As I begin rotating more and more of my assets back into Granddaddy Bitcoin, I find myself asking the same old tired maximalist questions.

Will a person one day be able to retire off a million sats?

As crazy as it sounds: yes.

In fact I imagine one day people will be measuring Bitcoin only in sats.

1M sats is 0.01 BTC, for frame of reference.

Satoshi Nakamoto assumed that as Bitcoin gained value over time, the units would be changed to satisfy unit bias. Today one BTC is 100M sats. Nakamoto assumed that by now 1 BTC would be a million sats, or perhaps even 100k.

At a spot price of $20k, 1 BTC = $2 would imply that 1 BTC would be worth 10k sats. Pretty crazy when we consider the exponential growth of this network over the last decade or so.

But alas, as much as I like to say that Nakamoto is of alien origin and attempting to prevent humanity from destroying itself... he made some very human mistakes like this. He assumed that the Bitcoin community would be reasonable. As we can all see, the Bitcoin community is anything but reasonable. It's essentially turned into a cult with a very rigid ideology.

Satoshi's biggest mistake was creating a STATIC block_size limit. Again, he assumed that the community would be rational enough to increase the blocksize by hand if it needed to be increased. He would have never imagined that this was such a contentious change that it would have created the fork of Bitcoin and Bitcoin Cash. If he's still alive, I bet that development blew his mind.

@theycallmedan often talks about Bitcoin's limitations and how they programmed in systemic failure 100 years down the road. It is very difficult to argue against @theycallmedan's logic when it comes to most things. His game theory is solid across the board, but I do take issue with this idea that Bitcoin will be hobbled in 100 years time as the halving events cripple the incentive to secure the network.

My first argument against this concept is that Bitcoin is a living entity. It is not an immortal being. It is not a zombie corporation or government that can stay alive forever as long as it eats enough brains. The value of crypto is community, and Bitcoin very well might not exist in 100 years, because that community will be dead.

Of course, communities can obviously live longer than 100 years through the process of procreation. I also view the Earth itself as a living entity. 4 billion years old and still looking sexy. All I'm saying is that it is very presumptuous to make the claim that Bitcoin needs to be operational in 100 years time. It very well may be... but also it might be an antique that nobody actually uses for practical purposes; a collector's item whose on-chain transfers are looked at on more of a spectator-sport level and a huge flex than anything else.

Bitcoin very well may fall out of favor in as little as forty years. I believe it will be flipped by another asset in as little as 5 years. Many wrongfully assume that the top crypto by market cap needs to be decentralized. What is that logic based on? All the money in the world is centralized. Doesn't it make sense that, at least for a short time, billionaires will flex their power to coopt something like Ethereum and make it #1 for a time? Even Ripple's XRP could be #1 at some point. Again, people are not rational. The market is not rational. Why would we assume otherwise?

Getting off-topic. 👍👍👍

What I was really trying to get at was: Zoomers are telling Millennials to stop using the Thumps Up emoji because it's triggering and rude. Humanity is in an exponential stage of evolution. Every generation of humans born from this point forward are going to be radically different (even moreso than before). Do we really expect that Bitcoin is going to be used by the upcoming Alpha generation? What about the generation after that? lol... yeah right... Bitcoin is the Facebook of crypto. At a certain point it's the uncool thing that old people are doing. Fact.

So... Bitcoin fees?

The idea that Bitcoin is unsustainable is true on some fundamental level, but it is unclear just how much. A 'deflationary' currency is probably not going to continue to grow forever. That's just the core nature of deflation. Bitcoin derives all of its value via security and trust. The only reason security and trust have so much value in this current climate is because... look around.

Those are scarce assets.

As crypto evolves they will become less and less scarce, thus reducing Bitcoin's ability to grow. Which is fine honestly. Security is a very small niche that falls into the background eventually, and that's fine. Bitcoin is the backbone of the new world we are building, but it is just a backbone. It's just a tiny piece of the puzzle.

"Miners will lack incentive to mine."

