The Shitcoin casino is reopening for business, frens.

This time the users are the product. https://StarsArena.com

That's right bruvs

There's yet another social media token that just launched that claims to be "superior" to Friend.Tech. Is it actually superior to FT? Eh I don't know... probably. Friend.Tech isn't very good and a superior product is still going to implode under the shear weight of its own unsustainability.

- 2022 bear market

- 2023 maxi market

- 2024 new narrative market

- 2025 raging bull

As we approach 2024 we can expect that the four year cycle will continue to play out. That means the shitcoin casino is about to spin up a new rampage of tokens. What kind of tokens will those be? Well 2016 it was ICO. 2020 was DEFI & yield farming. 2024 is yet to be determined, but my strong guess is social media at this point. We've actually been pointed in this direction for quite a while.

It all started with NOSTR (sort of)

- Mastodon

- Rumble

- Blue Sky

- NOSTR

- Friend.Tech

- Stars Arena

The pattern gets stronger.

Even though platforms like Rumble & Mastodon aren't really crypto-adjacent, they are free-speech adjacent and try to market themselves in a way that promotes account ownership and freedom. Unfortunately it's obvious that none of that marketing actually matters; it's the same for every platform that gains enough adoption. Once a certain threshold is breached the dictators come in and steamroll the ecosystem.

I haven't looked in Blue Sky in a while because I already did enough research on it to know it's not going to work. Same with NOSTR. NOSTR is a cool idea because it's connected to Bitcoin and the Lightning Network, but the incentives and infrastructure to scale simply do not exist. The user experience is terrible and the lag is untenable even as a tiny network.

Friend.Tech and Stars Arena both have a strategy of allowing every user to basically have their own token. Friend.Tech used to call these "shares" then rebranded to "keys". Stars Arena seems to be calling them "tickets". No matter what they're called it's going to be funny if the SEC decides they are unregistered securities. I mean they aren't but, SEC just does whatever they want at this point.

So I made an account yesterday or the day before.

It was really easy. All I had to do was log in with Twitter and give them access to my Twitter account just like I would with a phone app. Seeing as my Twitter account is near-worthless to me I literally have nothing to lose.

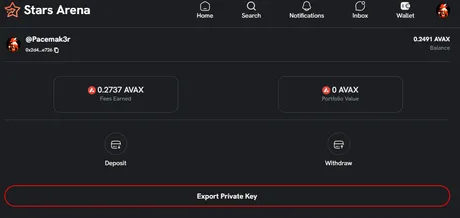

I was very surprised when I logged in just now that my account has actually made money. Bots have been buying and selling my Tickets. So if you want to make a few free dollars and don't mind giving this website permissions to your Twitter data you should sign up.

Considering that Stars Arena is so new I definitely would consider buying the token for the platform and engaging in these shitcoin tokenomics. But there's just one problem: it seems that this new business model doesn't actually create a new token. For example: on Friend.Tech the underlying currency used is simply ETH on the Base L2 chain. Stars Arena seems to be the Avalanche version (AVAX).

I know very little about Avalanche but I do know they are considered one of the top gaming EVM L2 chains. I've never seen anything built there that I've had particular interest in, but some of the production values of these games are much higher than the average crypto project. Obviously I assume that most of this is just VC money floating around hoping to make a quick buck.

