Alright so we have an emission reduction on CUB coming tomorrow, and bonding is supposed to be coming down the pipe at the same time. Currently, both of these events are being marketed as an extremely bullish double-whammy that, in tandem, are basically guaranteed to push the price up.

The premise of this theory is a pretty simple one.

- Deflation is largely thought to be a desirable attribute in crypto.

- By lowering the inflation rate we cutoff supply and limit selling.

- Bonding will lock up LP tokens, further cutting supply.

- These supply shortages will "obviously" increase the price.

Considering Polycub is currently trading at all time lows right now (60 cents) this theory has a lot of merit. How could the price possibly go down in the face of all these deflationary pressures that cut off the supply and prevent sellers from dumping the token?

Um... easily?

Again, both of these events are being marketed as a bullish advancement of the token, when in fact both of these events are actually pretty bearish, especially on a short-term timetable. How is this possible?

Whelp, cutting inflation is all well and good, if and only if, the inflation you were allocating had a negative estimated value (-EV). In other words, if we (Polycub) were allocating inflation to stupid places, or if we allocated too much inflation to a good place, then yes, cutting inflation to those areas is a great idea.

So the question we must ask is obvious: was Polycub allocating inflation to stupid places? If so, why? And also, how have we intelligently identified and corrected the problem? The answers to these questions may astound you!

Can we see where I'm going with this? To say that inflation going down (on a fixed time schedule) is bullish implies something... like...

Yes, we were allocating inflation to stupid places, on purpose... But hey, do not worry, we figured this all out in advance. Tomorrow the system will correct itself automatically.

Can you imagine if the Federal Reserve decided what they were going to do in advance by letting a monkey chuck darts at a dartboard? That's essentially what is going on in DEFI across the entire crypto sector. You might make the argument that the FED might have better luck employing this strategy, but that's not really the point.

We have to tools to fully control everything and create currencies that are superior to USD in EVERY WAY, but we use those tools, not to create stability and consistency, but to do the exact opposite. Every tool in the kit is used to pump the token price at all costs, leaving it in freefall until it scrapes the bottom of a supply shock. The fact that every single token employs this strategy is quite a marvel to behold.

As you can imagine, this is a frustrating experience.

To see every crypto bro running around like, "Well, obviously we could never create a token that had a stable value like fiat does."

What? Why?

Unit-of-account is a fundamental property of currency itself, and literally everyone in crypto is like nah let's just create unstable assets that pump and dump randomly and without warning, with zero elasticity or buffer in place. This isn't a Polycub thing; this is me ranting about the entire sector as a whole. It's not a good look.

I've made it no secret that I am not a fan of deflationary assets. The only reason I let it slide for Bitcoin is because Bitcoin is the ultimate store of security. The deflationary mechanic of Bitcoin has absolutely nothing to do with building value and everything to do with plugging up every possible attack vector (aka increasing security).

As one might imagine, the comparison of Polycub to Bitcoin feels incredibly disingenuous, as Polycub is a centralized derivative of a derivative of a derivative. Polygon being a derivative of Ethereum's EVM code with many shortcuts taken to increase efficiency at the cost of security. Polycub being a derivative of CUB and an extension of the LEO community itself. Sushiswap as a derivative of Uniswap.

As far as I know every DEFI coin on every EVM chain is basically unilaterally controlled by the entity that issued the contracts. If you control the keys to the contracts you can do whatever you want. Maybe not every single DEFI coin works this way, but for Cub and Polycub this is certainly the case.

So again, to be like, "Oh yeah we are basically the Bitcoin of DEFI," even though Polygon isn't really super secure (I actually heard that it is controlled by 8 nodes who only need 5 to reach consensus) on top of the contracts being unilaterally controlled by the LEOfinance team... Hm, yeah... just because there are aggressive halving events... I don't understand the comparison at all. Actually I understand it perfectly I just don't agree.

Because 100% of Bitcoin's inflation goes to the miners (security), and the reason why that inflation gets cut in half every four years is because Satoshi Nakomoto realized that transaction fees alone will eventually pay for 100% of the security and all inflation can cease to exist once Bitcoin matures. Again, this is not a thing that builds value, it is a thing that builds security.

Meanwhile...

Polycub allocates 100% of it's inflation to yield. It delegates all security to the Polygon network via MATIC fees. This is a pretty significant technical difference. But you know marketing is marketing, so whatever. You do you, Polycub.

And I really have no problem with projects with centralized control when the founder is trustworthy and the project is new and fledgling and requires guidance. Satoshi Nakamoto premined a million Bitcoin (that's the equivalent of mining every block for the first 139 days). That's quite a chunk of change, and that centralization still exists today. If he just popped up out of nowhere and started dumping it all for other assets surely the price of Bitcoin would crash at least 90%, probably more from the panic it generated than anything else.

So back to the real issue.

Is too much inflation being allocated to Polycub? I mean, yes, obviously this is the case. Obviously 1000% yields on LPs and single-stake farms is totally unsustainable and ridiculous. I think the question we really have to ask is... why did we start it out that high in the first place? Was there any value is jacking up yields to the moon in the areas that were decided on? I'll save that conversation for another time.

And you know, we already saw this go down with CUB itself.

Emission rate was 3, then 2, then 1 (with CUB launch). None of those emission decreases resulted in anything bullish. Why are we assuming these emission reductions are somehow different?

Because at the end of the day people want to farm on a farming platform. So sure we can reduce the emission rate and cut the supply off, but that also cuts the demand to actually hold the token and farm it because the yields have decreased substantially. But I think I've talked about emissions long enough, don't you?

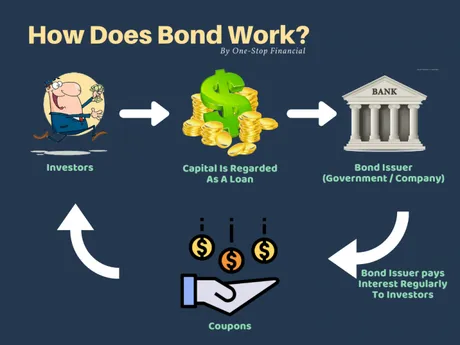

Onto the bonding!

Surely bonding and locking LP tokens into the Vault will generate value for Polycub! ... Also no... Does anyone remember the Cakepop IDO on CUB? What happened? Users needed LP tokens to participate in that (CUB/BUSD LP). Where was all the money being stored? In the kingdom. Users had to sell half of their CUB and pair it to BUSD to participate in that. This drove down the price, and this is something I speculated might happen before it even did.

Now it's happening again with bonding and everyone is like... 'Oh yeah of course this is bullish'. What? 74% of all the tokens are in xpolycub. If LP tokens become valuable due to bonding, users have to sell half of their stack to get the LP tokens to participate. That is not sounding bullish to me when stacked on top of an emission reduction. Call me crazy.

Conclusion

I still actually have a LOT more to say about all of this, but I just wanted to throw it out BEFORE emissions get reduced and BEFORE bonding goes live. I do not see how either of these two things could possibly be bullish in the short term, and I expect that the token price will be testing 50 cent support before the next emission reduction.

I am learning a ton from these launches and my analysis of them. The information is invaluable really, because at the end of the day I want to launch my own DEFI coin right here on Hive. I think it's pretty clear that Polycub is in for a pretty bumpy ride, but at the same time the tenacity of the LEOfinance team is not something I would casually underestimate. I have a ton of money locked up in the LEOfinance ecosystem and I don't plan on that changing anytime soon. Gamble gamble.

Posted Using LeoFinance Beta

Return from Polycub: Follow the Money ; Emission Reduction & Bonding to edicted's Web3 Blog