Have you heard of Fractional-Reserve Banking?

It's the latest craze. Been doing it for a couple hundred years. What you do is loan money that doesn't exist out to people who agree to pay an exploitative usurious debt-slave interest rate on said fake money. Easiest way to make a quick buck.

Seriously though, this is how it works:

Imagine you have a billion dollars in your bank. That money doesn't belong to you. It belongs to the people who deposited money into the accounts that you secure. More importantly, it belongs to the FED with interest. However, you're legally allowed to gamble with the money that your constituents give you.

Out of that billion dollars, you might only be required to hold 200 million in the vault in case users want to cash out. The rest is available to be given out as car loans, house loans, personal loans, credit cards, or whatever else. You're running a business, so the idea is to give loans to people with a good credit score so there's a higher chance that you get paid back with interest.

Someone doesn't pay you back? No problem. That's why we have debt collectors. Rather than trying to get the money back yourself you can simply sell this bad debt to a 3rd party collection agency via auction. Whichever agency bids the highest number for said debt will own the debt, and try to collect from the poor person who's down on their luck.

Unfortunately, you'll be lucky if they pay even 5 cents on the dollar (5%) for said debt. Bad debt is risky, and debt-collectors need to play the odds on how much they can actually collect from someone who's defaulted on loans. Over time, they will offer better and better deals to the poors in order to sweeten the deal and perhaps make money on the trade.

Interestingly enough, most poor people who default on loans have no idea that any of this is going on the background. They have no idea that once debt is sold, they can no longer be sued in court. They have no idea a collection agency might have bought their debt for 2 cents on the dollar. They have no idea how credit scores work or how to build back their credit score.

Grossly off topic

So then other negotiating agencies pop up that you might see on commercials promising you they are on your side and they will negotiate a better deal with the debt-collectors. Don't worry, they'll get their cut and make you pay more than you would of had to if you just talked to the collection agency directly and negotiated your own deal. Better yet... you could just not pay back the debt and figure out other ways to increase your credit score, like high interest car loans and secured Visas.

https://www.theblockcrypto.com/linked/90025/occ-regulator-banks-stablecoins-issuance

https://www.marketwatch.com/story/crypto-prices-jump-after-u-s-regulator-says-banks-can-use-stablecoin-connect-to-blockchains-11609811050

https://www.coindesk.com/occ-banks-stablecoin-payments

This is the news of the month.

Everyone is flipping their collective shit over this new development where banks will be allowed to issue stable-coins. It's a double-edged sword, but it is damn interesting.

Highlights from all 3 articles:

The federal banking regulator published an interpretive letter addressing whether national banks and federal savings associations could participate in independent node verification networks (INVNs, otherwise known as blockchain networks) or use stablecoins. The letter said that these financial institutions can participate as nodes on a blockchain and store or validate payments.

Still, the OCC said INVNs “may be more resilient than other payment networks” due to the large number of nodes needed to verify transactions, which can in turn limit tampering.

“Our letter removes any legal uncertainty about the authority of banks to connect to blockchains as validator nodes and thereby transact stablecoin payments on behalf of customers who are increasingly demanding the speed, efficiency, interoperability, and low cost associated with these products,” Acting Comptroller of the Currency Brian Brooks said in a statement.

It also specifically mentions the use of stablecoins for transactions, saying blockchain networks can mitigate costs for cross-border transactions as a "cheaper, faster, and more efficient" means of payment. For that reason, it's empowering banks to utilize blockchains and their stablecoins for converting to and from fiat during remittances — and even issue stablecoins if they so choose.

The more I think about this situation, the crazier I realize it is, and what is right around the corner, looming.

https://www.coindesk.com/us-lawmakers-introduce-bill-that-would-require-stablecoin-issuers-to-obtain-bank-charters

REGULATION

So this STABLE act also pairs with what's going on here. It looks like traditional crypto exchanges like Coinbase and Bittrex are being choked out, and if they want to continue issuing stable-coins, they'll have to be fully regulated just like a traditional bank.

Truth be told I'm not sure if this is that big of a deal, as American exchanges are already in compliance with a lot of that regulation. This recent development just puts retail banks on a more even playing field with the much more sleek crypto-exchange counterparts.

A new U.S. congressional bill would require stablecoin issuers to secure bank charters and secure regulatory approval prior to circulating any stablecoins.

“Any entity that wants to issue something that walks and talks like money or like a deposit should be regulated like a depository institution,” he said. Grey is an adviser for the bill.

Which is obviously hilarious... because they want to call it money, and they want to tax the fuck out of it, but at the same time they want to legally classify it as property and impose laws on it that were created during the WW2 era. Pick a lane, dipshits.

Alright so here's where it gets crazy:

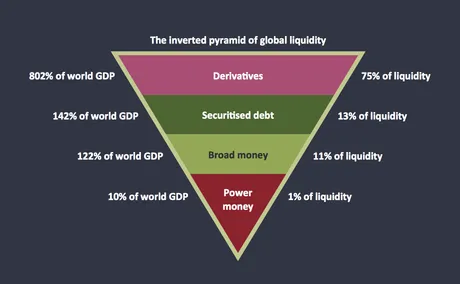

All retail banking institutions are essentially being given the greenlight to become proxy central banks. As long as they have the USD collateral to back the value of stable-coins, they will be allowed to issue that many stable coins. Think about that for a second.

See anything wrong with this picture?

