Crack reduction complete.

Rugpulls & Reputation

https://twitter.com/BillyBobBaghold

First off let's talk about reputation. LEOfinance (khal) is doing an AMA right now with the GEMZ community on Telegram. We want to convince them that we are legit and won't pull out the rug. Lot's of scams out there.

Full disclosure.

Lot's of LEO whales were waiting for this dip. Many may have waited a little too long. Many want to see a price of $3.00-$3.50 before they make another big commitment.

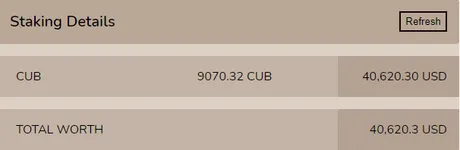

Inflation has been reduced 33%, and price has also reduced 33% from $6 to $4. Looks like this might be the bottom, so I FOMOed in hard. Exited all the LP pools and went all in on the DEN. If GEMZ wants to buy in: my coins are not for sale. Luckily there are still plenty of other coins for sale in the BUSD and BNB pools LP pools paired to CUB.

It's funny that price dropped exactly as much as inflation. I was hoping for a dump but to have it be that exact is comical. Perhaps we can expect a 50% dump next week during the big reduction.

x140 points total

This is how many ways CUB gets split up on every block. As of today, every block 2 CUB get created. Those two CUB are split into 140 pieces, and those pieces are distributed to the 22 pools as follows:

LP FARMS

- CUB/BUSD (x40)

- CUB/BNB (x24)

- bLEO/BNB (x12)

- BNB/BUSD (x5)

- USDT/BUSD (x4)

- BTCB-BNB (x6)

- ETH/BNB (x6)

- DAI/BUSD (x4)

- USDC-BUSD (x4)

- DOT/BNB (x6)

- CAKE/BUSD (x2)

- CAKE/BNB (x2)

- TOTAL (x115)

DEN STAKING

- CUB (x10)

- BUSD (x2)

- BNB (x3)

- USDT (x1)

- BTC (x2)

- ETH (x2)

- DAI (x1)

- USDC (x1)

- DOT (x2)

- CAKE (x1)

- TOTAL (x25)

So obviously we are allocating way way way more inflation to the LP farms than we are to the dens. Why is that? Because we want to incentivize the community to put their tokens up for sale so that the network has deep liquidity and we can attract big-money players.

We see that 45.7% (64/140) of all CUB inflation goes directly into the two main pools. This incentivizes users to buy CUB so they can farm the highest yields.

Many have stated that they do not understand the non-CUB pools and it seems like a net loss. This is a misnomer. Khal has copied a tried and true formula that's going to work. We are luring the entire BSC network into this farm with our diamond hands. The higher the yields we can maintain, the more users will want to enter our farms and pump the price of CUB.

It's a really great feature that anyone can farm CUB with like a dozen tokens. It takes a lot of the risk out of farming. Think the market is going to crash? Why not farm the stable coin pools? Think BTC is going to leave everything in the dust? Why not farm CUB directly with BTC. In fact we see that the BTC den is the lowest yield, and thus highest competition, heavily implying that this is exactly what many farmers are thinking: they want to have low risk by holding their safe bags like BTC & ETH.

Competition

New users will look at these farms and wonder how a contract with an x1 yield could possibly be higher than an x4. Shouldn't the yield be x4 higher if we are allocating x4 more inflation to it?

That would be true, if competition to farm wasn't a thing. The more users that enter a given pool, the more the rewards are split up. At these high yields, we've seen massive diminishing returns over the last week, and that's totally fine. They will keep dipping until we find some kind of equilibrium.

CUB DEN

The CUB DEN is going to end up having the lowest APR yield by design if it moons like we want it to. That's because as the price of CUB moons, so will the APRs of the other farms. The equation is as follows:

APR = (Total USD earned per year) / (Total USD value collateral)

Essentially, we have to use USD as the unit-of-account for these calculations, otherwise the math doesn't have a stable base and won't make any sense.

Therefore, as the price of CUB increases, the APR of every single farm goes up except for the CUB den. Why? Because the CUB den's collateral changes at the exact same rate as the total-USD-earned-per-year. The only way the APR on the CUB den can change is the competition in that pool changes; aka coins move in/out of the staking contract.

What about the LP pools that are half CUB?

Because the CUB/BUSD & CUB/BNB pools are half CUB, the APR on these pools will only move half as much as the other farms. For example, if CUB spiked from $5 to $20 (x4), all of the farms APR would go x4 except for CUB (which would do nothing) & the two main LP pools would only gain x2 APR.

Therefore a rising price in CUB is going to GREATLY incentivize farming CUB in the pools that don't require CUB. This is great because it's going to lure the entire BSC network. Everyone who enters these pools then pays the 4% deposit fee which then in turn pumps CUB even harder. Win/Win.

What's the point of farming the main pools if APR spikes up half as fast?

Again, the point of holding CUB isn't to get the best APR. The point of holding CUB will more revolve around an increasing token price, just like every other token out there. The APR on the DEN and the CUB LP pools don't matter as much because users that hold CUB will get all the gains of a rising token price, while the other pools will not.

Wait, what happens if collateral increases?

Imagine if BNB were to go x10 tomorrow. What would happen to the BNB APRs in these farms? Well, the amount of CUB being farmed would be the same, but the underlying collateral would be worth much more. This would greatly reduce the APR yield in those pools. The BNB den would lose x10 APR while the LP pools would lose half that (x5) due to only half of the collateral being BNB.

It's a race!

What we hope for is that the price of CUB skyrockets and blows everything out of the water, at least during these initial stages. This will create a ton of hype and incentivize outside farmers to enter the pool and moon the price even more because of the high yields.

Stable coin farms.

This is also why there are so many ways to farm CUB with stable coins. 4 Stable coins are supported by CUB: DAI, USDT, BUSD, USDC. This is great because the underlying collateral of stable coins is just that: stable.

Therefore the stable coin farms APR yield will directly match CUB's price movements. If CUB goes x2 the stable coin only pools will also go x2 APR. If CUB loses 50% the stable coin pools will lose 50% APR.

To recap:

- If CUB goes up, APR goes up.

- If CUB goes down, APR goes down.

- If underlying collateral goes up, APR goes down.

- If underlying collateral goes down, APR goes up.

- If users leave a farm, APR goes up.

- If users join a farm, APR goes down.

The interesting thing here is that some of this volatility could work out in our favor. Say someone puts BTC into the den and pays the 4% deposit fee, they might not get that money back. If CUB crashed and BTC spiked the APR might drop quickly and they'd rage quit and give us their money. Not an ideal scenario, but it's not all sunshine and rainbows with crypto.

Conclusion

There is a lot to parse here, and the math still isn't on an even keel because inflation is still twice as much as it will be in a week. We'll likely have to wait several weeks before exponential competition in the pools dies down and APRs start to stabilize. At the moment APR is just constantly going down due to diminishing returns from compound farming and increased competition on massive unsustainable yields. This is certainly worth revisiting in a week or two. I'm sure I'll still be noiding out on CUB by then.

Posted Using LeoFinance Beta

Return from Parsing CUB Inflation to edicted's Web3 Blog