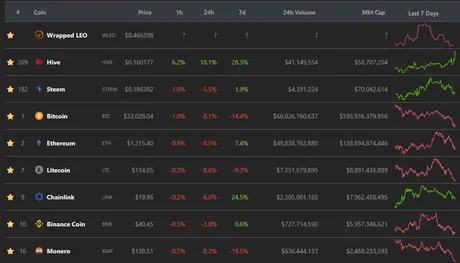

Last night I felt compelled to do a market update. I simply felt that the market was looking pretty weak and I'd better reiterate my stance that Q1 is probably going to be pretty bad for Bitcoin. Lo and Behold I wake up in the morning to a 10% drop across the board. Very unsurprising.

This is where I usually get fleeced by the market.

There will be a big drop and we panic and make a panic move, in this case fearful that the market will drop more and we dump out to fiat. Of course what usually ends up happening is that we get a bounce up... oops... just lost money from the panic sell. Too bad so sad.

Unit Bias trading.

Bitcoin is already pretty predictable relative to other volatile assets, but I'll be damned if it's not getting even more predictable. Just look at how the market is trading Bitcoin these days. Every $5000 tick turning into a resistance/support line... it's honestly pretty weird.

But you know what I wasn't expecting?

That's right baby you ready for some Hive FOMO!?

Hive has been sucking rocks for this entire bull run. We have literally been consolidating at rock-bottom for an entire bull run, and that has obviously been very demoralizing.

However, now that Hive bulls are starting to realize... hm... maybe this bull run is over and Hive is still at rock bottom... gee... maybe I should buy more Hive... ??? We are due for a serious comeback.

Hive has been uncorrelated to the market since inception. We are carving our own path, and that's great. Unfortunately everyone seems to take the spikes for granted and the dips are a travesty when the rest of the market moons. We could be due for one of the biggest reversals of all time. Hive is the only project that I would bet on to do well during Q1 considering the current market bubble vs the Hive consolidation phase. Even at 15 cents, Hive is obviously a steal deal.

It looks like Hive is in an INSANELY bullish channel right now trading against Bitcoin. Basically the 7 day moving average is acting as some kind of monster support line in the short term here. You'll also noticed that the 7, 25, and 99 day average are all fanned out in order, which is a pretty bullish signal for up up up. Pretty crazy stuff.

Seeing it play out like this... I don't think we are going to see those all time lows anymore. There's been so much Hive dumping over the last 4 months, I think we were consolidating at rock-bottom the entire time during that epic x4 bitcoin bull run.

Now that the Bitcoin bull run may be over those Hive bulls may be greedily eying what was acting as a stable coin for the last four months: Hive. At the ultimate 10 cent support, Hive is basically a stable-coin that can only go up in price. At 15 cents... it's a bit more risky but still, the upside is obviously massive.

Such fomo, much wow

Such fomo, much wow

Bitcoin volume

While the Bitcoin run is pretty much over in my view (for at least 3-6 months) we should still consolidate sideways between $30k-$35k while volume remains solid. Again, this is good for Hive because we've been consolidating for so long at rock-bottom and we have upcoming airdrops that bulls will likely FOMO over. There's a lot going on with Hive that the price has fully ignored as many big bag holders have been aggressively exiting for 4 months... but that's the thing about powerdowns isn't it? They only last 13 weeks. Looks like selling pressure is finally falling away.

The real reason I wrote this post:

Yesterday I also wrote a post about Byzantine Fault Tolerance and 51% double spend attacks. Many people are now trying to claim that the reason Bitcoin dropped 10% just now is because of this exact double-spend attack... of course they are being idiots but whatever...

Taking a look:

https://markets.businessinsider.com/currencies/news/bitcoin-price-double-spend-flaw-critical-report-suggests-2021-1-1029990921

This glorious and ridiculous FUD is absurd.

If in fact the $21 double spend did occur, it could be a fatal blow to the popular cryptocurrency in that the flaw Nakamoto set out to solve in fact remains a vulnerability that could crush confidence in the asset.

You heard it here first guys!

Pack it up! Bitcoin is going to zero because someone might have double-spent $21... lol this level of ignorance is truly mind-boggling. But don't take my word for it.

Why don't we ask Bitcoin master: Andreas Antonopoulos?

There was a chain re-organization in the Bitcoin blockchain. This is a common occurrence that is part of Bitcoin's normal operation. It is a result of decentralized consensus under Proof-of-Work. All PoW chains do this.

Two blocks were mined almost simultaneously, competing for the same height, meaning that they had the same parent block and were trying to extend the chain of the same block

Only one can ever succeed in the long run. It is possible that different nodes and miners see one or the other block first and assume it is the winner. This is also normal in a decentralized consensus algorithm

ventually, within an average of 10 minutes another block is mined. This new block has as its parent one of the two competing blocks. Which one? Whichever one the miner saw first and assumed to be the winner.

The new block extends the chain, resolving the issue.

Of the two originally competing blocks, one is now a parent and the other is the last descendant of a shorter chain. The chain with the greatest cumulative difficulty is selected by all. This "orphans" any descendants from the other chain because it is discarded.

Again, all of this is normal. A 1-block reorganization happens every couple of weeks on average as a consequence of decentralized PoW.