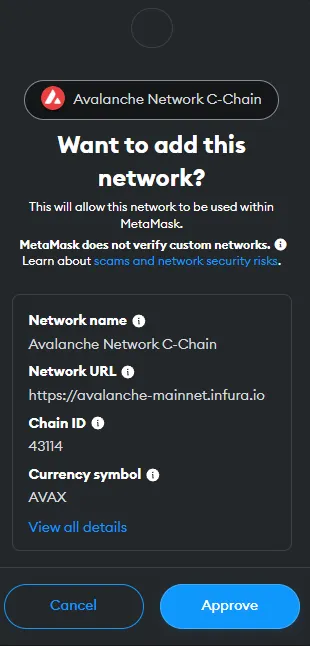

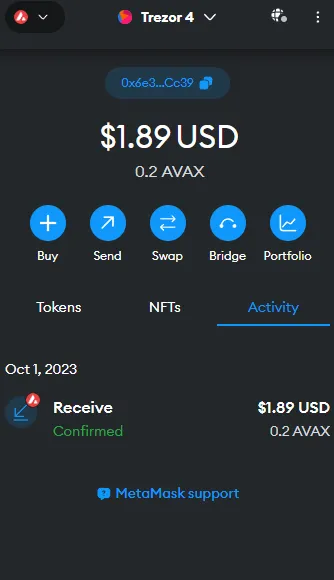

In any case it looks like SA is the same as FT in that the base token is simply AVAX. You can see in the screenshot above that they even created a private key I can export. I have no idea how that works or if they have access to my key, but it looks like I can easily move the money to a Metamask wallet that I know is under my control. I just need to configure a new RPC node in Metamask to connect to the Avalache ecosystem, as I've never done that thus far.

I must admit that the advent of Stars Arena has kinda sorta made me want to take up a very tiny AVAX position. Maybe a couple hundred dollars; def less than $1000. As a gamer I really should be paying more attention to this ecosystem, and now that something like Stars Arena exists it just pushes me further into thinking that I shouldn't be ignoring it like I have been over the last few years. Like many alts: the price is right and no longer feels totally overbought like it did during the bull market.

The fact that SA has no direct shitcoin to trade on (other than individual account "ticket" stonks) means that any kind of adoption could potentially push the AVAX token higher... although I wouldn't hold my breath as it might be quite difficult for a project like this to push of the market cap of an asset of $3.4B. That's already about x30 larger than the Hive MC to give some context to the situation.

What about shilling your own tickets?

This is also an option, but not a very good one. Ultimately the behavior being incentivized with this business model is extremely toxic. The best strategy is to create your account and then immediately buy your own shares/keys/tickets/stock with the intention of dumping them on your followers later. I can't do that because then I would lose a massive amount of reputation on Hive. Not worth it.

In fact this is such a good strategy that it's exactly why my account has already made money. Bots are buying and selling my tickets. Why? Because they want to frontrun me trying to frontrun everyone else. There is a massive missing aspect to these networks:

FAIR LAUNCH

Clearly this technology requires a fair launch feature. As the moderator of my own account I should be able to choose when my shares are available to be bought and sold. I should be able to set a period of time that allows anyone to buy my tickets at a fair price in the beginning without the ability to sell them. Expect this to be a feature with upcoming shitcoins of a similar flavor. Expect that at least one of these kinds of products will exist on every single EVM chain. The virus is spreading.

To Recap:

This new business model is a huge contender in terms of the narrative of the next bull market going forward. Instead of creating a new token that gets premined and potentially rug-pulled by scammers... it actually turns every user into a potential scammer. It's decentralizing the art of scamming via social media, which I just think is so ironic and hilarious. Fate certainly has a dark sense of humor.

Of course the ideal concept is that I'm going to create "highly valuable" content behind my paywall and users are going to pay for that content. This creates a smoke-shield for "tickets" and gives them "utility", making them not securities. Never fear, even if the SEC does greenlight prosecution against such technology: they will only ever be able to target the top 0.1% of offenders, if not less. These are the rules of centralized top-down regulations. Basically the threat of legal action needs to scare people into no longer "breaking the law". Government simply does not have the resources the prosecute everyone.

This very much mimics exactly what happened with torrenting movies and music back in the day. The decentralized nature of P2P file sharing made it extremely difficult for regulators to stop IP from being shared permissionlessly. Friend.Tech and Stars Arena show us that this concept is being applied to social media itself, and it's actually kind of ingenious now that we see a pattern emerging.

What is the SEC to do?

What they would obviously like to do is sue & fine the developers who created products like FT and SA, but alas they cannot. Why? Because FT and SA never created tokens. They never created assets that could be ruled as securities (except for the ones that get created by user accounts). This means the SEC can only attack the users individually or the devs of the main chain (in this case AVAX or BASE).

Considering that Coinbase is already in the middle of a legal battle with the SEC it's pretty clear the regulators have very little power over this situation. It's obvious that Coinbase is going to annihilate them in court after the recent crypto victories like Ripple and Grayscale. The SEC is powerless to stop this model from propagating.

