Check it out.

Been at this since 2019.

2019

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $3467 | $3733 | $4000 | $4267 | $4533 | $4800 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $5067 | $5333 | $5600 | $5867 | $6133 | $6400 |

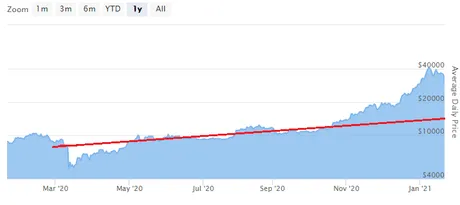

2020 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $6933 | $7467 | $8000 | $8533 | $9067 | $9600 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $10133 | $10667 | $11200 | $11733 | $12267 | $12800 |

2021 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $13867 | $14933 | $16000 | $17067 | $18133 | $19200 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $20267 | $21333 | $22400 | $23467 | $24533 | $25600 |

Bitcoin Doubling Curve

| 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|

| $100 | $200 | $400 | $800 | $1600 |

| 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| $3200 | $6400 | $12800 | $25600 | $51200 |

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| $12.8k | $25.6k | $51.2k | $102.4k | $204.8k | $409.6k | $819.2k |

The rules of the doubling curve are simple.

Bitcoin has been doubling in value every year since the baseline value of $100 during 2013. This metric has been shockingly accurate, and I'm amazed that no one talks about it, because when you chart the doubling-"curve" on a logarithmic chart (as many Bitcoin enthusiasts are known to do), the curve gets bent into a very obvious straight line.

Many have tried to tell me that the doubling curve is no longer accurate because of the COVID crash of March 2020. To which I reply: the exception proves the rule. The fact that Bitcoin recovered back to the curve within 5 weeks isn't evidence that the doubling curve is inaccurate. It's obvious proof that the doubling curve is still firmly in place.

It's funny, because when Bitcoin is trading on the curve (as it normally does) people will give the theory credence. However, the second BTC spikes x2 or x3 above the curve people will again go delusional and say the doubling curve is no longer accurate. Infinite greed is a helluva drug. We are going to return to the curve sooner or later.

The case for sooner.

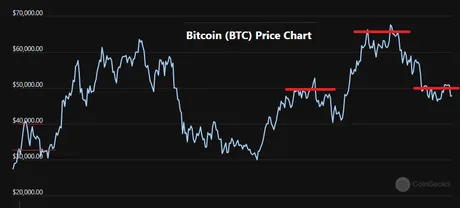

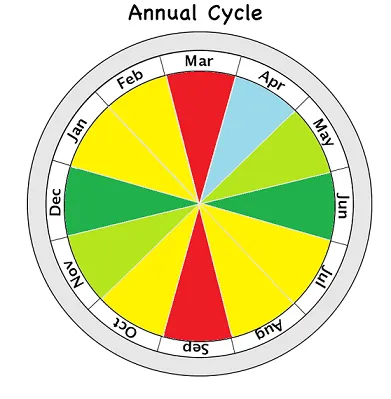

We can see a very strong head-and-shoulders pattern forming. On top of this, we are currently in a bullish moon cycle but the price is not pushing up. This leads me to believe that the head-and-shoulders pattern will complete and Bitcoin will crash to $40k, and perhaps all the way back down to the baseline $30k. It's a very good time to derisk any overleveraged positions.

At the same time, head-and-shoulders patterns only complete something like 55%-60% of the time, so it's certainly not guaranteed to happen, especially with all the mega-bullish on-chain analysis that's been going on. Also, we never experienced that mega-bubble we were expecting, so if that is still in the cards (summer 2022) then the H&S pattern surely will not complete.

At the same time we must consider who is responsible for the current pump. I think we can mostly agree that it is institutions, and institutions have diamond hands. Not in the way that crypto retail has diamond hands (holding no matter what) but in the sense that they do not FOMO and they make much safer hedged plays while providing liquidity and taking gains every quarter. We can assume that the big money entering the space right now will make the price action less volatile, which is good, but also means that a return to the doubling curve is more likely.

Time above the doubling curve.

We have already been trading in a bubble for over a year now. We skyrocketed above the curve in November 2020, and we've been towering above it ever since. This is not normal. This has never happened before. Usually it only takes 3-6 months for regular bubbles to deflate back to the curve. We have only traded above the curve for extended periods of time during and in the wake of MEGA-bubbles; the ones that go x10+ higher than the curve.

Super cycle?