A 2-block reorganization happens less often, maybe a few times a year

A 3-block reorg is extremely rare. I don't think we've ever seen one

This is why exchanges require 3 confirmations

What happens to any transactions in the discarded block? If they are also in the winning block then all is well. If they are not in the winning block, each node puts them back into its mempool as "unconfirmed" and they wait for another opportunity

During a re-organization, there is a chance for someone to attempt a "double spend". This is not a double spend from the perspective of the blockchain as a whole. Only one spend survives, therefore no double spends happen. That's the whole point of PoW consensus.

But from the perspective of the recipient of a payment, they may see a transaction that appears to have 1 confirmation (it is in a block), then disappears when that block is discarded.

Very rarely, the sender will sneak a different transaction in the competing/winning block. Let's say this is a payment for a lesser amount (more change back), or to a different address.

Because the original transaction is gone (discarded block), the new transaction (winning block) is the only "real" transaction. The blockchain has prevented a double spend by discarding one and only recording the other.

From the perspective of the recipient, they thought they were "paid" after 1 block, then they... weren't. This is why "confirmations" provide /probabilistic/ immutability. The chance of a reorg drops with each subsequent confirmation

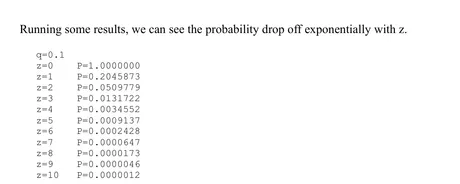

This is described in the Satoshi whitepaper on page 8. In fact, it's the only math equation in the paper and it describes the declining probability of a re-org, showing why "6 confirmations", though arbitrarily chosen is a good basis to consider a transaction finalized

Here's page 8. As you can see the chance of a block getting discarded from a reorg declines /exponentially/ as more blocks are added to the chain. Finality is based on probability.

So when do you consider a transaction finalized and when is it safe to give your customer the TV or the fiat or whatever value you are exchanging? It depends on the amount!

I waited 3 confirmations after selling my car for $11,000 USD (IIRC). Was enough for me.

It also depends on the risk of the buyer going away. I'd sell a house on 0-conf, because I know where they live!. They can't run away with it. Some things are more dangerous: I'd wait 6 confs to exchange for cryptocurrency, because once I give it I can't get it back.

During this most recent re-org, a transaction of $22 was in both competing blocks as two competing transactions. We don't know why. We don't know who. But there's nothing "impossible" about this. It is part of the protocol

Now, for $22 many would accept 1 confirmation. Worst case, you're out $22 of something you gave in return that was delivered instantly and irreversibly. Not a big deal.

Many credit card vendors don't take a signature for amounts under $25 for the same reason: while it can be disputed without a signature, it's not worth the extra time and delay to get one for such an amount. Same risk model here.

In fact, we do not know that the recipient of that payment lost money. They may have been waiting for 2 confirmations and not delivered the other part of the value. So in that case, they lost nothing - they consider this "unpaid" because it didn't get 2+ confirmations

Someone article quoted the lie "it could've been $22 million". Well, no, it couldn't. If you accept a $22m payment on bitcoin, I would assume you understand how Bitcoin has worked since 2008, exactly as specified in the paper. You don't "deliver" on that payment after 1 conf

Several other incorrect statements are also made in that and other articles about RBF and Segwit. Here's the truth: this is a normal function of any PoW blockchain. A re-org with two different versions of a transaction can occur in every other PoW chain.

Nothing weird or outside the consensus algorithm happened. Bitcoin continues to work exactly as it should. The only thing that happened is bad "journalism" if it can even be called that. In a bubbly market, a rumour can circle the globe before it is debunked.

Consider it debunked.

ANDREAS ANTONOPOULOS GOES HAM!!!!1

25 Tweets later we see this garbage debunked by the expert himself. It's rather amazing that I was just talking about this yesterday. To assume Bitcoin is broken because someone may or may not have scammed someone else for $21 is fucking hilarious. It just goes to show that the people pumping money into Bitcoin have no fucking idea how it actually works and will panic over anything.

The FUD IS BACK, BABY!

This is just yet another signal that stupid shit like this can send the market into a panic. The market didn't move because of this, the market moved because it's bubbled (x2.7 doubling curve) and literally any amount of FUD can get inside people's heads at the moment. Q1 is gonna be shit for Bitcoin, I guarantee it.

HIVE!!!!!11

On the other hand, Hive might pull the most epic comeback ever in the face of this declining market. Totally uncorrelated, Hive does not play by the rules.

A week or whatever ago I said I would only be bullish on Hive if we broke 15 cents... well... we broke 15 cents and it was at a time when the rest of the market crashed 10%... pretty bullish if you ask me. In my opinion, we should have never gone under 20 cents in the first place, but we had whales intent on dumping their bags. In my view this only served to put coins into stronger more trustworthy zealots of the Hive blockchain.

Conclusion

The market is panicking, so it's probably smart not to panic. Panic selling today is probably not a smart move unless we get that dreaded double dip. Personally I think that is unlikely considering unit-bias support at $30k.

It's been a long time since Hive went up in the face of the rest of the market crashing. Could this be a signal for an epic reversal, or will this momentum run out of steam soon? Who knows. All I do know is that I'm a Hive zealot and I acquire more Hive because that's what I do; end of story.

Nom Nom Nom

All your bags are belong to me.

I'd also like to note that I've written a market update at every critical point in the market (even if I usually get the direction wrong). This is another one of those moments. Be sure to bet against me if you still believe in my legendary accuracy.

Posted Using LeoFinance Beta

Return from My timing is impeccable! to edicted's Web3 Blog