understand cooperative capitalism. There is no way to subvert the "competition". There is no way to undercut the little guy or corner the market. There is no way to buy regulators who make laws that push out the startups. The code that one project develops can be incorporated in the others. We are on the brink of a new way of life; one that fosters working together over backstabbing.

Conclusion

I believe this trickle-down model will become more and more relevant over time. There will be no crypto apocalypse. For every coin that dies two more will take its place. The blockchain is going to defy all laws of previously established economics.

These economies are bootstrapping themselves in a feat never before seen in history. Wealth is being created "out of thin air". Of course we all know that countless work hours are being pumped into these projects to give them value. When one looks at the true competition (central banking) it becomes quite clear to see how a Podunk project could go x100 in a year.

Fiat is a carriage being towed by horses on a dirt road. Crypto is a formula one race car getting laughed at because it's stuck in the mud. Just wait until we pave the streets and the world drops its jaw in disbelief.

Return from My Cup Runneth Over (Trickle-Down Theory) to edicted's Web3 Blog