The saying "don't look a gift horse in the mouth" means that you shouldn't criticize a gift, even if you don't like it very much. A gift horse, in other words, is a gift. ... The idiom itself probably stems from the practice of determining a horse's age from looking at its teeth.

So I was looking up the gift tax exemption for 2021 because... you know... I might be a millionaire by the end of the year. Fingers crossed. I've always been dirt poor... so it's possible I may be looking to pay back all my debts and fork out some massive gifts, given the best-case scenario. I guess we'll see.

So the last time I was looking at this tax exemption I remember it being something like $12,500. Which is interesting because it's never been $12,500.

https://resources.evans-legal.com/?p=3627

| Year | Estate Tax Exclusion | Estate Tax Initial Rate (Above Exclusion) | Estate Tax Maximum Rate | Gift Tax Annual Exclusion |

|---|---|---|---|---|

| 1977 | $120,667 | 30% | 70% | $3,000 |

| 1978 | $134,000 | 30% | 70% | $3,000 |

| 1979 | $147,333 | 30% | 70% | $3,000 |

| 1980 | $161,563 | 32% | 70% | $3,000 |

| 1981 | $175,625 | 32% | 70% | $3,000 |

| 1982 | $225,000 | 32% | 65% | $10,000 |

| 1983 | $275,000 | 34% | 60% | $10,000 |

| 1984 | $325,000 | 34% | 55% | $10,000 |

| 1985 | $400,000 | 34% | 55% | $10,000 |

| 1986 | $500,000 | 37% | 55% | $10,000 |

| 1987-1996 | $600,000 | 37% | 55% | $10,000 |

| 1997 | $600,000 | 37% | 60% | $10,000 |

| 1998 | $625,000 | 37% | 60% | $10,000 |

| 1999 | $650,000 | 37% | 60% | $10,000 |

| 2000-2001 | $675,000 | 37% | 60% | $10,000 |

| 2002 | $1,000,000 | 41% | 50% | $11,000 |

| 2003 | $1,000,000 | 41% | 49% | $11,000 |

| 2004 | $1,500,000 | 45% | 48% | $11,000 |

| 2005 | $1,500,000 | 45% | 47% | $11,000 |

| 2006 | $2,000,000 | 46% | 46% | $12,000 |

| 2007-2008 | $2,000,000 | 45% | 45% | $12,000 |

| 2009 | $3,500,000 | 45% | 45% | $13,000 |

| 2010-2011 | $5,000,000 | 35% | 35% | $13,000 |

| 2012 | $5,120,000 | 35% | 35% | $13,000 |

| 2013 | $5,250,000 | 40% | 40% | $14,000 |

| 2014 | $5,340,000 | 40% | 40% | $14,000 |

| 2015 | $5,430,000 | 40% | 40% | $14,000 |

| 2016 | $5,450,000 | 40% | 40% | $14,000 |

| 2017 | $5,490,000 | 40% | 40% | $14,000 |

| 2018 | $11,180,000 | 40% | 40% | $15,000 |

| 2019 | $11,400,000 | 40% | 40% | $15,000 |

| 2020 | $11,580,000 | 40% | 40% | $15,000 |

| 2021 | $11,700,000 | 40% | 40% | $15,000 |

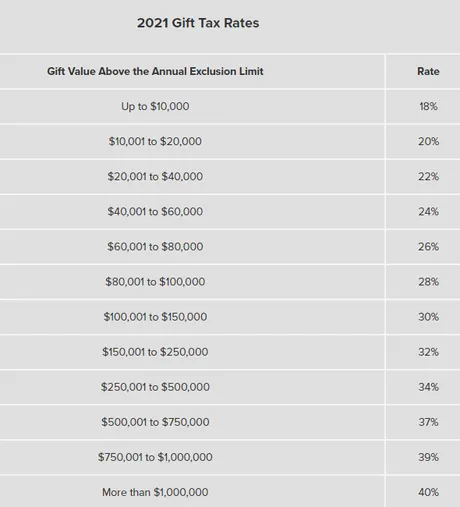

Alright so the answer I was looking for was $15k, a bit higher than I was expecting... cool. So anyone can give $15k to someone else without having to worry about the tax implications.

https://smartasset.com/retirement/gift-tax-limits

However, for some reason, I was compelled to keep reading.

There ended up being a lot more information here than I had ever realized existed.

There is also a lifetime exclusion of $11.7 million.

$11.7M? What?

That's a weird number... but what does it means?

Turns out that this gift tax is actually linked to your estate tax when it comes to inheritance. After all... your inheritance, as it turns out, is legally a gift. Zombies do give gifts after all!

