I'm still trying to wrap my head around liquidity and how it flows around like water. It seems like such a simple concept to grasp at first glance, but the variables quickly grow to exponential complexity within a fully functioning economy.

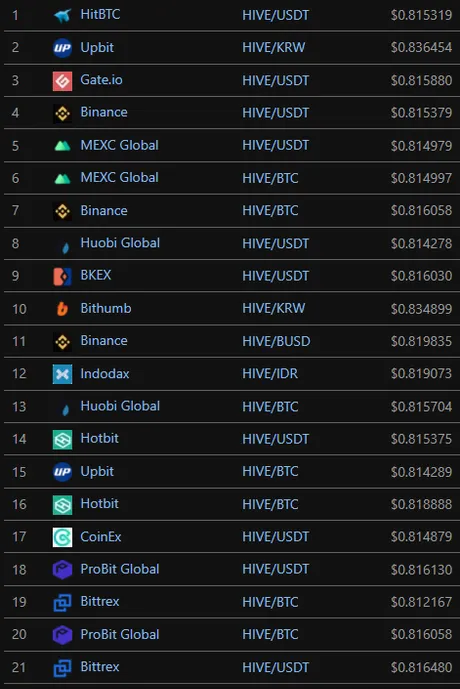

For example, how much is Hive worth if two different exchanges list a different price? Is one price correct and one price wrong? Is the answer somewhere in the middle because the market needs to be arbitraged? The answers to many of these questions are simply a matter of perspective and opinion, and are heavily dependent on other variables that need to be considered.

The internal market is a mindfuck.

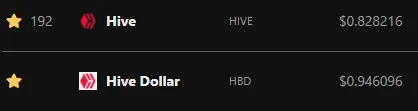

- Right now it says Hive is worth $0.85.

- But also the internal market automatically assumes HBD = $1

- So the real price is (1.0 : 0.85) (Hive : HBD)

- Coingecko says $0.828

- Bittrex says $0.816

- Binance says $0.82

- Upbit says $0.836

So which price is correct?

- They are all correct, and they also all incorrect.

- We haven't even factored in liquidity and depth yet, yikes!

- Financial markets are in a constant state of flux and paradox.

So when the HIVE/HBD internal market says Hive is worth $0.85, but the rest of the world is telling us it's worth less than that, what does it mean? It means that in fact: it is not Hive that is worth more on the internal market, but HBD that is actually worth less than $1. And then when Hive is trading lower on the internal market it means that HBD is actually worth more than $1. It's such a backwards way of thinking and hard to parse the info sometimes in relation to the seemingly simple (but highly complex) economics in play.

The really confusing thing about the internal market is that it's a complete joke and has the worst liquidity of all the exchanges, which is ridiculous now that AMM exists. It should have the strongest liquidity; exponentially larger than all the other exchanges combined. We accomplish this by allocating massive yields to the LP pools. With HiveEngine acting as a testnet, we don't even have to wait or ask for permission. We could be doing these things, right now; today.

Order of operations.

The order in which these technologies were created also affects how we interpret and perceive them. I wrote a very interesting post about how every single website in existence provably explains the concept of Impermanent Loss incorrectly. Seriously, check it out, it's actually kind of mindblowing. How could every single website explaining IL get it wrong? Impermanent loss has NOTHING to do with arbitrage, but every single definition references arbitrage. We know this to be unequivocally false because IL happens exactly the same even if there is one market, making arbitrage between markets impossible. How is that even possible that every single website gets it wrong?

It legit took me hours to understand IL because every website explained it incorrectly.

How? The answer is because centralized exchanges and order books were invented BEFORE AMM. Therefore everyone looks at the issue through the lens that centralized exchanges are the authorities that set the price and AMM DEXes are just this fun little side project that is basically controlled by the liquidity of centralized exchanges.

Obviously, this is ridiculous sentiment, because many of the DEFI protocols being invented today are allocating 100% of their inflation just to incentivize maximum liquidity. With this in mind, it is impossible for a centralized exchange to compete with these new incentives. A centralized exchange can't get more liquidity than a DEX providing 100% APR to liquidity providers. That is a fact.

So it is currently assumed that centralized exchanges determine price, but what if they didn't? How would we even know? My definition would be: If a DEX has more liquidity and depth than a CEX then the DEX price is more accurate than the CEX one. Once these markets are arbitraged the ending price will be much closer to where the DEX price started compared to the CEX price.

Where was I?

Ah yes, so if the internal market was upgraded to an AMM with massive yields allocated to it, our internal liquidity would be way higher than external liquidity, and thus it would not only set the price of Hive, but also make HBD x1000 times more stable.

Back to the 100M/100M example.

Imagine we allocated enough yield to the internal market to get 100M HBD worth of liquidity into the pool. First of all, we only have 25M HBD total in circulation, so right off the bat millions upon millions of Hive would have to be converted to HBD just to support the new paradigm. This alone makes the upgrade worth it (especially in the short term before the inflation used to incentive yield starts diluting the value of Hive).

So we have an LP with 100M Hive / 100M HBD.

