Lot's to talk about so let's get to it.

First off, Ross Ulbricht, have you heard about this? Trump is considering giving the original front-man of Silk Road a pardon for his "crimes".

Should he do it?

Yes, obviously. Giving someone two life sentences for setting up a free-market is ridiculous. Plus they tried to trump up the charges by adding a contract killing to the mix, which was totally bogus.

Two cops were arrested for stealing confiscated Bitcoin during this case, and more recently Citizen X was extorted by the government for $1B that was stolen from Ulbricht. Citizen X could easily be yet again someone who was involved with the case that got caught later and they don't want to admit what fuckups they are so they are keeping it hush hush. More likely he is getting off scot-free in exchange for $1B and the establishment doesn't want you to know that people with money can literally pay to get that get-out-of-jail-free card.

I can't find it at the moment but I also wrote about an encrypted wallet that held the forth highest amount of Bitcoin in the world. There are many many articles about this on the crypto news circuit. People were paying thousands of dollars on the darknet for this stupid thing just on the off-chance that they might be able to crack the encryption... so stupid.

Turns out, this is the exact same Bitcoin wallet that the feds seized from Citizen X. Small world.

Ross was made an example of and thrown into a torture chamber that extracts lifeforce via tax-dollars. His imprisonment doesn't help the world, it hurts it, as do the vast majority of other incarcerations. Abolish the prison-industrial-complex now. I have spoken.

BITCOIN

Now that we've been trading at all time highs for two days straight with no end in sight (2 weeks), everyone is popping out of the woodwork to cry about how BTC is an overvalued bubble. Cry more, noobs. It won't change anything.

Even worse, unit-bias has made a full return and there are a tidal wave of scrubs coming forward who claim that "Bitcoin is too expensive" so they are going to do something stupid like buy Ripple's XRP instead because it's "less expensive".

I even saw a Tweet the other day of technical analyst Willy Woo calling for exchanges and aggregators to start measuring Bitcoin's arbitrary units on a lower scale so these jackasses stop thinking it's expensive. This is something I've been calling for for years. Just price everything in sats and everyone will lose there mind about how Bitcoin is so inexpensive now. After all, $1 buys over 4000 of them at the moment.

God, people are so ignorant it's mindblowing. Stuff like this is never going to get better because there's a sucker born every minute and crypto will be constantly onboarding noobs for the next twenty years or more.

Even people who I DIRECTLY SAY TO THEIR FACE: "NO! UNIT-BIAS!"... come back to me with "Yeah I bought some Doge because it's cheap." What the actual fuck why are you even asking me questions while I spend an hour helping you out? Is it just rainbows and unicorns when I open my mouth? All we can do is work around their ignorance and create a smoother transition in terms of user experience (UX).

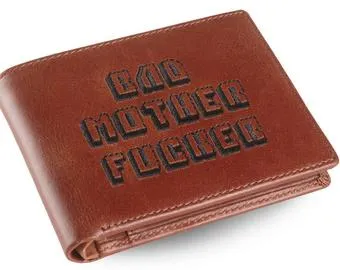

"Say What Again"

Also even people who are supposed to know what they are talking about are now coming forward to spew nonsense. This wave of corporate adoption is a never-ending stream of the same boring rhetoric.

- 21 Million Coins

- Scarcity makes Bitcoin valuable.

- Hedge against dollar devaluation.

- Gold 2.0

- Good investment; I'll make money.

Why is that annoying?

Because when you look at what all these corporate toolbags are saying about Bitcoin, ask yourself, what are they saying about it that can't be applied to gold, silver, or other precious metals? The answer is nothing.

Bitcoin is ALIVE

These corporate bloodsucking vipers finally figured out that they are going to make money so they opened their bags, but then they turn around and spew absolute bullshit to the public because they don't know any better. It's annoying.

Abundance.

Bitcoin isn't about scarcity. It's ironically about the exact opposite. Bitcoin doesn't gain value because of scarcity and 21M coins. It gains value because it provides an abundance of trust in a system contained with nothing but deceit and corruption. It also provides an abundance of synergized network-effect gains. There is no competition. Everyone is bringing value to everyone.

Again, nothing we can do about it... let them compare the rock to the armadillo. Their foolish notions about what is happening here is going to burn them sooner or later, and I'll be pointing and laughing when it happens.

Think about it. Bitcoin and crypto is all about open source development. The community provably owning a piece of the pie. Cooperative capitalism.

It's literally everything a venture capitalist wouldn't and couldn't understand due to a lifetime of brainwashing with the exactly opposite system. They're gonna to get wrecked sooner or later, and it's going to be hilarious when they realize they were the ones that caused it to happen. Thanks for being on my team, you greedy goblins.

Essentially they are doomed to create exploitive systems that put themselves in control, but those systems will be open source. Therefore, all someone has to do is tweek the code and relaunch the non-exploitative version and all the work they just did becomes property of the world.

What a tragedy.

They'll bitch and moan and cry foul and theft of intellectual property, but it won't matter, because the systems they've decided to build on are self-governing. It won't matter if such-and-such government comes forward to condemn what is happening, because these networks are autonomous city-states within a much larger network (cryptosphere) in which these city-states protect each other.