This is the amount of money that you can give as a gift to one person, in any given year, without having to pay any gift tax. You never have to pay taxes on gifts that are equal to or less than the annual exclusion limit.

Yeah yeah, whatever!

I already knew that. What I didn't know is what happens when you go over the limit... because lol... that was so far out of the realm of possibility, why would I even bother to figure that out? But now I live in crypto land where anything is possible. So here we are.

If you gift more than the exclusion to a recipient, you will need to file tax forms to disclose those gifts to the IRS. However, you won’t have to pay any taxes as long as you haven’t hit the lifetime gift tax exemption.

LOL... what?!

The $11.7M lifetime gift tax exemption? That one?

WHAT?!

Yes... every time I do research on tax law my mind gets blown. Taxes are so obviously a scam. The rules only exist so that players who know the game can jump ahead of everyone else.

So many people are running around out there thinking taxes are of the utmost importance so that we can pay for infrastructure that everyone needs. The advent of crypto in combination with the recent economic fallout prove otherwise.

If a community needs to pay for infrastructure that everyone uses but is not profitable to the developer: you simply print the money out of thin air and give it to the developer. The FED is doing it right now (quantitative easing). Hive is doing it right now (proposal funding and block rewards). Taxes only exist to strengthen the dollar so that more value can be syphoned off the top without the system collapsing.

But that doesn't matter, does it?

Because if you don't pay your taxes the men with guns come to your door and throw you in a cage that is ironically paid for by: taxes. All hail the Great Satan! He's got a pretty dark sense of humor but we love him anyway. We all love our Big Brother.

Wait, where was I?

Oh yeah...

Most taxpayers won’t ever pay gift tax because the IRS allows you to gift up to $11.7 million over your lifetime without having to pay gift tax.

YA DON'T SAY! lol

And that $11.7M doesn't even count the $15k you can give to as many people as you want every year.

So apparently what's happening here is that every time you go over the gift tax limit, your estate deduction dwindles by the same amount. So if I gave $40k to someone this year, $25k would be deducted from my $11.7M estate tax deduction. Then when I die or whatever only $11.675M would be untaxable. Pretty... weird.

In almost every case, the donor is responsible for paying gift tax, not the recipient. A recipient will only pay gift tax in special circumstances where he or she has elected to pay it through an agreement with the donor. Even though recipients don’t face any immediate tax consequences, they can face capital gains tax if they sell gifted property down the line.

I thought this was particularly interesting as well, because I figured the person who received the gift was responsible for paying taxes on it... NOPE! However, if I gifted crypto and then the crypto gained value, that would create a capital gains tax, which is annoying but expected.

Gift tax has brackets just like income tax.

However, I feel like these tax brackets very much confuse the issue, because you'd have to give away over $11.7M in your lifetime for them to even apply. Seems like so much red tape for a rule that applies to so few people. Is what it is I guess. The legal system is a swiss-cheese loophole piece of subjective arbitrary garbage. That much is obvious.

Also, you'll notice in the table at the top of this post that the gift tax exclusion used to be $3000 from 1977 through 1981 until it was bumped up to $10k, and didn't start moving up from $10k until year 2000. Also the maximum estate tax since that time has dropped from 70% to 40%, which is an insane reduction. It should be no surprise that the rich have been getting taxed less and less over time, because the rich are in charge of this system and this gift tax clearly only applies to rich people (top 0.1%).

It's also crazy to see the lifetime Estate tax exclusion increase from $120k to $11.7M over the course of 44 years. Is that the result of inflation or the result of rich people getting out of paying taxes? Likely a bit of both. Google claims that $1 was worth $4.53 in 1977, which is only a factor of x4.53, while the estate tax exclusion factor has risen x97.5. Wow... pretty wild. That's a difference of x21.5 less inheritance tax after inflation has been accounted for.

The federal government will collect estate tax if your estate has a value of more than the federal estate tax exemption.

You can only exempt your estate up to the amount of your remaining lifetime gift tax exemption.

I can't stress enough how weird it is to see that your inheritance will be taxed more if you gave more money away when you were alive. I find this so incredibly strange... but I guess it makes sense? Just didn't realize the law worked like this. This clearly implies that legally, inheritance is a gift, which again makes logical sense but I just thought it would be its own separate thing.

All of this means that one way to prevent taxation of any assets you pass on is to gift those assets in increments of $15,000 or less. This could take some planning on your part but it is completely legal. There are also some gifts that you never have to pay tax on.

There are also some gifts that you never have to pay tax on.

Tell me more.

