Dump from here, amirite?

To be fair, descending triangles like this after such a rampage are usually pretty damn bullish, but you also have to break out of them first. Part of me feels like it needs to decline all the way to $20k before the issue is forced and we finally get out of this narrowing band.

Normally I'd say this is a place were we could safely sell and then buy back in if we go above the line, but that strategy has proven time and time again that it doesn't work anymore. So many examples of whales purposefully coloring right outside the lines in that exact way to exploit that kind of behavior. I guess what I'm trying to say is that drawing support or resistance lines are even more flimsy than they used to be, and making a decision as soon as the line is crossed is now a very easy way to lose money.

I still can't help thinking that the doubling trendline on the logarithmic scale is still sitting way up at $40k. If the legacy economy had already imploded by now I'd make the claim that reaching $50k by the end of the year was all but guaranteed. However, we are still in the middle of the FED raising rates and a possible deflationary snapback and an energy crisis and the housing market looking terrible and a bad job market and... yes, the list just goes on and on. Economy bad. Bad economy.

FOMC meeting is in a week... and like I said before, I think the increase in rates and all the other bad news has already been priced in. Still a good chance that the FED raises rates and the market just goes up like it did last time because it was already oversold from the FUD weeks prior. Will be interesting to see if that plays out again, especially if it pushes us above the resistance line.

With warehouses filling up with product that people can not afford (or are unwilling) to buy, I'm predicting that we are headed toward one of the most insane Black Friday end of the year sales ever. It's gonna be a real one: not like the memes we've seen in recent years.

Logistics and storage space are a resource that many companies are running out of. They'll take the loss if they have to. Loss leaders are still a good way to make money if people buy other stuff in a shopping spree. This is why I don't agree with the tactic of boycotting Black Friday.

To "oppose capitalism" and the bloodsucking corporate economy, many got the super smart idea to boycott Black Friday entirely. Why? That's exactly what you shouldn't do if one is trying to financially extract value from a corporation. Like seriously, make it make sense. Corporation offers you a better price and you're going to defeat them by paying the higher price later? Ah well, that's absurd.

The entire point of Black Friday is the tactic of loss leading. They take a loss on a few really good deals to lure you in, then you go on a shopping spree and buy way more stuff then you planned on getting. The best way oppose Black Friday isn't by boycotting it... it's by buying all the things you were going to buy anyway at a discount and not getting sucked in on the other stuff. It's about choking profits and exploiting the loss leader tactic. Funny how people think they are employing more discipline using all-or-nothing tactics instead of basic logic and restraint.

It's also noteworthy to mention that branding comes into play here as well. People start developing loyalty to their brand of choice. I didn't know this until recently, but apparently there are a lot of people who are diehard into shopping at Target. Now, that's just weird to me, but it is what it is. People start emotionally bonding with a brand and can attach positive emotions to it. Black Friday and loss leading tie into that positive brand identification in a big way. Get a good deal at Target, now the brain remembers that interaction and uses it to make decisions later.

Hive is still trading flat.

Would it be nice if we were moving up with Bitcoin? Sure. Number go up. That's always fun. But also this shows how extremely decoupled Hive has become in relation to Bitcoin, and that's a good thing. We don't want a chain that just mimics grandad. We want a network that stands on its own.

This makes volatility trading much easier. What happens if Bitcoin just keeps going up and Hive just keeps trading flat over the next few weeks? I don't know about you, but if Hive hits the MA(200) of 2221 sats per Hive, that's a really easy place to buy and hopefully will act as a support line, or perhaps even catalyze a rally. It's a bit easier to buy low and sell high in terms of Bitcoin than it is with USD for obvious reasons (higher correlation and more guarantee of recovery/correction over shorter timespans).

Then again, Hive has made a lot of gains that still might not be priced in. I mean honestly... look at what Hive has done in the past two years... and then look at what Bitcoin has done. Bitcoin is a stagnant block of code by design and everything else is hyper-evolving around it. Working as intended. It's a very interesting dynamic. Bitcoin supports the alts, and alts support Bitcoin, and hardly anyone is framing it this way, and instead will overtly thrust competitive cut-throat capitalism onto the space. It's wild.

Some would claim that the breakout has already happened. I'm not that convinced but, these are the kinds of pumps one would expect to see at the end of a brutal consolidation. Thinking back to 2018, if this is the case we should be a lot more grateful. 5 months of pain is a lot less than one or two years of a crypto winter. Then again, we never did get that mega-bubble, and volatility begets volatility. Perhaps this is all just standard operating procedure.

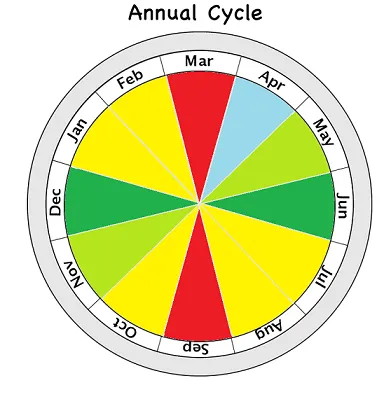

I suppose my official prediction is that we are going to test $25k again and get swatted down until October or November. It will be interesting to see if the ol' cycle chart actually plays out this time.

We basically traded sideways for the first 5 months of this year, then we crashed into the dirt after that. And now it looks like we should recover but... the economy is still in shambles. Very odd situation to be in to be sure. I think we have to expect something unexpected is going to happen (as is often the case). I mean obviously anyone who predicts these things accurately makes a boatload of money if they actually trade off the prediction. Even the masters are only going to get it right 60% of the time.

Logic would dictate that even if we do get an amazing rally it will probably just be a bull-trap in the end and crash back down after the economy finally implodes by whatever domino tips over first. Makes sense. We could easily get to $50k by the end of the year only to crash back down to $25k months later. Always expecting volatility is a safe play in crypto. The low liquidity ensures and early stages of this market ensure it.

Conclusion

The current bear market has been much easier to stomach than 2018. Is it because we already survived 2018 and now we are basically in the clear? Or perhaps this bear market won't actually be as bad as 2018 even though we are headed into a brutal recession. The answers to these questions won't be known for another year until we get through it all. Maybe it's a little of everything.

Still, something feels much different this time around. A transition is being made. Slowly but surely the world is waking up to this tech and realizing it is the future. So many formerly dismissive entities are jumping on board. Within this context, the current spot price of the markets means very little compared to macro trends playing out over the next decade.

While everyone has been worried about inflation and the CPI and whatever else, we are clearly headed into a deflationary snapback caused by overstock, lack of disposable income, and extreme over extension. This fishtail isn't even close to reaching equilibrium yet. It is not reasonable to assume we'll reach any kind of stability anytime soon. Luckily crypto thrives within an environment of volatility, no matter what crypto Twitter says.

Return from Oh Hi Resistance to edicted's Web3 Blog