First off I would like to go on record saying that kimchi is fermented cabbage, and it's disgusting. Other people love it, I'm not a fan. There are very few foods in this world that I don't like, kimchi is one of them (and curry). How is this relevant to the topic at hand? It's not, I'm just really passionate about how much I hate kimchi. Sue me.

The term kimchi premium originates from a time in history when Korea was paying a lot more for kimchi than other countries because of a supply-chain issue. Normally in situations like this arbitrage kicks in and assets whose price pumps from demand incentivize entrepreneurs to buy cheap product and find a logistical way to get the cheap stuff to where it is more highly valued. This is arbitrage 101.

It makes sense why a physical product like kimchi might be valued more highly within a country that consumes a significant amount of that product. The logistics of moving around physical product is not a trivial matter, although many assume it is because it happens in the background and they only ever think about it when things go wrong (see: covid 2020). But... how does this happen with a digital asset like Bitcoin that can be transferred borderlessly & worldwide in 10 minutes? The answer may surprise you! (Working on my clickbait skills.)

It turns out that the reason Bitcoin can have logistics issues has nothing to do with Bitcoin and everything to do with centralized exchanges and banking regulations. Honestly we shouldn't even be calling exchanges: exchanges. We should be calling them what they are: banks.

Crypto banks.

So because the regulations in Korea are ridiculous, a premium can occur. I could write an entire post about it, but I'll let Investopedia summarize.

Investopedia:

Essentially it is impossible for non-Korean citizens to make an account on a Korean crypto bank (unsurprising), but also it's hard for even Korean citizens to deposit Bitcoin onto exchanges like UpBit to profit from the arbitrage opportunity. Whenever demand outstrips supply the premium will occur. We now see this same type of thing happening in Nigeria, but there are some pretty significant caveats that arguably make it a completely different situation.

A few days ago reports were going out that Nigerians were paying up to 60% more for Bitcoin than other countries. The number being thrown around was $38k per Bitcoin. I thought that sounded a bit weird considering what I've learned about Nigeria recently, but I ignored the news until I came across a cointelegraph post that explained it in full.

Bitcoin in Nigeria is 60% more expensive, but there's a catch

The disparity between the official naira-to-USD rate and the actual market value of USD for Nigerian traders causes a 60% "premium" over the current market price of Bitcoin

Similarly to Korea, we can see that once again it is actually the fault of wildly overreaching banking regulations that are responsible for this premium. Unlike Korea, the premium doesn't actually have anything to do with Bitcoin and everything to do with a Nigerian's ability to trade their currency (Naira Nie-Ruh) into USD.

CBN shows that $1 equals N460 on Jan. 30. However, the exchange rate of USD in the parallel market, or the actual price that Nigerian citizens can make transactions in U.S. dollars, is close to N750.

Yup

So this isn't a premium on Bitcoin at all, but a premium on USD, which is actually much more common in developing nations because of how corrupted their central banks have become. The Central Bank of Nigeria (CBN) doesn't want citizens trading their Naira for USD because that (ironically) devalues the currency. To avoid a death-spiral corrupt central banks in developing nations will often issue currency sanctions to prevent flight and force citizens to hold their worth-less fiat.

Is it possible for us to set up a p2p trading system that allows Nigerians to give us their Naira in exchange for Bitcoin, and then dump that Naira back for USD on a foreign exchange? Probably, although subverting sanctions is almost certainly illegal and the only way to not get caught would be a decentralized solution where no one person is funneling millions through a single account, as to not attract any attention. The need is great but the legal risk and overhead cost is too high to justify building such a thing.

The corrupt central banks are initially responsible for citizens wanting to exit the system, and they always double down on more corruption by forcing citizens to pay a gigantic premium if they do want to exit. None of this would happen if the fiat currency operated as intended and enough people actually had a reason to hold it organically instead of artificially.

It's also important to note that the rules do not apply to everyone. Anyone with insider connections can trade their Naira for USD at a fair price. The political system is far more corrupt than USA, as hard as that is to stomach. It's also possible to make the trade fairly given certain 'legitimate' extenuating circumstances, like working or going to school outside of the country. In these cases it is often allowed to dump Naira for other currencies at a fair exchange rate.

Life in Nigeria is pretty fucked up.

Just in case I don't write a full post on it, here are some things I learned:

-

There are many circumstances in which $1 has x10 the purchasing power in Nigeria compared to America. This isn't too shocking for anyone who's been to Mexico or another developing nation, but still.

-

One of the only ways to make good money is to join the crude oil industry or the corrupt government. You have to sell your soul and be an evil bastard, but making six figures (USD) is a huge financial burden lifted. Because crude oil products are worth more outside the country than within, it is often exported for USD and the prices can get jacked up within the country because it's not worth selling for cheap within national borders. This problem was extremely exacerbated when Russian oil sanctions began and there was a huge supply shock worldwide.

-

Power outages are frequent (multiple times daily) and anyone who needs a consistent power supply has to buy a generator.

-

It is not uncommon to get malaria every other month, and the healthcare system is streamlined to deal with unique issues like these. Although perhaps "streamlined" isn't the best descriptor, considering healthcare is not ranked particularly high. Although huge improvements have been made over the last 20 years, moving from almost dead last (187/191) in rankings to above average (86/195).