You can give unlimited gifts in these categories without facing a gift tax or having to file gift tax paperwork:

-

Anything given to a spouse who is a U.S. citizen

-

Anything given to a dependent

-

Charitable donations

-

Political donations

-

Funds paid directly to educational institutions on behalf of someone else

-

Funds paid directly to medical service or health insurance providers on behalf of someone else

LOL political donations are untaxable?

Of course they are... Christ. Right up there with Charity.

So if you keep it in the family (wife and kids) it's untaxable. If you pay for school or medical bills, it's untaxable. Charity or politicians? Untaxable.

Now I see why people make such a fuss about political donations. You could literally buy a politician, have them in your back pocket, and not even pay taxes on the transaction. LOL! Pretty wild!

Also imagine the people who control charities (and church tax exemptions are even more insane)! So easy to make backdoor deals and create a black box of money flow that the federal government can't touch.

If your spouse is not a U.S. citizen, you can only give him or her $157,000 each year.

RATS!

Only $157k?! PSH!

Lastly, it’s important to note that charitable donations are not only exempt from gift tax, they may also be eligible as an itemized deduction on your individual income tax return.

Which is why when a corporation says, "Oh look at us we're so generous for donating to charity," they are absolutely full of shit and doing it because it's a massive tax write-off and they get to capitalize on public sentiment at the same time while selling their product. Definitely worth a closer look some other time.

You should complete Form 709 anytime you gift in excess of $15,000 – even if you’re within the $11.7 million lifetime limit. You’ll have to file a Form 709 each year you give a reportable gift, and each form should list all reportable gifts made during the calendar year.

Summary:

The IRS allows every taxpayer is gift up to $15,000 to an individual recipient in one year. There is no limit to the number of recipients you can give a gift to. There is also a lifetime exemption of $11.7 million. Even if you gift someone more than $15,000 in one year, you will not have to pay any gift taxes unless you go over that lifetime gift tax limit.

Analysis

This entire process was far more involved than I expected. I learned a lot of random facts. The most important of which is that gift tax is intrinsically linked to inheritance tax, the giver is responsible for paying taxes (if any) on the gift, and political donations are untaxable (yikes). But even if you go over the limit... you don't have to pay taxes on gifts until you breech $11.7 MILLION DOLLARS. That's crazy.

Why does this matter?

Because crypto is pure insanity. That's the short answer. Using crypto, we can create a community. Using a community, we can create LLCs (limited liability corporations), charities, politicians, lobbyists, and even churches. All of these legacy tools can be used to avoid, bend, or break tax laws (legally... and profitably illegally even if caught).

Once you add crypto to the mix of tools that can be used to bend and break this system, the options become limitless. Imagine funneling money through a church using privacy coins like Monero. LOL. Imagine all the tax write-offs and deductions we could make with access to an LLC that also controls a charity behind closed doors.

Add DEFI to that.

Add stable-coins to that. Add meme tokens with thin liquidity; taking fake losses in the 'billions' on paper without actually suffering a real loss; right at the end of the fiscal year. Add all the tricks used to turn short term capital gains into long term capital gains. Long and short positions... wash trading... "stock" options... there are so many tools that we are not using yet that it's actually unreal when you start to unpack it all.

Add decentralization to the mix. You can give away $15k as a gift every year untaxable? Give everyone in the community $15k. Leverage that money for other projects. You can pay 0% long term capital gains up to $40k a year? Yet another exploit when considering a large group of people working together.

Bleed them dry!

What happens when we tell our people to max out all their credit cards and take out as many personal loans as possible, only to funnel the money into Bitcoin/Monero (perhaps even through the "church") and have them drop off the grid, or better yet just pretend the money is gone (boating accident) and declare bankruptcy? Did you think I was joking when I said a war was coming? This is a financial war, and the dinosaurs need to be bled dry.

Go farther; push harder. Hire lobbyists to constantly hammer politicians with demands. Play the game; buy them out; change the law in our favor. Protect all of our citizens with the full power of the best legal teams. Deconstruct the surveillance grid. Decentralize the Internet.

Force them to legally accept that cryptocurrency is currency.

It won't be hard to beat the dinosaurs at their own stupid game while at the same time winning at the new game as well. They are old and lazy and fat and not prepared for any kind of fair fight. They've been winning the easy fights against figurative economic children their entire lives. They won't know what hit them. Like a Mack Truck to the face.

Conclusion

Kill 'em all! ... In their pocketbooks. The next revolution won't be won with weapons. It will be won with money. It will be won by destroying the very concept of intellectual property. It will be won by giving the means of production back to the people where it belongs.

Related posts:

-

Return from Never look a gift tax horse in the mouth. to edicted's Web3 Blog