Market Watch RSI:

Seems like I'm getting pretty good at predicting the BTC market. Just like I said as soon as the New York Stock Exchange opened (after a brutal weekend) Bitcoin got bid up from $47500 to $54000. This was essentially bound to happen because the sharks are still buying strong, and the weak hands are selling scared. All of the newbies learned a nice hard lesson today. Stop selling low, newbies. DIAMOND HANDS!

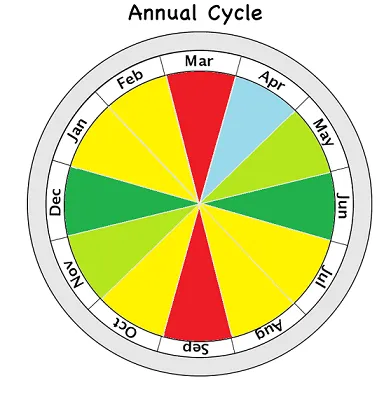

This move was even more obvious because the Relative Strength Index was at it's lowest levels since March 2020. Buying today was as easy as buying at $4000 a year ago: it was a no-brainer for the sharks. Looks like this dip is over and once again: May is going to be a killer month. Expecting a local peak in June with another ~30% retracement.

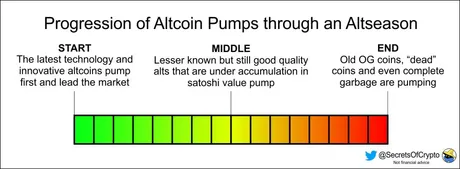

Now, normally given a regular bull run we'd skip Q2 being a good quarter and probably crash back to the doubling curve. However, this is no normal run. This is the MEGA RUN: the biggest one we've seen yet. The chance that Q2 and Q4 perform extremely well is high. Again, we'll know the run is over when all the shitcoin ICO projects from 2018 that everyone thought were dead start pumping.

Personally I'm looking a networks like DeepBrainChain (DBC) that existed back then. DBC is a decentralized computing artificial intelligence token. You rent your computing power to the AI and other users buy that power from the network (just like GOLEM except AI instead of generic computing). DBC has already gone x20 in the last four months but I bet it will eventually do something crazy like x1000.

Even though the logistics of truly decentralized AI are nearly impossible (I've done research on this one) investors don't give a shit. They hear decentralized and AI and they throw their money at it without doing any research of the viability of the project. I mean... hell, it's been over 3 years... can I rent my computing power to earn money yet? The answer is 'no'. Mining 2.0 is still a fantasy even after over 3 years of development. I was super bullish on mining 2.0 all the way back in March 2018. I'm not seeing results.

But that's not what this post is about!

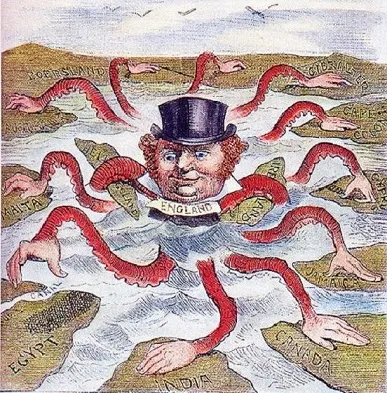

This post is about blockchain imperialism, a topic I just realized recently will be a big issue going forward. It came to me as I was think-tanking my upgraded concepts of DeFi as they relate to algorithmic stable coins. In that context: allowing the DeFi token to control interest rates is a conflict of interest (pun not intended). The community is far more likely to break their own system in order to give themselves more money in the short-term while destroying the long-term viability.

This could be a big problem, so my solution was to think about allowing a 3rd-party parenting governance network to make these decisions. It is in the best interest of this governance token to make objectively fair decisions. There is little conflict of interest because the outside governance token will not directly gain value from the decisions they make, but they WILL gain INDIRECT value from the networks they control IF they govern those projects to the best of their ability. Theoretically it's a win/win for all parties involved if the governing body can mitigate corruption within the ranks (big if).

The more I think about it, the more it makes sense to allow an outside governance token to control many different projects all at once. By centralizing governance, those who want the governance token become the leaders of multiple networks. Seeing as leadership, direction, and organization in the decentralized arena is one of the most complex and problematic aspects, it makes a lot of sense to streamline governance and put a "centralized" authority in charge of multiple platforms.

But then I realized: holy shit the legacy economy is going to love this. They love being in charge and they will do anything to put themselves in charge. Imperialism is the standard, and foreign governance tokens are the perfect solution to employ said decentralized imperialism within the cryptosphere.

What could possibly go wrong?!

It sounds bad, but when we look at the problems associated with real-world imperialism, a lot of those issues do not apply to a decentralized landscape. For example, in the real world if your subjects do not obey you the easiest way to keep them in line is through shear force (military), fear-based tactics, and propaganda. In a digital landscape, none of these tactics will work. If the governing body becomes corrupt the communities that they lord over will just fork away from the oppressors.

Therefore, the only reason to allow an outside governing body to control us in a digital landscape is if that relationship has symbiotic value for both sides. If either side has nothing to gain from the relationship they will break the bond and move on to a better solution.

Just look at Hive!

We've already done just that. A centralized authority tried to own us and we said fuck that: we're out. It sucked but I think we're stronger for it.

What doesn't kill you...

In fact, Hive itself is also a centralized governing body. We are already imperialists. The only way to elect witnesses is with the core governance token (Hive). The only way to fund dev proposals is with the core governance token. The only way to create more governance token is derived from our consensus.

When someone else builds on Hive, they are accepting that we control pretty much everything that goes on here. You aren't even allowed to post on the blockchain without Resource Credits, and you can't get RCs without the core governance token (once again).

However, this is obviously a bit different than having direct governance powers over other projects. When someone builds on Hive they don't allow Hive stake-weighted votes to control what they've built: that's the big difference here.

LEO 2nd Layer Governance

In fact, LEO itself is creating a new 2nd-layer node network that validates consensus. This will be one of our many airdrops coming soon™. We have to ask ourselves: what kind of powers will this governance token have? How many decisions will be made with the new token? If the new token can control what happens on other networks such as LEO/CUB/Blank that would be perfectly in line what what I'm talking about here.

Conclusion

Governance and leadership are two of the biggest variables holding crypto back. It becomes quite obvious that many networks will centralize some of these issues to make them more efficient. Some of these sacrifices will be worth it, and some of them will not. But we aren't going to know what's what until we try.

Be on the lookout when the legacy economy figures out exactly how they are going to lord over this new emergent economy. I think it's fairly obvious that will overextend their position and try to set themselves up as lords of the universe just like they always do. I wish them well on their journey. It's a lot harder to control people digitally than in the real world. No one's scared of the shit-talking brat online that threatens to come to your house and beat you up.

At the end of the day it makes a lot of sense to consolidate power and streamline leadership. Developers don't make great politicians (witnesses). Trying to do everything at once comes with diminishing returns. Following this logic, I think the chance is high that we break up these functions into factions that are easier to chew. Everyone has a niche/mastery. Best not to force a jack-of-all-trades scenario (said the red-mage).

Posted Using LeoFinance Beta

Return from Open-Source Imperialism to edicted's Web3 Blog