How do we compare Bitcoin to other assets?

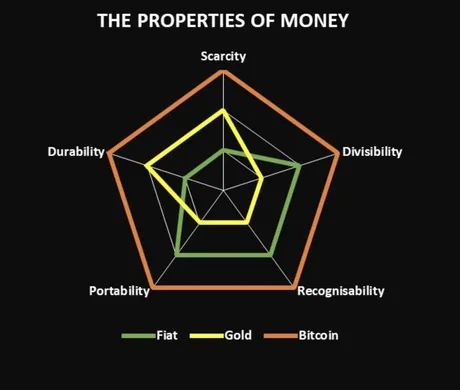

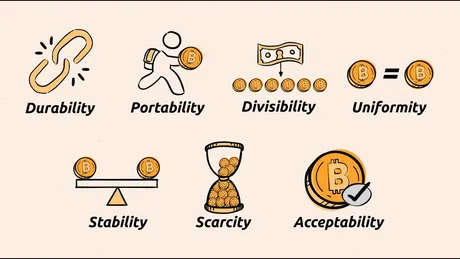

Turns out if you ask the Internet we'll end up getting a bunch of absolutely ridiculously biased answers. Look no further than the infographic above for such evidence. Imagine doctoring an opinion to show that Bitcoin is superior to all assets in every way by exponential margins. Obviously that's ludicrous.

Take "divisibility" for example

Like seriously when's the last time you were like, "Yeah USD is a great medium of exchange but it would be really helpful if they brought back half-pennies." Bitcoin could never be more divisible than USD. Out here in the real world they are both equally divisible with nobody wishing that they were more-so. Trying to add math into this equation is an extremely midwit disingenuous bad-faith argument, and basically every single infographic I could find does exactly that.

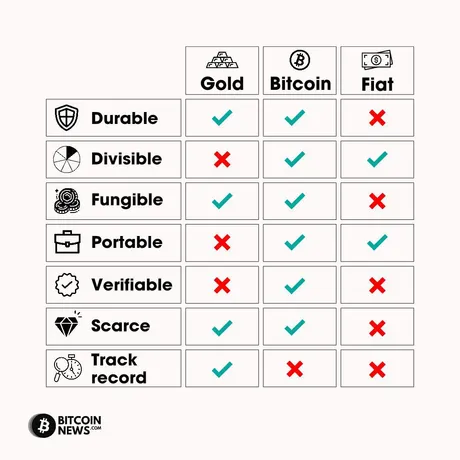

Here's one that says USD isn't fungible.

Do you believe that hogwash? When's the last time you ever experienced $1 not being equal to another dollar? Literally doesn't happen. At least not to most people. You can make petty arguments like money in the bank can be frozen and isn't like cash, but that's a pretty thin argument in the grand scheme of things, just like the divisibility angle. The entire point of the Secret Service is to protect the sanctity of the currency. That's who deals with counterfeiters.

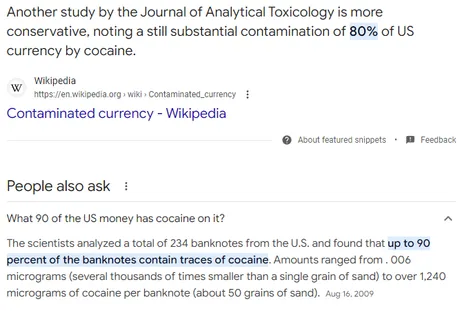

In fact, court cases have been won to this affect. There's a very famous case where a bank tracked stolen money to some random guy who had committed no crime, and the court concluded that allowing the bank to take back their money from the law-abiding citizen would completely break the fungibility of USD because 1 USD would no longer be equal to one USD. Privacy is a fundamental feature of both currency and fungibility. Money being used as a transaction in a crime can not be linked to law-abiding citizens down the chain. What percentage of cash has traces of cocaine on it again?

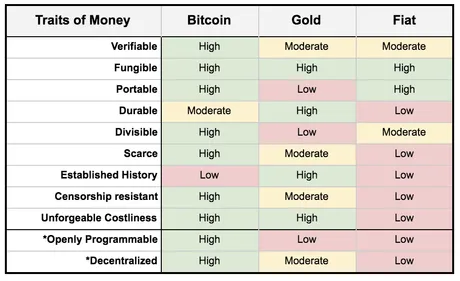

Here's another one that says fiat has a bad "established history". Really? Really? Over a hundred years isn't enough time to know? Is that a serious take? Okay then. This one also chimes in with the divisibility argument just like all the rest, which we already know to be one made is bad faith to make Bitcoin look better than it is.