It will be truly mindblowing when these city-states begin to take physical form and come under attack by governments and other adversaries. Why? Because centralized force does not know how to control a decentralized entity. They don't have the tools to do such a thing.

Imagine the wars with Vietnam, Iraq, Iran, Syria, North Korea, Egypt, etc etc etc.

These wars have already proven quite costly. In fact, the easiest way to profit from them is through defense contracts that syphon tax dollars from Americans. How hilarious is that? America goes to war to maintain imperialism and you pay for it out of your own pocket. Fun stuff.

Now imagine that the country we invade doesn't have centralized architecture, but is instead build on decentralized flat architecture. Holy shit! The centralized architecture is already hard enough for us to control... rigging elections, assassinating political opponents, rampant propaganda, yada yada yada.

Can you imagine how impossible it would be to control a decentralized country? Elections, are done on the blockchain... pretty hard to rig those... money is hidden and hard to confiscate. The "people" in charge have been automated out by a set of agreed upon rules that can't be changed without owning stake.

Trust me, we'll see another Justin Sun scenario play out in real life that makes all the citizens rich as they simply fork to a new network and destroy all of the attacker's stake. Gonna be hilarious, and we'll all be like "Duh! We already did that!"

Imperialism is not possible given this scenario.

This is why DPOS is such a powerful governance system. It's just centralized enough to make quick decisions and organize and scale-up, and just decentralized enough to avoid all the bullshit problems we are seeing in the world.

Speaking of greed

This price action is insane. Let me point out that all of my recent predictions have been insanely accurate.

https://peakd.com/hive-167922/@edicted/breakout-alert

Again, consolidation for a week was exactly what I was expecting. Tons of people are going short at all time highs. The explosion upward will be massive if the buyers win the supply & demand war. Essentially as soon as we break above $20k everyone who bet against Bitcoin is going to get very afraid that they made a bad bet.

It was so obvious that the $20k-$21k range was completely no-mans-land and we were going to blow past it instantly. Now we have likely entered a parabolic run that will last a couple of weeks and crash into the damn mountain via the classic volcano pattern that Bitcoin loves so much. Will be interesting to see how high we get before the market becomes completely unstable.

I'm hoping for $50k... but I'll start cost averaging before that and capitulating if too much time goes by. We'll probably get several signals that the market is unstable with either a massive decrease in volume or an epic blow-off top.

It's also important to note that timing the peak is way too difficult, and it's probably way way way smarter to simply sell the inevitable dead-cat bounce that we always get after the top hits. Say we peaked at $35k and then the price crashes to $25k. There'd be a very good chance the dead-cat-bounce would bring us back to $30k-$33k before crashing again.

Holy volume

I forgot to mention the best part of this price action. It's not even the price, it's the damn volume. 50k Bitcoin trading hands over 24 hours? That's INSANE. 10k is normal. 15k is good and sub 8k is bad. I've never even seen it at 30k before, so 50k is insane.

Again, Coinbase volume is way more trustworthy than other exchanges. Coinbase has high fees, making wash trading very expensive, and they don't wash-trade themselves because they are extremely by-the-book rule followers in accordance with strict American regulations. It's a good metric to keep track of.

If Bitcoin does what it often does in the past, this flag should eventually turn into a wedge that gets less volatile over time. I assume this run still has a lot of steam left, and once that happens we will flag up again.

According to the rule-of-three, I'm expecting at least 3 flags up before the market becomes unstable. Sometimes we get a magical forth flag, but so far this has been a pretty classic run up. Not expecting anything tricky. After all, these institutional investors don't mess around. It's simultaneously nice and terrifying that such strong hands are entering the market.

Baseline

Considering we consolidated below all time highs for an entire month, $20k now serves as an epic baseline and jumping off point from here. No matter how high we go from here I feel like we are guaranteed to return to $20k, although I'm not sure about the timelines. Could happen in February at the earliest and summertime at the latest. We should be in for some seriously volatile chop over the next six months.

Hive

Yeah, it sucks for Bitcoin to be trading at all time highs while Hive continues to trade at near all time lows. One or more big stakeholders are dumping down to the 13 cent level no matter what happens here, so that is pretty annoying. All we can do is wait for them to run out of money.

This is a good thing in terms of decentralization, but it's obviously pretty bad in terms of morale and building value. Can you imagine if Hive was trading at all time highs as well? I can't. That's literally an x60 gain... lol. I'd be making over $500 a day just from blogging. #dreambig, amirite?

If this dump continues on I worry about what happens when Bitcoin starts dumping as well. You'd think we'd be immune to a double dump but history has proven otherwise. I imagine we could eventually get stuck in the 8-9 cent range which can't really be broken due to all the buying pressure there. Plus obviously very few users would want to sell there as well, so I'll be considering that an opportunity to buy more if it actually happens.

The moral of the story here is to not put all your eggs in one basket. Bitcoin might be boring but it is damn consistent. Corporate adoption isn't going to be pumping any altcoins anytime soon, so we have to hope that retail is up to the task. I think they will be considering their newfound Bitcoin-rich status, but we might have to wait until BTC is trading above $50k or even higher before the alt market really takes off.

Fin

Well I had more to say but I went and compulsively talked about price action again forever. Guess I'll just kill it here and save the rest for later.

Posted Using LeoFinance Beta

Return from Pulp Non-Fiction to edicted's Web3 Blog