-

Driving on the roads long distances is not safe and there is a significant chance you could be kidnapped and ransomed by pirates (or just killed). Air travel is expensive (or rather doesn't have a discount compared to America) because everyone is afraid to drive those distances.

-

Politicians engage in literal human sacrifice (ritual killings) in order to win the favor of the gods and get elected. Although perhaps 'gods' is inaccurate as most Nigerians are Christian and Muslim, with only 2% non-affiliated to a religion. Either way: superstition and dogmatic misinformation runs rampant throughout the country. I found this out just recently because it is election season. Sometimes they will even poison cash or the food supply to get the job done. Pretty cool, right?

-

Many Nigerians (including @samostically) have lost job opportunities because of the stereotype that all Nigerians are scammers and not to be trusted. Many of these scammers are called Yahoo-Boys (yes, because of Yahoo.com) and are often undergraduates that dabble with internet/technological fraud. Because the value of a dollar goes so far in Nigeria, putting effort into these types of scams can be x10 more worth it for a Nigerian than someone who lives in the developed world. A good chunk of this fraud includes 'catfishing' on dating sites (which is often portrayed in the media and reality-TV) and ATM scammers ("helping" old people and other illiterates to use financial technology).

Pretty crazy, eh?

I'm sure there's a lot more to be said about the harsh living conditions of Nigeria, and each one of them is worth its own blog post. I learned a lot of this stuff from @samostically, and we are pretty good friends at this point. He's having a rough time right now for various reasons, and I even let him borrow 79 HBD recently. I always get a kick out of the way people look at me when I tell them I send money to Nigerians. Cross it off the bucket list.

ATM withdrawal situation

The big catalyst for this capital flight into Bitcoin is speculated to be that Nigerian banks are limiting cash withdrawals to 20k Naira, which is only $44. The goal for these limits is to suck cash up out of the ecosystem and force more citizens into banking digitally. Cash is disappearing. This is a common theme that everyone in crypto knows about. However, in places like Nigera where the general population is much less knowledgeable about technology this creates a lot of hardship.

To all the Nigerians I'm following and give upvotes to:

@onwugbenuvictor @readthisplease @belemo @monica-ene @samostically

I'll often skip over your post and not upvote it because of the hyper-focus on price and the bear market and speculation of better days. Not always, but sometimes. I know this bear market sucks and it's tough to consider other topics given the circumstances. I'm also aware that I do speculation posts myself all the time. Guilty! Still, I'd prefer to see a bit more variety. Just sayin, take it as you will.

For example @monica-ene used to post a lot more DIY crafting things and now posts a lot more about finance. You can post DIY on LEO, no one's gonna stop you. You can even frame it as a money-making or money-saving scheme... which it is in almost all cases anyway, eh? On that note it is interesting what the mob decides to financially incentivize with their upvotes around here, but a lot of that is just networking and upvoting people we want to support regardless of genre.

Conclusion

Nigeria is a crazy place, and to say there is room for the country to improve is a gross understatement. Will Hive eventually be in a position to help them, the rest of Africa, and other developing nations as well? That's the goal.

It is unfortunate that no one actually wants Naira, otherwise this problem wouldn't exist. I don't want Naira, do you want Naira? Who would want to hold an asset that loses 20% per year? This is called galloping inflation, and it's nowhere near hyperinflation devaluation, but it's still very bad as a store of value.

I envision a Nigeria where everyone has free and equal access to all assets at a fair price, rather than a corrupt institution imposing loan-shark practices under the pretense of lethal force. Is there something we can do? Is there some way to undercut the banks and close the arbitrage loop? I don't know, but I feel like if it was easy someone would have done it by now and made millions of dollars in the process. Clearly it is not easy, but it may be possible.

Ultimately the biggest problem here is that citizens get paid in the native fiat currency (in this case Naira) and the banking system has a stranglehold on what it can and can not be used for. This is the perfect example of how citizen are turned into free-range pseudo-slaves at the hands of the banking sector and financial system.

But let's play the what-if game for a moment. What-if they had better infrastructure? What if they could get paid in HBD and spend HBD without every needing to go through a central banking middle man? These should be the goals we work toward to subvert this pseudo-slavery that is central banking and other forms of corrupt governance, of which Nigerian society gives such great examples.

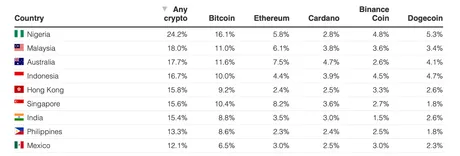

Nigeria is where it's at in my opinion. "It" being the perfect place for crypto to do the most good and build the most value. The national language is (drum roll please) English. Imagine that. How convenient. In terms of exponential crypto adoption: they're at the top of the list. This is in spite of their government being one of the most anti-crypto nations on the planet.

The citizens don't care. They know that the government is not there to help them. They're quite motivated to build as much value as they can within this harsh environment, and are willing to sidestep authority to do it. All these variables add up to Nigeria being a very important place on the globe in terms of building value within this ecosystem.

Posted Using LeoFinance Beta

Return from Nigerian Kimchi Premium to edicted's Web3 Blog