In fact divisibility on Bitcoin is made a lot worse given the fact that transferring it from one wallet to another has an increasingly non-trivial operation fee associated with it. Exactly how divisible is BTC if it's impossible to send $1 to another person for free?

Meanwhile, giving a dollar to another person is easy and costs nothing. The one dollar can be traded back and forth infinity times without ever losing any value. That's what we call velocity in the money game, which is a property these infographics will never discuss because it would make BTC look like a poor performer.

We can also see they added some extra categories to make BTC look better like *openly programmable and *decentralized. Nice try Bitcoiners, those are definitively not traits of money. At least they aren't within the current environment. Maybe in 10 years. Until then, stop reaching so hard, it's embarrassing.

Here's a more fair infographic because it doesn't even dish out ranks and opts to rather define the characteristics of good money. However, this infographic tells on itself by defining what durability actually means.

Money needs to be durable to prevent the loss of value. If something is easily destroyed, then you run the risk of having your wealth destroyed.

Notice how Bitcoiners will always give BTC top marks when it comes to the durability category even though Bitcoin gets destroyed all the time. It gets destroyed by user error and it gets destroyed by centralized custodianship. Both are extremely common.

In fact as much as 6 MILLION BTC may already be lost/unrecoverable. That is 30% of the total supply, and Bitcoiners act like this means nothing in terms of durability but then will talk about it at length when the store of value discussion pops up. It's a completely unhinged, inconsistent, and hypocritical mindset parroted by toxic and greedy charlatans.

Again, these are delusional takes that assume that the average case scenario will always be the best case scenario depending on context. "Bitcoin will never be lost if you just 'do it right' fam." That's not how it works boys. If this was a business model it would look like swiss cheese.

Wait a second what about unit of account?

Search the Internet all you want: you're not going to find one of these infographics that talks about unit of account or stability of the asset. As if the ability to price assets in the currency is a total non-issue. Again a category like this would show that BTC is clearly lacking when it comes to categorizing it as money.

Notice how Bitcoiners are always quick to talk about how Bitcoin is an awesome store of value and a pretty good medium of exchange in certain scenarios, but they'll never mention the taboo third attribute, which is arguably the most important one. If you can't price assets using the currency than how can it possibly be currency?

That'll be 0.00001234 Bitcoin? Yeah that's not going to fly. Ever. No matter as soon enough everything will just be priced in sats and we can get unit bias back on our side. After all, what sounds better? 0.00001234 BTC or 1234 sats? BTC 'only' has to x30 from here before 1 sat equals 1 penny. AKA $1M BTC. I remember the $1 BTC parity well, the $0.01 = 1 sat parity will be quite the sight to behold.

Search the Internet all you want: you're not going to find one of these infographics that talks about unit of account or stability of the asset.

Just kidding I found one!

And what is the answer?

Okay it's a scale... one side has a Bitcoin and the other side also has a Bitcoin. Thus the answer to the Bitcoin stability problem is that 1 BTC = 1 BTC. See? These people are unbelievable. Can't make this stuff up.

Question: will maxis take away their laser eyes at $100k or will they let it ride?

The jury is out.

Conclusion

I've never seen an honest (or at least sensical) comparison between Bitcoin and other forms of money (fiat/gold). In fact even bringing gold into the discussion is ridiculous. Gold isn't money. Everyone knows this; nobody uses gold as money. Why bring it into the discussion every single time? Probably something about Gold 2.0, which is also an extremely inaccurate take. Comparing a natively physical asset to a natively digital asset is a fool's errand comparison who's only purpose is to completely dumb the issue down for mass consumption.

So what is cryptocurrency if not currency? Well for one it's collateral. In fact it's pristine collateral that can be used to create money out of thin air. Arguably this makes it better than money, but it is still not money. If someone offered you the choice between a bicycle and a car you're going to take the car. That doesn't mean that the car is a bicycle 2.0 and you can ride it on the sidewalk. That is what maximalist sound like to me when they speak: idiots that invested in a car and are insisting to everyone around them you can ride them on the sidewalk. Yeah okay let's see how that goes. Good luck frens.

Return from Properties of Money to edicted's Web3 Blog