If I'm being honest...

I really thought there would be more crazy stories about crypto and tax collection and/or regulation. The kind of stories where it becomes obvious that crypto has broken free of the establishment and it's obvious that they've completely lost control of the situation. This never seems to happen. Ross Ulbricht gets a life sentence and the government was able to steal all the Bitcoin. Roger Ver gets imprisoned in another country after a decade of not even being a citizen. Coinbase gets sued by the SEC even though they did everything in their power to comply. Of course many of these events have yet to fully play out so we'll have to follow the conclusions in real time.

Still, I thought there'd be a lot more boating accidents.

To be fair maybe there are a lot of situations like this and the reason we never hear about them is because no one is reporting on them or the people engaging in this type of behavior are actually getting away with it. In particular every time I see this seem I think it's worth a serious discussion:

Can you guess at the comments?

They look something like this:

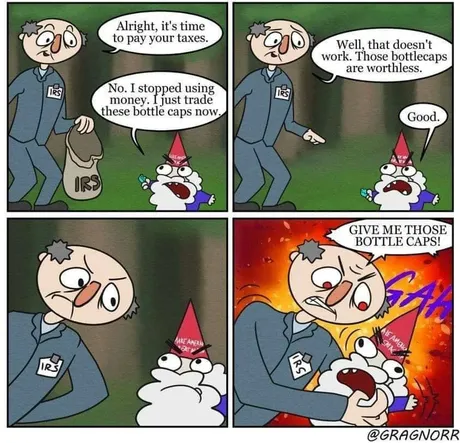

The vast majority of people seem to respond to the Chad P2P meme with the tired old argument of, "WELL ACKTUALLY BITCOIN IS A HIGHLY TRACEABLE PUBLIC LEDGER!" Dude, yeah... no shit. We all know that; this is not insight. It doesn't matter. That is such a weak and lazy argument pretending to be smart. The actual answer is we have no idea how this is going to play out. Assuming we do is a pompous mistake.

Uh okay... so you can track Bitcoin.

Let's pretend that privacy coins don't exist for a moment... otherwise the entire conversation gets completely derailed before it even begins. In this particular example someone got paid because they helped out at a construction site. The Bitcoin UTXO went into a new wallet that's never been used before, as this standard practice across the board. At best the entities analyzing the chain know the sender but have no idea who the receiver is. In fact in these situations it is often assumed that the sender and receiver are the same entity until proven otherwise. The more people actually use the chain for its intended purpose: the more convoluted and hard to track it all gets.

So this rogue UTXO is sitting there. Nobody looking at the chain has any idea who controls those coins. The only way to identify who does is to wait for that entity to transfer the money elsewhere. Preferably a centralized exchange that has the KYC information on hand. So what happens in the event that the money is spent elsewhere? This is a pretty big question-mark gray-area that depends on a variety of factors that we can't even begin to speculate on.

It's not super easy to convict someone of tax fraud.

In fact there are lawyers who's entire professional job is to make sure the rich people don't get convicted of their financial crimes. If the government claims this or that person has access to some wallet... can they prove it? By definition there will be a lot of situations where they can't, as this would be a Catch-22. To prove someone has access to crypto means the private key must be found in their possession, but finding the private key means they don't need to prove that and they can just drain the account and take the money.

There is a very real and significant chance that when people like SBF get out of prison they will be billionaires. Go to jail for ten years? Come out x1000 times richer. This should not be possible but it now is because confiscation of such assets can be extremely difficult.

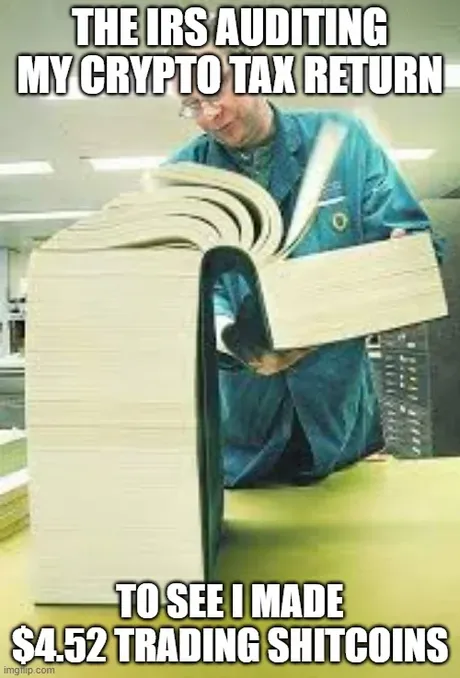

Another funny meme.