The halving event comes every four years. Had Nakamoto realized how absurd the Bitcoin community is, he would have been doubling the blocksize limit at the same time. Modern technology easily creates enough abundance to accommodate such an increase.

We don't need to project out 100 years...

In the next 10 years flat, the BTC block reward will be cut in half three times.

- From 6.25 to 3.125

- From 3.125 to 1.5625

- From 1.5625 to 0.78125

That 0.78125 level is interesting.

Because during bull markets, I've seen block fees higher than that. Meaning that in 10 years, operation fees will start flipping the block reward. Dan sees this as an unsustainable problem (for good reason), while I do not.

Who's going to use Bitcoin when it costs $1000 to make a transfer?

That's an easy question to answer, eh? People transferring around million of dollars at a time. If we are truly creating an abundance economy as we claim to be doing, there's going to be a lot more multi-millionaires in the world (assuming the dollar even exists at that point).

The answer to the question, "Who's going to pay $1000 for fees?" is a self-answering question. We are grading on a curve. Paying fees is a competition. Who ever pays the highest fee is the one that gets on chain. If fees are $1000 it automatically means that every single entity using the blockchain is paying the fee. That's who's paying it.

Asked and answered.

And as ridiculous as that sounds, this is the niche of the Bitcoin network: the highest security truth-table in the world by exponential margins. It becomes clear to me that at some point (while banks, governments, and corporations as we know them still exist), that BTC will be used by the biggest institutions in the world to transfer around millions if not billions of dollars at a time to each-other. This is what "disruption" looks like. It's not the obliteration of institutions (at least not at first). Crypto is for everyone and will empower the institutions that it disrupts, as ass backwards as that sounds.

I will say that Dan's logic as it pertains to "putting the cart before the horse seems pretty accurate when it comes to building a second layer to handle transactions. I don't know a ton about the Lightning Network, but on a lot of levels it seems like a complete non-starter. Hive is a better second layer to BTC than LN is. But obviously my opinion is heavily biased, just like Dan's. Know yourself.

The halving event is working better than expected.

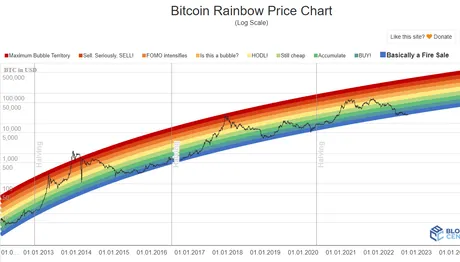

Inflation is cut in half every four years, so we would hope that the price of Bitcoin would double every four years to make up for this difference. The actual performance of Bitcoin has been wildly better than that. Not only does the price double every year instead of every four years (x16 every halving cycle), also the demand to use the chain goes up (increasing block reward via transfer fees).

https://www.blockchaincenter.net/en/bitcoin-rainbow-chart/

Therefore, with inflation being cut in half and price going x16, even excluding fees we see that mining rewards are going x8 every four years. However, this gain is offset by new miners coming in and competing for the gains. All of that value is pumped into securing the network, so rather than miners getting paid x8 times as much, the network simply becomes x8 more secure, while miners are habitually paid razor thin profit margins based on the cost of energy and plus the overhead cost of hardware. It's a brutally competitive game to play, and there are some big winners who get paid to follow the rules, which is why Bitcoin is so secure in the first place.

static const unsigned int MAX_SIZE = 0x02000000;

The 100 year problem.

Assuming that Bitcoin isn't going to increase the blocksize for 100 years is... tenuous. It's a single variable within a single line of code. They will increase it when they are forced to increase it. When will they be forced to increase it? Unclear, but my guess would be ten years. It has to be obvious to the entire community that deflation (in the form of a static data cap) is holding the network back. BTC could go x1000 before that happens. A rule of thumb would be: if you can't buy a car with BTC because the fee is too expensive, they're probably going to unanimously raise the blocksize.

Actually I think Bitcoin getting flipped by another crypto will be the biggest wakeup call to the maximalist community. Funny how greed and perceived losses will spring people into action. For now with first move advantage, BTC doesn't have to do anything. They can be lazy, and that's fine. Let them be conservative; that's good for everyone.