Those numbers are obviously not super realistic, but it's easier for the example because Hive has an implied value of $1 as long as HBD has an implied value of $1. In reality a pool like this would likely at least spike the value of Hive by something like x4 and we'd be left with 25M Hive / 100M HBD.

But what is HBD worth?

Again, it's either worth what people are willing to pay for it on centralized exchanges, or it gets converted into Hive using the MA(3.5) daily average price at the assumed price point of $1, to be determined by the oracle feed from the witnesses over that time.

However, with such insanely deep liquidity such as this ($200M total locked), the chance that HBD actually remains close to a $1 value is quite high. It's not so easy to move the price when you have that kind of liquidity.

But what if the CEX price changes?

So again, imagine if Hive spikes on UpBit or whatever to something crazy like $2, but the internal market is still 1:1. What does this imply? Is Hive overvalued on UpBit, or is Hive undervalued on the internal market, or is HBD overvalued on the internal market? Again, this is up for debate and depends on several factors.

For example, if the centralized exchanges are all signaling that Hive is worth $2 but the internal market signals $1, HBD must actually be worth $2 instead of $1. After all, if you can trade 1 HBD for 1 Hive, and then trade 1 Hive for $2, that must mean that HBD is $2, right? Yeah, not complicated at all! So simple.

So if HBD is worth $2, doesn't that mean that users can withdraw their LP tokens and unwrap them, dump Hive into HBD, and then convert the HBD back into the higher price of Hive determined by the oracles? Theoretically yes, if all the price points stay static, but that is highly unlikely because speculators would start arbitraging the markets before that could happen. After all, conversions take 3.5 days and we can get Hive/HBD onto an exchange within minutes.

The much more obvious play is to simply dump Hive onto the exchanges and leverage the insanely deep AMM pool to bring down the price of external markets. This can be done within minutes instead of days, and as HBD is being dumped for Hive and then Hive is being dump on exchanges, the internal market will begin to reflect the external price as the two markets sync up after arbitrage is finished. If AMM liquidity was deep enough the new price of Hive would only be like $1.05 after arbitraging the centralized exchange that spiked to $2 due to poor liquidity.

It all depends on how much liquidity is on the internal market vs how much demand is on exchanges. Currently liquidity on the internal market basically rounds to zero in comparison with centralized exchanges like Binance and Huobi, which I would argue is totally unacceptable.

Speculators and arbitrage bots act instantly, and they will either dump Hive on the exchanges to quell the supply shortage, or they will remove their LP tokens from the internal market and shove all their HBD into Hive to buy the cheap Hive. Eventually, prices on the exchanges and the one implied by the internal market will equalize. It's hard to imagine how exactly this would happen or where the numbers would end up after this liquidity sloshed around, but it is 100% certain in every case that having a higher liquidity available on the internal market is a massive advantage on several metrics.

Dumping Hive is easy.

As I already mentioned in my last post, dumping Hive on the CEXes when the price spikes is easy because anyone inside the LP has access to a massive amount of liquid Hive (and can get more by trading their HBD for it). Remember that 50% of the LP tokens value is intrinsically stored as HBD.

So what happens when Hive dumps externally?

That's a bit trickier and involves more speculation unless we have strong HBD pairs on the CEXes. Again we have to ask: if Hive is 50 cents on a CEX and $1 on the internal market...

- is the internal market overpriced?

- has the value of HBD been cut in half?

- is the external market just priced at a discount?

Again, I believe we must assume that the market with the most liquidity and depth is the correct one (the anchor), which is why the current internal market order book is always wrong (because liquidity there is trash compared to a CEX). However, in the case of an AMM with massive yield allocated to it, this gets flipped and the Hive on the exchanges is being sold at a discount.

Users can then go to the exchange, buy the discounted Hive, and dump it instantly on the internal market in exchange for HBD with very little slippage. If it turns out that HBD actually is underpriced after everything is said and done, it can be converted for $1's worth of Hive according to the oracle feed's 3.5 day average. Meaning, if the external price of Hive actually did dump 50% and the internal market shifted to reflect that, buying all that HBD would have been a really smart idea, as it can be converted into Hive or traded on the internal market once the internal price matches the external market.

However, the chance of this happening is low because the internal market has over x10 the liquidity as the centralized exchanges. It is in this way that the internal market can begin setting the price of Hive and HBD will remain exponentially more stable than it is today.

Again, it is EXTREMELY hard to fathom that the internal market could set the price of Hive, because in its current gimp state, that could never be the case. However, if we added exponentially more liquidity to our own stablecoin, this not only anchors the price of Hive, but also the stable coin.

Traders would begin to trade Hive around the values provided by the internal market rather than the external price feeds. It's so easy to just assume that this would not happen, but I think this is a huge mistake in logic. The biggest liquidity pools always wins. HBD would become so stable that assuming it has a $1 value would no longer be a foolhardy endeavor.

How else can we stabilize HBD?

