Crypto is ironic like that.

Have you ever signed an NDA? I have. Multiple times. Which is funny because I've never had any kind of serious career. Used to be you'd sign an NDA so that the company you worked for could be reasonably sure that you wouldn't spill trade secrets to competitors. These days seems like corporations and lawyers want you to sign an NDA for everything. I might have even signed one working as a grunt at the bottom tier of Amazon. The time before that I signed one during a brief employment with Sony Online Entertainment working as a temp.

But crypto is all about transparency.

The SEC is all about transparency as well it seems, and scores of celebrities have been brought up on white-collar charges in the wake of the regulatory machine attempting to crack down on crypto. Even Shaquille O'Neal successfully dodged being served for months. Just checked in on that story the other day and read that they got him back in April. He claims they threw legal paperwork at his moving car and called it good, lol. That's gotta be a fun story.

I don't understand crypto.

Apparently Shaq doesn't understand why he'd be named in the FTX lawsuit after everything blew up. After all he had nothing to do with the rampant corruption that was comingling funds and blatantly gambling with client money.

Shaq isn't the only one:

- Larry David

- Tom Brady

- Kim Kardashian

- Jimmy Fallon

- Gwyneth Paltrow

- Justin Bieber

- etc

Scores of celebrities are in legal trouble over their endorsements of crypto... but why? What makes a paid endorsement legal and what makes it illegal? How does getting sued for giving financial advice work? As we discovered in that post: it all starts with getting paid to make the endorsement (the vast majority of the time). If one gets paid to endorse a SECURITY without going though the proper channels, the SEC is well within their legal rights to come after them.

So what are the proper channels?

The funny thing about all of this is that if you do a deep dive on why the vast majority of these celebrities are being sued... it's because they simply failed to declare to the SEC how much they were being paid to make the endorsement. That's a big no-no. A lot of these lawsuits can be chalked up simply to bad accounting.

Thus when the situation is truly parsed out for what it is we can clearly see that the collapse of FTX had nothing to do with these legal complaints on a technical level. The real foundation of the lawsuits is simply that these celebrities didn't go through the proper channels.

If FTX never collapsed would these lawsuits still exist? Probably not. The collapse of FTX and the revelation of massive corruption within the company is what catalyzed the SEC to go after anyone they possibly could. Another variable to consider is that there was a lot of heat on Gary Gensler for meeting with SBF multiple times while all of this was going right under his nose. The SEC may be trying to divert blame away from themselves on this one by going hard on celebrities.

Has anyone noticed who they haven't gone after?

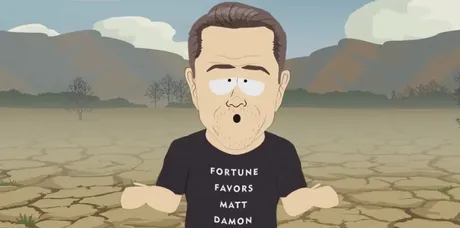

MATT DAMON

Yep you'll never see Matt Damon named in any of these lawsuits, which again is funny because he's the first person the mob calls out for blood. Fortune favors the bold, bruv. Apparently Matt is not a dumbass and actually did go through the proper channels on this one. All these other celebrities need to fire their accountants or something because it's honestly just weird that so many of them have fallen victim to these suits. That being said we can be damn sure they'll get it right the next round, although it might be a while before they're brave enough to take the bait.

So when a celebrity like Shaq says they "don't understand crypto", what they are really saying is that they "don't understand securities" (which is fair because they are complex). Shaq could do a commercial shilling a pair of shoes and earn millions of dollars. From his point of view that's the exact same experience and outcome as shilling crypto. An ad is an ad. However a shoe is not an investment contract. No one buys a shoe with the expectation that it's going to be worth more later (unless it's a collectable which is also not a security).

Is the SEC jumping the gun?

On the other hand the SEC is declaring many of these tokens to be securities with blanket statements without actually proving this to be the case. This has been their "regulation by enforcement" strategy from day one. What happens if they prosecute someone for shilling a security that is later to be proven not-a-security? The SEC can only lose credibility going forward from here, and that's a good thing. The law and crypto don't mix. Crypto governs itself as a sovereign entity by design. The friction will often be too hot to handle as crypto continues to collide with imperialism. Tread carefully.

What about Hive?

Hive is super interesting within this context because everyone here knows we aren't a security. Of course the SEC likely won't respect that unless the issue is forced. What would happen if we paid for celebrity endorsements through the @hive.fund? SEC lawyers would have to think long and hard before trying to prosecute something like that. Who controls that fund? How would they prove Hive was a security and thus under their jurustdiction?

We must also consider that Bitcoin is firmly not a security either, which works hugely in our favor. Why? Because again Hive can pay for things through the DHF, while Bitcoin has no such function. Hive can pay for things that benefit Hive in a way that provides a legal shield for anyone being paid in such a fashion. This is the magic of actual decentralization: it's definitively not a security and finds itself immune to the SEC's bullshit.

The disconnect between the SEC & The People

While the mob demands that Matt Damon be drawn and quartered, the SEC can do nothing because he did everything by the book. But does anyone actually care that Damon did everything right? No, of course not: he caused just as much damage (probably more) than any other celebrity that didn't go through the proper channels.

This showcases the concept that the SEC's rules don't protect investors and really have nothing to do with the reasons they give for why these rules exist. All of these celebrities could have done it the right way: making them immune to litigation, and the exact same amount of damage to investors would have been sustained either way. Think on that for a bit.

Conclusion

If you get paid to shill a security... just declare it correctly. The SEC's non non-disclosure agreements pertaining to securities are no joke. To be fair if you already have that much influence in the first place it should be someone else's job to do such things for you. Make sure your accountant isn't trash like Kim Kardashian's. Taylor Swift is actually on record as declining the money from FTX because she specifically asked if anything they sold could be deemed a security. Again, Taylor Swift and Matt Damon smart, Shaq: not so much.

Return from Non Non-Disclosure Agreement to edicted's Web3 Blog