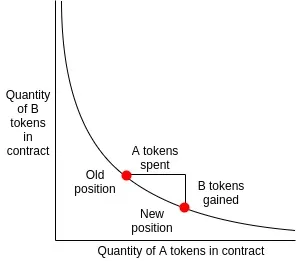

It takes me a second when I try to wrap my brain around Uniswap pools. You put a certain amount of crypto into them (50/50) but you'll likely not receive that same ratio when you cash out (unless price hasn't moved).

Rather than an orderbook, liquidity on Uniswap is contained in a single pool, and money is moved in and out of that pool using an algorithm that balances each side. For example, I'm providing liquidity to the wLEO pool. If LEO moons the ratio of ETH to LEO in the pool will shift toward ETH, and when I cash out I'll receive less LEO in return and more Ethereum than I put in.

The best case scenario for Liquidity Providers on Uniswap is for tons of money to get sloshed around but the prices don't really move. This allows LPs to farm the 0.3% trading fee built into the platform to incentivize liquidity yield-farming.

The Hedge mechanic.

More and more I find myself wanting to provide liquidity to the ETH/DAI pool. DAI is a stable coin, so I can count on that side to maintain its value from a relative standpoint. Where does that leave me if the price of ETH goes up or down in relation to $1?

Well, if ETH crashes in relation to $1, that means ETH is being pumped into the pool and DAI is exiting. Say I had $1000 worth of ETH (2.7 ETH) and $1000 worth of DAI in the pool, but then ETH crashed 75%. This would double the ETH in the pool and cut the DAI in half. If I were to cash out, I'd get 500 DAI back ($500) and 5.4 ETH ($500). Even though ETH crashed 75% my ETH in the pool only lost 50% because my coins doubled in size. In total I went from having $2000 to $1000 after a 75% ETH drop.

Conversely, if ETH spikes x4, I get x2 more DAI (2000) and half as much ETH (1.35 ETH worth $2000). So I double my money when ETH goes x4 and I lose half my money when ETH crashes 75%. Makes sense considering half of my assets are locked in stable coin DAI.

None of this even counts trading fees, which would probably be pretty good during such volatile circumstances. If ETH goes x4 and then dumps 75% I've done nothing but collect on exchange fees. #winning. If I had ETH and DAI just laying around collecting dust it would be silly to not pool it into Uniswap and yield farm the pool (assuming the security of LP tokens is infallible).

Supporting DAI as a matter of politics.

DAI is the most popular decentralized stablecoin in the world. As an ERC-20 token, its native home is Ethereum. There are a few things about it I don't like, but IMO it's the best thing we've got as far as stablecoins go (especially ones native to Ethereum).

Ironically enough, the recent popularity of Uniswap has actually vastly increased the fundamental demand of DAI (due to DAI being required to fill the pool in order to yield farm). Before now MakerDAO had to jack up interest fees to maintain the $1 peg, now DAI is consistently trading above one dollar despite having a very low interest rate (currently 2% down from 10%).

Ride the waves

Now here's where it gets interesting. Say we come up with some kind of trading strategy given extreme ETH volatility. Yeah sure, you may have just lost 50% of your money from ETH crashing 75%, but where is ETH gonna go from there? That might be the perfect time to cash out of the pool and take the extra ETH that's been given to you (even if it's worth 75% less than before). It might even be a good idea to take the DAI side and pump it back into ETH. 75% is a huge drop. Perhaps it's time to go all in when that happens.

Conclusion

So not only can you hedge your bets and yield farm exchange fees using the ETH/DAI liquidity pair on Uniswap, you can also use it as a metric for when one wants to enter or exit the market given how much volatility is out there. ETH spiking hard? Cash out a little bit to DAI and take gains. Is there blood in the streets? Turn some of that DAI back into ETH.

The point here is that many people (ESPECIALLY INCLUDING MYSELF) make extremely emotional trades and employ min/max glass-cannon strategy all too often. Then we realize:

"Wow I really with I had some USD to buy this dip right now. Too bad I already spent it all & went all in a month ago."

By farming the ETH/DAI Uniswap pair, you'll always have liquid DAI available to trade the market. Half of your LP tokens will be used to claim DAI, that is a fact. The algorithm doesn't work any other way. This promotes good trading habits and the ability to hedge one's bets.

For example, in the situation above if we had just straight up bought $2000 worth of ETH instead of a 50/50 ETH/DAI split we could buy 5.4 ETH. However, should the price of ETH flash crash 75% from there we still have 5.4 ETH but it's only worth $500.

In the case of providing liquidity to Uniswap we'd have 5.4 ETH plus 500 DAI leftover in the event of such a crash. This is a good hedge. We could then decide ETH was very oversold, sell the 500 DAI back into ETH, and double our ETH holdings too 10.8 coins. If we wanted to take it one step further we could even lock that 10.8 ETH in a MakerDAO smart contract as collateral, take out a 500 DAI loan, and sell that into ETH as well increasing our total ETH to 16.2 in the hopes that we'd be able to pay back this loan cheaper when ETH spikes up again.

Gamble Gamble.

Trade responsibly.

Barring this extremely risky tactic, if nothing else, Uniswap is a great way to provide value to the network simply by yield farming exchange fees with funds you were planning on HODLING anyway. That's just free money sitting on the table!

Uniswap has already shown that it can dwarf the volume of centralized exchanges... and we haven't even seen a huge bull run with crazy volume yet. This trend is only set to continue moving into 2021. In all likelihood, farming Uniswap fees should be VERY profitable during these high volume/volatile periods of history. Considering Uniswap has x3 the trading fees of Binance (0.3% vs 0.1%) and users are more than willing to pay that premium, I'd say this fact is certain moving forward.

Even using today's numbers ($400M pooled w/ $20M daily volume) we see that it only takes 20 days for the entire pool to be swapped back and forth. That's a 5.5% APR for liquid funds that can be removed from the pool at any time. It's not like Hive or LEO where the tokens are locked. It's also safe to assume that volume and fee collections will be multiples higher than this (thus multiplying the yield farm and APR ROI) during periods of extreme volatility. Uniswap is basically designed to be arbitraged should the market become volatile. This process forces fees to be drawn from traders and arbitrage bots into the pockets of Liquidity Providers.

I'll give some more insight into this when I'm actually farming the ETH/DAI pool, but the more I think about it the more promising this prospect seems to be. Farming a stablecoin pool on Uniswap means you'll always have emergency stablecoins available should market conditions become favorable enough to justify going all in.

- Not sure if the market is going up or down? Farm the pool.

- Think the market's going to crash? Grab some more DAI.

- Think the market's going to spike? Get some more ETH.

This is all obviously rudimentary trading advice, but the mechanics of farming Uniswap pools makes it much easier to maintain a balanced position.

Return from Providing Uniswap Liquidity as a Hedge Against Volatility. to edicted's Web3 Blog