Perhaps institutions are FOMOing into Bitcoin, but they are doing it much more slowly than retail would. These guys aren't going to blow their wad in a three week span like us plebs. They will do it over the course of perhaps years. This would allow us to trade above the curve for quite some time before the bubble gets popped. However, I think some kind of event would eventually trigger institutional FOMO.

What's the longest we've stayed above the curve?

This is the alarming part. In 2013 we were above the curve for about 15 months. This was caused by a mega-bubble. In 2017 we were above the curve for around 20 months. Again this was caused by the mega-bubble halving event. The even more interesting thing here are the months leading up to the peak.

- In 2013 it only took 2 months to peak (13 months of bear market).

- In 2017 it took 9 months to peak (11 months of bear market).

- Now we've been 13 months above and potentially no peak yet.

So we have to ask ourselves one of two questions:

- Is the mega-bubble canceled because institutions won't FOMO?

- Is this simply part of the lengthening bull cycle theory?

It's very hard to answer this question in the moment, but if we return to the doubling curve within the next couple of months we'll know that the mega-bubble never happened because institutions don't FOMO like retail does. Personally I don't think this will happen, because at this point institutions are still looking to buy and $40k has massive support. However, a return to $30k is essentially a return to the doubling curve, which I would actually be happy about, as it would make me extremely bullish for future price action. Buying the curve has never been a bad play, and leverage trading it is usually a good idea as well (unless economy melts down like March 2020).

Without further ADO!

2022 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $27733 | $29867 | $32,000 | $34133 | $36267 | $38400 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $40533 | $42667 | $44800 | $46933 | $49067 | $51200 |

This is the 2022 BTC doubling curve.

Lookin pretty sexy.

I always enjoy calculating the curve for the new year, because every year the jumps double in size. Last year every month went up by $1,067. The year before that every month jumped $533. This year every month goes up by $2133. EPIC!

So we can see that the doubling curve will already be ABOVE $30k by March 2022, and above $40k by the end of July. That's fantastic. If Bitcoin starts crab-walking sideways the curve will catch up to it quite quickly (before the end of the year), and we'll know it's safe to go long once again.

What could trigger Mega-bubble FOMO?

Many people have been speculating (including myself) that the real kicker will be when the SEC finally approves a spot-ETF for BTC. The SEC claims they are rejecting these applications to "protect investors" but it's quite clear now that they really just don't want to allow an asset to come into play that would boost the value of Bitcoin. By allowing Futures markets and other paper derivative assets that aren't actually backed by Bitcoin the SEC shows that they ironically want assets that are more manipulatable, not less.

This would imply that the mega-bubble comes whenever the SEC says it comes, which is annoying, but probably also not true. Even though a spot-ETF would allow a lot of money to be invested into Bitcoin that didn't have access before, these futures/options ETFs are already doing that job, and would obviously dilute the value of the spot-ETF should it be approved.

Rather, what I'm thinking is the thing that could trigger FOMO among institutions: runs along the lines of what Michael Saylor is doing. He's found multiple ways to acquire massive low-interest-rate loans and pumped that money into Bitcoin. While the rest of us plebs are paying like 15%-25% APR to go long on BTC, he's paying 2%-5% and racking up billions of dollars worth of debt in order to go long.

Pro move, because BTC goes up by x2 per year, and obviously a 100% return is a lot higher return than the 3% interest rate accrued by the loan. Not only that, his low-interest-rate loans can't be liquidated like a normal long on a centralized exchange. He's made all the right moves, and yet still people post stupid shit like this after a 10% "dip".

Didn't know Saylor was trans. How progressive!

LoL, cmon...

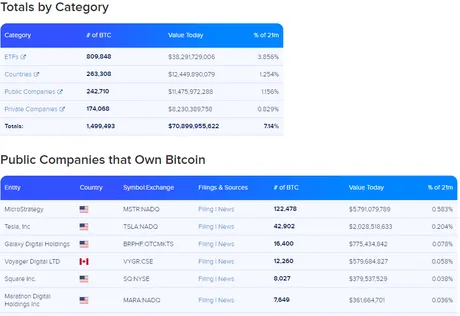

https://www.buybitcoinworldwide.com/treasuries/

His company owns over five billion dollars worth of Bitcoin, more than half a percent of the total supply, and that doesn't even include his personal stash. Guy is a legend. Price dips 10% in 24 hours and now he's in the poor house? Please, the loans he took out aren't even going to get paid back in ten years (unless Bitcoin spikes and he pays them all back so he can re-leverage on the dip).

