I missed three days of blog posts due to technical difficulties.

But the holiday is over and now it's time to get back too it. Apparently the world has not stopped turning. Black Friday has come and gone, and today is Cyber Monday. Apparently people are still buying things as I've been seeing reports that Black Friday smashed a record or two with however many billions in online sales.

I was also shocked to find out that Coinbase still controls like 10% of the entire Bitcoin supply. Funny how everyone thinks that Satoshi Nakamoto moving funds would be terrible for the market when a single exchange holds even more tokens than the founder. FTX loses $10B on overleverage while the elephant in the room is that Coinbase controls x3 that amount.

In the wake of all the FTX drama we learned that Coinbase is the custodian of more than 2M BTC, which is absolutely wild. Of course a big chunk of that is reserved for Grayscale's Bitcoin fund and whatnot. Still, doesn't really matter; that many coins in one place is not great, especially when considering that many have exited the exchanges already in the aftermath of all the rolling insolvencies going down. Doesn't seem to matter: people will keep their money on exchanges no matter what happens. Most will not learn until they personally lose BIG.

Speaking of rolling insolvencies...

BlockFi declared Chapter 11 bankruptcy today. Add them to the list of fools who didn't realize not-your-keys-not-your-crypto. This really has been an eye opener in terms of even the biggest players not realizing they can't trust some other institution with their money. It's crazy to think that these people were so greedy that they'd risk it all just to get a 5% return on the deposit. The risk analysis on that front was wildly incompetent.

Speaking of bad risk management...

It's nice to see Chinese citizens protesting against against government lockdowns, but will it really be worth it? Apparently Apple has shut down an app in China that protesters were using to communicate P2P on their iPhones without having to go through the Chinese firewall... so that's fun. Super cool that Apple bends the knee to China (just like every other corporation). Actually that reminds me of this random Pomp podcast I listened to (3 hours long) that I never wrote a post on. Still have the notes on that, maybe I'll get around to it later this week. Essentially all corporations have to do whatever the CCP says in order to operate within their borders, which creates some pretty messed up dynamics in terms of capitalism interacting with a totalitarian nation.

Have you see some of these videos coming out of China? People being locked inside their apartment building with no way to acquire food. Drones spraying god-knows-what into the air and telling citizens to close their windows. Honestly it looks like such a nightmare scenario. I can't even imagine trying to organize a peaceful protest in the face of that. Like asking a lion pretty please don't eat me while we put our necks in their jaws. Clearly this isn't going to end well for anyone (China included).

Metamask announces IP tracking

On a lighter note, the company that provides the main Ethereum Metamask node has stated that they're going to be logging IP addresses and connecting them to wallets. Obviously this pisses off just about everyone in crypto. How dare they log IP addresses and track the data going through their node!

Personally I think this is a totally necessary part of the journey. Why do people think they have a right to privacy when they are using someone else's hardware? If you don't like it, run your own node or find someone that isn't tracking the information. It's important to note here that there are still many nodes out there that don't collect data (as far as you know). When the tech is open source, anyone can theoretically run their own infrastructure, even if in practice this becomes statistically impossible.

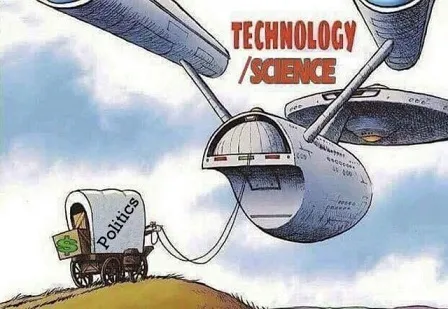

This is also another great example of how important DPOS is. Imagine if someone on Hive was logging all the data that came through their node and was giving it to a government agency or selling it to corporations. They'd automatically lose a ton of support and likely be kicked out of the top 20. Hive maintains very healthy incentives when it comes to decentralization and the right to privacy. This is even more true when we consider that it's pretty inexpensive to run our own node, whereas something like Ethereum just keeps getting more bloated by the minute. Trying to do everything is not a smart business model when it comes to extremely inefficient and redundant databases. The main Ethereum Metamask node was a huge centralized attack vector, and it should be no surprise that regulators intend to capture it. In fact, it would be more surprising if they didn't. 2023 will be the year of regulatory overreach.

We must admit that it's a little bit entitled to assume that people who run servers are going to run them the way we want them to run. The entire point of decentralization is for the regulators to move in and force it to happen. Decentralization will NEVER happen if the government doesn't break up the centralized entities that are more convenient and efficient than the alternatives. People get mad because in the short term this puts pressure on the ecosystem. In a bear market that's the last thing anyone wants to see. Well, too bad, get used to the volatility and act around it, or die by it. It's honestly not that hard. People just need to stop being greedy goblins and play it safe instead of increasing their risk in the most risk-on ecosystem imaginable. This is the one thing that CZ does that puts him and Binance ahead of everyone else within the space. Take note.

Conclusion

The economy still looks very bleak, and by extension so does crypto. By all accounts, 2023 will be a pretty brutal year considering all the red flags we continue to see. I would expect the post-Christmas slump in January and February to be a rough time. My only solace at this point is that perhaps we can forge some kind of reversal in the market by summer, even if the economy itself is still on the struggle-bus. After all, markets move faster than the lumbering economy.

If we believe the WEF and their statement of, "You will own nothing and you will be happy," then some truly messed up things need to happen over the next year or two. It's difficult to be optimistic, but we can try. After all, crypto has never existed within a recession. If anything it will be nice to see if we can finally depeg and outperform at some point or another... or if not then at least we'll know for next time.

The one promising outcome from all of this is that development is not slowing down. In fact, development is speeding up. When devs get crunched by a bear market, they work twice as hard. It will be fun to see what gets built this time around. After it's all over I'm sure will laugh about it and remember it just like 2018: a distant memory and a hard lesson.

Posted Using LeoFinance Beta

Return from Post-Thanksgiving Events to edicted's Web3 Blog