So how do the devs make money?

As I described in previous posts about FT, the fees incurred to trade keys and tickets is relatively huge. A lot of friction is being created by charging these fees, but that doesn't matter during the initial hype cycle of a new asset. This once again makes it the perfect narrative for the next bull run. Eventually this friction will seize the engine of commerce, but not before the best scammers can run off with their share of the loot.

What about Twitter and META and Threads?

Both the Twitter/Facebook rebrands to X/META and the advent of Threads (the Twitter competitor created by META) all point to this idea that social media is being shaken up in a big way. Elon Musk has the right idea for a lot of the changes he's been making. He's charging for subscriptions and limiting bot accessibility... but also allowing accounts to monetize themselves and make money. He's even charging for API usage: something I've said Hive will eventually need to do as well.

The problem with these changes is that they are the direction that WEB3 needs to head in, not WEB2. Elon Musk seems to be unknowingly applying a good WEB3 strategy to an incompatible WEB2 ecosystem. I have to assume it's not going to work, but then again once Twitter incorporates crypto it may become a viable WEB2.5 model. The jury is out on that one.

Where does Hive measure up in all this?

It was only a very short time ago that I thought decentralized social media being the next narrative for crypto would hugely benefit Hive. Now I'm much more skeptical. Hive simply does not operate in this scammy and unsustainable way. We are not a shiny new thing. Imagine being a MAKER bull during DEFI 2020 and getting no love despite being an actual DEFI product with a usecase that had staying power during the previous bear market. Nobody cares: they just want to gamble in the shitcoin casino. The chance that the same happens to Hive is unfortunately quite large IMO.

There's also the matter of @khaleelkazi and LEO.

Khal has already stated multiple times that he has plans to incorporate these exact kinds of paywalls and premium content subscriptions into the LEO ecosystem. He could learn a lot from this type of business model; incorporating the good parts while patching up the problems (like fair launch) and removing the totally unnecessary friction of the absurdist trading fees.

We've all see what happened when LEO tried to copy the DEFI 2020 trend with CUB and PolyCUB (basically failures that currently hang by a thread) so definitely take such developments with a grain of salt. The big difference being that no new token is being created: which is actually a huge deal. It would simply be an extension of the LEO ecosystem and the "REAL" Threads (aka not the META one).

Looks like AVAX is so popular that you don't even have to find the node information yourself anymore. If you click the networks button in Metamask it will direct you to a trusted node to connect to, which is what I just did. AVAX here I come... I guess.

lol it worked!

I transferred the fees I earned from the bots trading my tickets and I now have $2 worth of AVAX in my Trezor-secured wallet... badass. This is significant because, like Hive, this money was created out of thin air and given to me with no upfront investment.

This is important because I can now use the AVAX network without ever having to use an exchange so that I can seed my account with tokens for gas fees. Gas is very cheap on AVAX (because gaming network) although there was a lot of drama during the bull market that claims some operations where getting as high as $10. However, today Metamask is estimating that it would cost 1 penny to transfer AVAX to another wallet, to put it into perspective. I've seeded my account with gas fees for free, and that is very noteworthy for the exact same reason it is significant on Hive itself.

Conclusion

All in all Stars Arena was a very seamless and streamlined experienced. Onboarding from Twitter was as easy as clicking a button in my browser. Bots traded my tickets and generated a free $2 in fees which I used to seed my AVAX wallet for free. I now have access to gas on the AVAX ecosystem without having to do anything but click a button signing up for SA.

This feels like it could easily become the new 2024 shitcoin casino model that I've been speculating on for over a year now. Instead of new assets getting created that could be ruled as unregulated securities, devs have figured out a way to outsource that risk to the users themselves while still siphoning trading fees into their own pockets, kind of ingenious really.

All this being said the writing on the wall looks most dire indeed. Users are being highly incentivized to scam their own followers and profit from them using this model using various pump/dump strategies. A smoke-screen of "premium content utility" masks the true intention of pure degenerate gambling. Good luck in the casino, frens. You're gonna need it.

Return from New Narrative Confirmed: Welcome to StarsArena.com to edicted's Web3 Blog