Regulators are already panicking about the economy and the velocity of money. Last I checked they were allowing banks to hold ZERO PERCENT RESERVES. Talk about fractional-reserve banking? How about zero-reserve banking?

How about negative reserves?

Now that banks are being allowed to issue stable coins backed by their "reserves", what I've come to just now realize is that banks are being given the greenlight to hold negative reserves through this mechanic.

Given the example above where we have a billion dollars in the bank, now imagine loaning 100% of that money out to the world at interest. Imagine charging negative interest rates; something that apparently Europe is already doing and would have been considered absurd ten years ago.

Now imagine printing A BILLION STABLE COINS, because after all, each one of those coins is backed by $1 in your empty vault... lol. This is the future we are headed towards

https://peakd.com/informationwar/@edicted/could-stable-coins-crash-the-economy

I am suddenly reminded of this SUPER relevant post I wrote about stable-coins crashing the economy. The timetables have moved up by leaps and bounds... because I was assuming that corporations would be the ones to fuck everything up. Turns out... all banks are about to print double the money they actually control. Absolutely insane.

Anyone who knows about central banking realizes it's a scam. Debt with interest can not be paid back. The American Dream is a pyramid scheme. However, it's a very good scam that hasn't caved in on itself, yet

Each one of these companies pinky swears that they aren't going to print money out of thin air. Some will operate within the law. Some will pay to have the law bent. Some will break the law with the hope of escaping justice.

All three of these groups are going to find the means to leverage their position to leech this broken economy even more than they are now. This is not going to end well.

Debt creates debt. It's amazing that we've even been able to keep this charade going this long. They use the lessons of the past to become the masters of borrowed time. Rome has got nothing on us.

Yeah, I wrote that.

January 1, 2019... lol... two years ago. Crazy.

Imagine it

Okay, so every bank has just printed double their money. What are they going to spend it on? LOL! Probably Bitcoin! This is a massive precursor to banks entering the cryptoverse with money printed out of thin air to trick people into selling their Bitcoin. Mindblowing.

This is also a precursor to Banks, Corporations, and Governments having huge stacks of Bitcoin in reserve. Truth be told, because Bitcoin is a Unicorn asset doubling in value every year, it's quite possible that this scenario won't end in complete disaster.

Because Bitcoin is a unicorn asset and all the biggest institutions in the world are about to start competing for it... that actually might save the entire economy. Banks, corporations, and governments that would have otherwise defaulted and been totally fucked might not be because they have these reserves.

I'm now envisioning a future where the old legacy economy is totally propped up by Bitcoin. As I have already explained in a previous post, the currency minted in the future will all be indexed by every asset that a bank, government, or corporation owns. This means that these "stable-coins" will be backed by both fiat and Bitcoin and altcoins when Bitcoin become mainstream enough.

Side note

ALL STABLE COIN OPERATORS ARE ALSO ARBITRAGE TRADERS!

Read this post I wrote about the logistics of operating a stable coin. Running a stable coin is WAY WAY WAY WAY WAY more complicated than you think it is. Your stable coin will not maintain the peg just because you have dollars in the bank backing up the value. When the peg breaks you have to actively correct the price with arbitrage, or allow 3rd party arbitrage traders to do it for you.

A couple days ago TETHER broke its peg to the downside during the crazy dumping that was going on. This happened on both Bittrex and Binance, and perhaps elsewhere as well. What we need to realize is that these exchanges do not print Tether, and they are not responsible for maintaining the peg.

So of course people jump online and accuse Bitfinex of printing money out of thin air to buy Bitcoin with funny money, but nothing could be farther from the truth. When Tether breaks the peg to the downside on not-Bitfinex, that just means people are dumping Tether very quickly and arbitrage traders are having trouble routing money to these exchanges to buy it back to maintain the peg.

Therefore, all stable-coin operators are also arbitrage traders, because when you issue a stable-coin, you are responsible to maintain the peg on every single exchange that uses your stable-coin. You could let random arbitrage traders do the work for you, but then you'd just be leaving free money on the table. If you buy back your own stable coin for a low value (say 98-99 cents) and then sell your stable coin at a high value (say $1.01-$1.02) then you're just making free money while also offering your services to the public.

There are about to be a wave of stable-coins due to this development, and guess what? Tether is probably going to be the most trustworthy one out of all of them. Why? Because Bitfinex demands that their reserves in the bank are liquid. Other stable-coin operators will be far greedier than that, as they will be new to the game and not realize how difficult it is to actually maintain the peg during massive mega-bubble volatility.

Conclusion

Everyone is making a big deal about stable-coins being accepted by the banking system, but the ramifications are far far far greater than what anyone seems to be anticipating.

Every bank that uses this exploit to print money that they don't have will eventually implode if they don't have Bitcoin reserves. Maybe this is all part of the plan. Maybe, just like all the conspiracy theorists have been saying for years, old fiat currency will be destroyed in a controlled demolition, ushering in an excuse to steal everyone's value and start over at ground zero with CBDCs and a new variant of exploitative mechanics.

Now that I'm better understanding what this new law means: Negative reserve banking to the tune of -100% reserves, that really puts this all into perspective. A bank run is inevitable, and when it comes we sure as hell had better be holding Bitcoin in a self-hosted wallet and not selling out to these vultures printing fake money, no matter how high the USD price spikes.

HODL!

Posted Using LeoFinance Beta

Return from Negative Reserve Banking & Stable Coin Mania to edicted's Web3 Blog