Even more important is to point out the ETF category. This information is incredibly misleading because it shows 3.9% of all Bitcoin inside of ETFs, yet we already know that 0% of actual Bitcoin is backing these futures markets. This is why if an actual spot-ETF gets approved it will downright rock the market to the core. It's not easy to buy 1% of the total supply of bitcoin, as we've already seen, buying 1% of the supply spikes the price like x2 or more over multiple weeks.

However again, I don't think this is what will cause BTC to mega-bubble.

I've already hinted at this in a previous post.

Retail Banking 2.0

This is what will cause Bitcoin to mega-bubble. When all these institutions realize that not only is Bitcoin the best hedge in the world, but it can also be used as collateral for loans, and those loans can be used for anything, from longing Bitcoin to venture capital investments to personal loans to loaning it to others who want to short Bitcoin to printing money directly (like DAI). The possibilities for institutions are endless, but the infrastructure is still lacking. Once the infrastructure and regulations are more clear, institutions will realize that owning a lot of Bitcoin allows them to make some crazy unheard of plays that were previously impossible to accomplish.

For example.

Say an institution has $10B worth of Bitcoin (assume Bitcoin spot price has gone up due to further institutional investment). They leverage this property as collateral for a $1B loan. Easy, the Bitcoin can't get liquidated unless Bitcoin crashed 90%. But at the same time it might actually IMPOSSIBLE for Bitcoin to crash 90% because said institution might be waiting for that exact moment to buy more Bitcoin with funds from another source. See how that works? These guys can manipulate the market in crazy ways that aren't even illegal.

This institution, be it a bank, government, hedge fund, corporation, government, doesn't matter what the institution is, they have power. They can use that Billion dollars they just minted or borrowed for anything. Maybe they buy property as to hedge their position further. But wait, now that they own property they can use that property as collateral for another loan. But wait, if that institution is a retail bank they can use the property mortgage loans to fill up their vault and loan the money to someone else (house/car) at a much higher interest rate. All because they bought Bitcoin.

And there's very little risk in all of this. The billion dollars is x10 overcollateralized by Bitcoin. There's a hedge fund for the hedge fund that will buy a shit-ton of Bitcoin should the price crash 80% or more. Property is a good hedge and usually incredibly risk-averse. Giving out loans is what a bank does anyway... so whatever... business as usual.

But wait, there's more...

Because what if the institution in question isn't a bank? Well, even corporations are going to start realizing that their Bitcoin is going to start giving them access to tools that were previously only available to banks. In fact, not even banks can just give themselves a loan with their own collateral. You have to get the loan from the central bank. Crypto allows anyone to give themselves a loan... that's wild, and these things are still in their infancy and will only improve over time.

It is when institutions collectively realize "Holy shit! Look at all this new stuff we can do now!" That Bitcoin will Mega-Bubble once again. Honestly, that could take years. Again, this plays into super-cycle theory. We may be trading above the curve for quite some time (unless a mega-bubble) actually happens.

Analysis

I give myself a lot to think about here, but the backbone of this post is solid. Bitcoin is still seemingly perfectly doubling every year, and no one seems to realize it. Mindblowing. Check it out: I even calculated it in reverse:

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|

| $3.13 | $6.25 | $12.5 | $25 | $50 | $100 |

Bitcoin was worth over $3 a coin right when it launched, but nobody had any idea it was worth that much. It took 4+ years to actually catch up to the doubling curve (after the first halving event).

ETH Tripling Curve

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| $10 | $30 | $90 | $270 | $810 | $2430 | $7290 |

I'm also guessing that ETH is actually tripling every year.

I calculated this chart a year or two ago when ETH was trading below $300, so when I first charted it, it seemed to be way off and incorrect. Now that ETH is trading near $4000 it's pretty much right where it should be according to this curve. I still haven't calculated how long until ETH flips BTC if this is true. Let's do it right now... 2 years. ETH will flip BTC in 2 years methinks.

In fact, this makes even more sense from the institutional perspective, because permissionless ways to mint loans already exist on ETH, and now with yield farming an AMM tech the development is absolutely out of control compared to BTC. It only makes sense that institutions would gravitate toward the platforms that give them the most power.

Conclusion

Crazy times. We are stuck in a very weird transitional period where we are either going to mega-bubble after a lengthening super cycle, or this head-and-shoulders pattern will complete and we head back to the doubling curve. It honestly doesn't matter which of these things happens. It's not that hard to hedge our bets in both directions when the underlying asset is literally doubling in value every year. Very curious to see what Summer 2022 has in store for us.

Posted Using LeoFinance Beta

Return from New Year: New Doubling Curve to edicted's Web3 Blog