Many seem to think that the IRS is some omnipotent all-seeing entity when in reality they are chronically underfunded on purpose by design. They also tend to attack the middle class. Just wealthy enough to make the attack profitable and just poor enough to not be able to defend themselves in court.

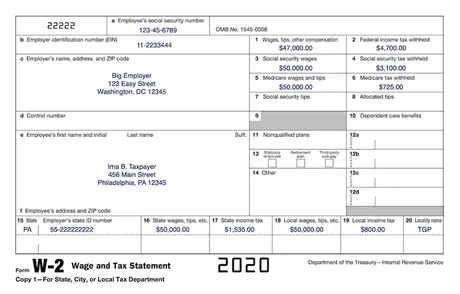

The IRS doesn't know how much we owe them. They wait for red-flags to go up and check on the red-flagged accounts. They know how much employers or investment firms report to them, but that's about it. For most this very well could be 100% of what they owe the IRS but that doesn't imply that the IRS should just assume that's everything. Why would they? Pay up!

This is how people are conditioned.

They get their W2 forms from their employer. They know the IRS has this information and so they have to pay. In fact most people get a return on their taxes because overpaying is almost always better for all parties concerned. This wouldn't be the case if citizens didn't live paycheck to paycheck and actually managed their money correctly, but it is what it is.

Point being that it doesn't matter if crypto is being tracked.

What matters is what is and is not getting reported to the IRS. This is why the rules keep changing for fiat ramps while getting more and more aggressive. Last I checked they have to report anyone who makes over $600 total in the entire calendar year. Before that it was something much higher like $20k in trading volume or perhaps even more.

I don't know what the statistics are on people who "forget" to pay tax on their unreported income, but it's obviously higher than reported income and way harder to figure out and prove in court.

In fact this is a common strategy for all self reporting.

Even people who aren't breaking the law and do everything by the book love to bury the IRS in paperwork because it exponentially decreases the chance of being audited. Imagine a government employee being paid to do all that work only to find out the IRS owes that person money. That is the worst case scenario for them. This is a for-profit operation after all. Revenue is all they care about; it's right there in the name.

Ultimate point being that people are conditioned in a very certain way when it comes to taxes and crypto shakes that up in a big way when people are running around making moves and employing smart contracts that do things that only banks and hedge funds could do previously.

To assume that "Bitcoin being tracked" is exactly the same as a W2 tax form from an employer is beyond ignorant. Sure... it might be easy to catch the cheaters... but can they actually extract value from the cheaters or will the government lose money trying to enforce the rules? The macro side of the equation and underlying incentives make a big difference in overall outcome.

And what about account recovery?

How crazy would it be for someone to take their account back from the government after it's been confiscated? Something like that could make national headlines. This is not a particularly complicated smart contract either. It's just a crude version of multi-sig combined with timelocks. Ethereum and all EVM chains could easily implement such a thing. Even Bitcoin might be able to.

Making P2P illegal?

At a certain point it becomes painfully obvious that governments like USA will be forced into an awkward position of not allowing P2P transactions between customers and retail outlets without a "money transmitting license". Which is the same as banning it because who's going to KYC every customer that walks through the door like they're opening a bank account for the first time? Nobody... unless they already had the info to begin with like PayPal and whatnot.

Who will build the roads?

The idea behind taxes itself is to pay for global infrastructure that everyone uses, but at what point does that become so bloated and corrupt that these diminishing returns hardly have any affect at all? Many would argue we were doing just fine before income tax even existed in the first place, and crypto shows that perhaps printing money and imposing a flat tax by way of currency dilution is a superior answer.

Conclusion

What kind of friction can we expect going forward in terms of the government and cryptocurrencies trying to forge their own path? If recent history has been any indication we can expect to escalate from here. The only question left remaining is if citizens will comply with this type of overreach or if they'll simply be forced to ignore it like we see in places like Nigeria where crypto is pretty much fully banned but nobody cares or obeys those rules. The more uncomfortable people get the more they're forced into making tough decisions. I see no end to the drama given the current economic climate and this supposed trajectory.

Return from Nice Try IRS to edicted's Web3 Blog