The story doesn't totally add up.

Binance has officially canceled the deal to bail out FTX. Pretty odd considering how it all went down, but FTX was so comically insolvent ($8B?) that it was not financially viable. Not only that... it's likely not legally viable. Acquiring a company that just did a bunch of illegal stuff is likely not a very good strategy. FTX has become nothing but a liability.

Was CZ really just being a nice guy and letting people get the fuck out before blowing up the entire market? He legit created a bank run with a Tweet. What a crazy timeline we are living in. Anyone who was paying attention had more than enough time to dump all their assets and exit the platform before CZ nuked it. I think I actually will keep that idea in my back pocket: CZ was just trying to warn everyone something was up. How honorable. I would love to find out that he borrowed a bunch of BTC from other exchanges and shorted it, knowing we were about to nuke. That's a fun timeline as well.

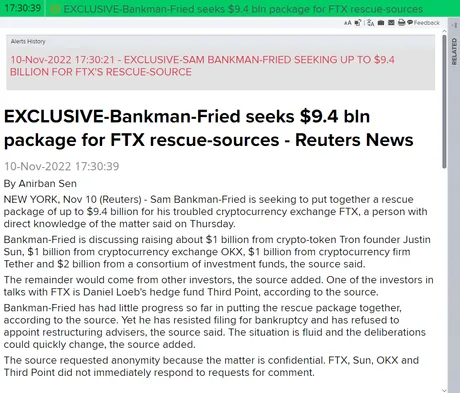

Justin Sun is also getting in on the action.

He's extending a 'lifeline' to people that still have their coins stuck on FTX. Tron trading and withdrawals have been enabled. And now people are buying Tron on FTX for $1 a coin just so they can escape the FTX hellhole. Crypto Twitter says what he is doing is illegal. Would we really have it any other way? All hail the Sun.

CPI

CPI data came in hot today at 7.7%, which was lower than expected (7.9%). This sent stocks spiking 5% today, and Bitcoin has since recovered back near $18k down from $16k (and now $17k as I proofread this post). Again, I predicted all of this in advance with my "Red Mirage" post. The Blood Moon signaled the end of the bear market. We are now firmly within the bull market with a new local low of $15500.

So my predictions have been pretty on point lately. For months I've been saying the lowest Bitcoin can go is $16k. If this ends up being the bottom then I was basically perfectly correct. We were only lower than that level for 3 hours. Predictions don't get any better than that.

This marks the end of the bear market.

Obviously I've been saying June 17th was the end for months now and we'd have a make a lower low to undo that fact. Lo and Behold: FTX was insolvent the entire time; lol. Again, all the reversal patterns point to this being the beginning of a bull market. DXY is going down. CPI is going down. Gold & silver are going up. Everything is looking pretty good. I mean obviously the economy is in shambles, but when has the market ever cared about that?

The year of the maximalist.

The next 12 months are going to be a very important time for BTC. Do not be surprised if Bitcoin goes up but alts just kinda trade sideways. Given everything that just happened, it becomes even more clear that simply buying Bitcoin and securing the keys locally is more important than ever. Everyone can see this, and the maximalists are unsurprisingly declaring victory once again, even as the market nukes. Yes, they are insufferable, but they are also right half the time. This time, they are right. I will allow it.

Apparently there are two different versions of FTX?

An international version and a USA version. Apparently the USA version is still completely operational, so we can see that this story hasn't even come close to playing out yet. There's still a bunch more drama to be had. For example: a few hours ago law enforcement called on Bitfinex to freeze all USDT wallets of FTX. Bitfinex has complied. Let the fun begin.

Speaking of Tether...

People are extremely emotional right now, and it's easy to see why that would be. FTX goes insolvent, and the knee jerk reaction is that Binance and Coinbase will go insolvent. More recently, crypto players are calling for USDT to crash to zero because it broke the peg on a random exchange like Kraken I believe. Again, don't listen to the hysterics. This is just more fishtail logic being espoused from people who do not have the ability to think straight right now. Like I said before: we need to wait 2 weeks for the dust to settle and see where we are at after the New Moon pump. That's November 23rd. This is no time to be fading the crystals girls.

If I wasn't sick right now I probably would have been able to maneuver around this situation with much more grace. I was able to make a tiny bit of money off the dip, but still a drop in the blood-bucket considering how far we crashed and how illiquid my Hive stack is. But that's fine, all part of the process.

The market always nukes/rallies right around my birthday. Guess what it did this time? Thanks for the hard lesson, Goddess Moon. The same lesson I got last year as well when we were at $66k. Woof! By this time next year crypto will be on a rampage. So that's something to look forward to.

This is the highest volume I have ever seen, ever.

Again, people are being totally irrational and blowing this situation way out of proportion. It's being equated to the MT GOX hack for gods sake. Can you believe that? MT GOX was THE EXCHANGE. It had the vast majority of the volume, and the exchange was HACKED. Getting hacked and gambling the fate of the company on leverage are two completely different things. If you get hacked, the thief can dump the coins on the market. If you're overleveraged, the money is simply gone when the collateral gets liquidated. It's a much more definitive/predictable outcome.

We also have to remember the context that most bears were giving before this all happened. They were all targeting $10k-$13k before. Now they are targeting all the way down to $8k. This event was the perfect opportunity for temporary bears to shove their coins onto the market so they could buy in at a lower price.

Again, bears do not realize we are grinding at rock bottom levels, which is why the market is so ridiculous right now. These damn day traders are trying to capitalize on the rampant fear and irrational state of the market right now by making it even more volatile. That's fine, let them try to get that better price. Just be aware that there's a bunch of money outside of Bitcoin waiting for a lower price right now. There's powder in the keg across the board. If you ask me I think they're gonna get burned and reenter at a slight loss.

Basically when Bitcoin is trading at $20k+ again everyone is going to forget that all of this ever happened (in terms of going bearish for a better price). The $20k unit bias is strong. Once we get past $20k we can assume that all the day traders currently waiting for a lower price have all bought back in.

Hive?

I've been considering purchasing Hive with the Bitcoin I've been accumulating, but honestly I still think BTC is going to outperform for a WHILE. Six months to a year. One of the best trades I ever made was buying Hive at 400 sats. I'd like to get to a lower level before making another purchase such as that. Something like 1000 sats would be nice. I guess we'll play it by ear.

Conclusion

What a wild ride it's been, and it's not even close to over. SBF says he's 'sorry'. LoL. Kick rocks. That little bastard literally testified to congress not so long ago that all their operations were totally transparent and legit. Now this. I think we have to assume regulators will make an example out of him, especially considering the context of Do Kwon still being on the run and regulator's predictable ability to pick low hanging fruit. The USDT wallet freezes aren't going anywhere.

I don't think we'll see a lower low than the one we just got. Volume is still off the charts and we need two weeks for the dust to settle from this one. If the New Moon pump hasn't brought Bitcoin back up to something like $18k+ we might need to readjust this assessment.

Making deals with Justin Sun, eh? Yeah, that's going to end well for you. Stay based, fam.

Posted Using LeoFinance Beta

Return from PSYCH! to edicted's Web3 Blog