The blocksize was meant to be changed. Nakamoto was counting on it. It's not a contentious thing to do when the network is actually being held back. Is the network being held back? x2 gains year over year say no. The 1MB limit is fine, for now. I bet it increases 10x when they finally decide to do it. That's 10x more fees for miners (x5 if the cost is chopped in half). There's no reason to think that Bitcoin will not work when operation fees are the only income miners have to draw from. We already see that the halving event is exponentially less than number go up by x8 every halving cycle.

Resource Credits

Many people assume that the way Hive does things is a lot better in many respects. It's not better; it's just different. Yield farming bandwidth is an insane concept. Hive is the original DEFI network.

We think that Hive is superior.

Want to know why? Because we've never run out of bandwidth before. Watch what happens when we do, people will wake up to the hard truth that yield farming bandwidth is a massive double edged sword. This is something that I've been harping on for years now, and we have yet to run out of bandwidth, so I just keep blowing the same smoke; waiting to be proven right in the field. Still waiting.

Ironically, Resource Credits are highly deflationary in nature. They strip away competition and provide subsidy (and incentivize rent-seekers) for those of us that were here first. On Ethereum, if you build a game based on smart contracts, it better be a damn good game and smartly programmed, because if not it's going to fail spectacularly when fees go up. On Hive, developers are basically guaranteed a seat at the table; all they have to do is power up Hive and they have a constant inflow of bandwidth.

As price of Hive goes up, it will become harder and harder to attain bandwidth. Given legitimate adoption of Hive and HBD and a bond market and RCs as a scarce derivative asset... the price of Hive could easily go x1000, and that would not be a good thing unless we were able to simultaneously increase bandwidth by x1000, which I guarantee we absolutely can not. Speculation always trumps fundamentals. All I can tell you is that we are in for some surprises created by Chaos Theory and the infinite amount of variables that collide in this simulation.

RCs vs on-chain fees

Both of these solutions are prone to scaling issues. Resource credits give an advantage to investors that got there early. Fees going up gives an advantage to investors that got here early. There seems to be a pattern here. Those who get here early get an advantage.

However, this is not true for developers on Ethereum within the context of fees. Everyone has to pay the same fees no matter when they enter the ecosystem. This is not true on Hive: those who got here first have a much bigger monopoly on bandwidth. Again, we've yet to see any of this play out, because we've never actually run out of bandwidth before. We will, sooner or later, and then we'll get to see how these theories actually work out in practice.

Hive is more agile

Yield farming bandwidth might be deflationary, but Hive can more than balance this disadvantage away with upgrades to the system. HF26 allows us to compress data on chain. That's a huge advantage that allows RC costs to remain cheap and abundant (even for new entrants). We are constantly making upgrades to the system, whereas Bitcoin is... not. Again, this is the double-edged sword of development. Bitcoin's resilient and unchanging codebase is a feature, not a bug. Hive's fluid codebase is a feature, not a bug. Every blockchain gets a niche. Everything is working as intended. It's all very zen.

Conclusion

Will a million sats be a lot? As someone who vividly remembers 1 BTC = $1, I can definitively make the claim that, yes, one day people will retire with nothing but a hundredth of a BTC (currently worth $192). Just like 1 BTC used to = $1, so will one sat = $1. That's $100M per Bitcoin. Sounds absurd. It will happen, and I can also guarantee that the blocksize limit will not be 1MB at that time.

A market cap of two quadrillion dollars is not absurd. Think about what humanity might accomplish over the next fifty years. Hell, Elon Musk is going to want to colonize Mars in way less time than that. Do not underestimate the power of abundance, automation, and artificial intelligence. Even more importantly: do not underestimate the ability to leverage crypto to distribute resources more fairly so that these technologies actually work the way they are supposed to rather than crushing the lower class under the boot of a displaced workforce.

My assets continue to be consolidated.

It's all about Bitcoin and Hive right now.

Need more Bitcorns.

Posted Using LeoFinance Beta

Return from One Million Sats and the Bandwidth Debacle to edicted's Web3 Blog