Lot's of crazy stuff doing down.

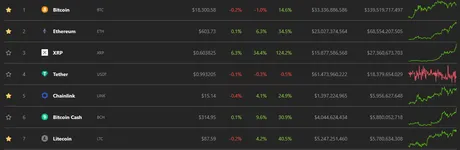

Ripple's XRP up 124% in 7 days? It's easily recaptured the top #3 spot back from Tether. If you'll recall, the market has reached maximum greed when XRP flips ETH. Be on the lookout. It may be no-dip-November today, but in a week it will be "Definitely Going to Dip December". Tread carefully.

Ethereum.

ETH is going nuts because ETH 2.0 is about to launch next month... hopefully on the 1st. Normally I would say this is a buy the rumor, sell the news situation, but this time around I have no idea. 524,288 ETH needs to enter the ETH 2.0 contract before the network can even launch.

Is ETH price sustainable?

It wasn't that long ago that I was margin-trading ETH using MakerDAO loans. It was a very risky play that has now paid off big time. It's nice to get a victory after a year of getting dumped on constantly. However, now I'm in a position wondering if I should pay back my loan or let it ride for a few more weeks.

This isn't your classic ETH pump/dump. The potential fundamentals here are insanely massive. It's being claimed that ETH will be at least 64 times faster (and potentially 64 times cheaper) after this upgrade to proof-of-stake goes live. On top of that, the upgrades that can be made to the new chain can ramp that number up exponentially in the months and years to come.

DeFi has been held back a lot due to Ethereum gas fees. If said fees are suddenly 100 times less that allows everyone to jump back into it and get to business. This is exactly the kind of upgrade everyone has been waiting for, for quite some time. "Selling the news" might be an extremely incorrect play if ETH 2.0 even delivers one tenth of what it is promising.

This puts me in an awkward position, but whatever.

It's a nice problem to have at the end of the day month.

Alt Season?

The crazy thing is that Bitcoin is just holding steady while everything else gets pumped. This signals to me that Bitcoin is being traded for alts, but the accounts selling alts are holding the Bitcoin. Because Bitcoin is being traded for alts but that same Bitcoin is not being traded for USD, we see a steady price while the alts rise "for free". Pretty crazy when you think about it.

Either that or the corporations are still buying every dip and stopping all dips from occurring in the process.

Personally I think it's the former. During this ultra-strong bull market users are afraid to take gains in the form of fiat and potentially miss out on the next run up. Rather than sell to USD they'd simply rather lower their risk by acquiring more Bitcoin. Quite the feedback loop.

Paypal and Greyscale

Institutional investment is ramping up. Due to the COVID 'emergency' many people are being allowed to tap into their retirement accounts without the associated penalties. I've seen a few claims on Twitter of people emptying the entirety of their accounts into Bitcoin. Pretty wild.

Paypal on the other hand is allowing a completely new and diverse market to enter the ecosystem by proxy. They are rolling things out slowly and are making sure everything is within compliance and regulation. I think crypto should see a pretty nice bump when they open up the doors for Venmo users, because that demographic is younger and way more likely to be interested in DLT.

Conclusion

Everything is looking up and the market is riding high. This local bull run could be the biggest one ever if you're not counting the mega-bull runs that happen every four years from the halving event. That monster should still be about a year away.

If the market does go somewhere crazy in the next two months (talking like $60,000 Bitcoin) this could be a major setback in terms of comparing 2021 to 2017. The summer 2019 volcano bull run took 6 months to equalize. Rather than getting small pump/dumps every quarter like we did last time it might be quite uneventful if the market needs to cool off for 6 months after this one. I guess we'll play it by ear and see.

Posted Using LeoFinance Beta

Return from Positive Feedback Loop to edicted's Web3 Blog