Ah, well, it's a lot of work and adds some extra attack vectors to the network, but I believe it's worth it. The most obvious thing Hive should do (on the DEFI side of the dev equation) is create a fully operational futures market that allows anyone on the network to print Hive or HBD on demand using collateralized debt positions. I have spoken about this many times, and did a lot of research on MakerDAO and DAI years ago, so I understand it pretty well.

https://peakd.com/hive-167922/@edicted/hbd-collateralized-loans-how-to-reduce-hive-inflation-to-zero-percent-without-hurting-the-reward-pool

In this post we see that I've done the math on reallocating the 15% inflation allocated to HP holders to an LP pool instead. Even that tiny amount of yield (that no one would miss) allocated to an LP pool would make a massive difference. However, we control Hive, and we can print more money if we want to. The idea that tokens should be deflationary is misplaced. We should allocate inflation to any and all utility functions that generate more value than they cost. That's just obvious business practice within a system of capitalism. When an investment is profitable: you throw money at it (duh). Deflation creates stagnant economies, which is going to hit Bitcoin like a ton of bricks one of these days (probably shortly after mainstream adoption).

The math back then showed that probably around 40M Hive would have been locked in the AMM if it existed and all we did was allocate the 15% we currently give to HP holders to it. Pretty impressive.

ANYONE could create Hive/HBD out of thin air?

Yep! Crazy right?

All we have to do is use the savings account as collateral for the loans. If the collateral dips too low it gets liquidated by the network to pay off the bad debt, just like margin trading works on a centralized exchange. Except the Hive version would be much better because we can add whatever incentives to the protocol that we wanted... be it negative interest rates or just extra yield allocated to the savings accounts.

Theoretically if your savings account is worth say $5000, you should be able to pull at least $2500 out of that collateralized debt position using the account as collateral. Doesn't matter if the $2500 was measured in Hive or HBD, we'd be able to create both on demand.

This creates a superior version of MakerDAO on the Hive blockchain, because HBD already has stabilizers in place, so being able to print money on demand increases that stability in both directions. Anyone that wanted to short Hive would print Hive out of thin air and dump it on the market using HBD collateral. Anyone that wanted to long Hive would lock Hive in the savings account, mint HBD and dump the HBD for more Hive. The necessary collateral remains locked until the debts are repaid. "Simple."

I've actually already programmed this code on my own project Magitek, and it is surprisingly simple... of course making sure the market doesn't get manipulated is another story. Imagine one whale seeing that another whale is overleveraged, so they dump the market and then liquidate the other whale's position at a profit. After they rebalance the market back to where it was before and basically scoop the other whale's collateral. Welcome to the mindgames that already happen on a daily basis within the economy. Leverage trading is very dangerous.

So why has none of this happened yet?

Well... it's risky... and Blocktrades seems to be very risk averse, and also has other priorities like HAF and RC pools, which is fine. Also I think that this would be a negative EV play for Blocktrades personally. Blocktrades has been providing liquidity to this network since the beginning of Steem. That means he's running arbitrage bots across multiple exchanges.

Also with the HBD stabilizer proposal in play (a proposal that 100% depends on liquidity being provided by an orderbook with a price gap), there may be major political obstacles in the way that prevent an internal market AMM from happening. Why would you personally build something that undoes like dozens if not hundreds of hours of the work you've done on your own bots? That's just my hot take though. The truth is not fully clear, and I'm not in a position to be demanding any answers. Thus far, I greatly appreciate all the work Blocktrades & friends have done since the very inception of the network (including the inception itself).

At the end of the day it all comes down to never having enough devs, and even less focus/leadership within a decentralized ecosystem. This seems to be a sweeping theme across the entire cryptosphere. It obviously doesn't help that the vast majority of Hive core devs just jumped ship and never came back. Pretty annoying honestly. So much drama. I think it's pretty obvious that we need some kind of training camp around here that teaches users how to code while getting paid, but that's a discussion for another post.

Conclusion

Economies are vast and complex, with dozens of variables interacting simultaneously. Even in the case of something simple like Hive price, there are dozens of markets all telling us a slightly different story. This is why 10 economists, like 10 doctors, can all reach a different diagnosis given the same symptoms. However, in reference to the internal market on Hive, I would argue that more liquidity is always going to be better for everyone, and that this liquidity will bleed into other markets seamlessly, rather than staying contained in a vacuum, as many have tried to tell me.

Hive is the original DEFI network. We are one of the only networks that pays users to create content, and we are one of the only networks that yield farms bandwidth itself in the form of Resource Credits. It stands to reason that we should continue building out the obvious DEFI tech tree, especially now that we know how well yield farming and AMM works on other networks that are encumbered by fees. Hive has no such limitation. 'Zero' fees for the win.

It's obvious that eventually Hive will leverage collateralized debt positions into a fully operational futures market, in addition to implementing an AMM yield farm to the internal market, and hopefully branching out to ThorChain's RUNE as well. It's all a matter of time and priorities, but I have a lot of faith that Hive will reach a tipping point that makes development proceed much faster than it does now. The DHF will likely have a pivotal roll to play in the future.

We are still so early in the game. Soon™.

Posted Using LeoFinance Beta

Return from Price Point Perspective to edicted's Web3 Blog