Zero-Sum Game Theory

The foundation of player vs player dictates that there are winners and there are losers. It is implied that if you win, someone else probably lost. Of course when it comes to crypto trading/gambling there are a lot more technicalities involved here than something like Chess. Chess is simple because we always know if someone wins the other player lost. Such is not the case in crypto pvp.

Crypto pvp (trading) is a lot more like poker

In poker usually only 10-20% (1 or 2 people at a full table) are making money on average. A lot of this has to do with the rake, which is the amount of money the house takes for themselves. Don't forget: the house always wins. The rake in crypto pvp is the trading fee. On Binance this is only 0.1%, but on a DEX you might pay 0.3% and on Coinbase it can get as high as 0.6%. This doesn't even count slippage on the trade if you're buying more than liquidity can handle at the moment.

The interesting thing about DEXes like Uniswap and Pancakeswap is that we can bet against the gamblers by becoming the house and providing liquidity to the network. Of course this comes at the risk of impermanent loss and even potential systemic failures of the tokens being paired together in the liquidity pool.

Another way that crypto trading is a lot like poker is that many make the same claim for how many actually 'win'. Should be around 10%-20%. I find this to be a bit shocking considering that poker rakes are notoriously higher than a 0.1% trading fee on a percentage basis, but somehow I feel like it's still accurate.

I actually don't have any theories on why that might be, as the math involved would lead me to conclude that there should be more crypto pvp winners than 20% given the numbers involved. I would guess something more like one third of all crypto traders should make money on average. Maybe 35%, with 40% really pushing it. A 0.1% trading fee should be low enough to allow for 40% to win, in theory, but in practice this seems not to happen.

One of the most magical things about crypto is that you can completely lose the trading game and still make money over time. There is no other type of gambling in the world that has ever been close to performing such a spectacular feat.

How does that work?

Well let's say Bitcoin goes 10x over the next couple years. If you're playing the trading game and you go in with $5000 and exit with $25000, you lost. In this case you should have just held Bitcoin and you'd be up twice as much money. This is the magic of exponential expansion and upgrading the foundation of money for the first time in a hundred years. Even when we lose we can still win. Bears and other shorts beware!

When Hive dipped to 40 cents yesterday and the day before I correctly pointed out that there was some support at that level. However, I opted to not buy and also advise that we all wait for that lower level at 35-37 cents. Obviously in retrospect we see the chart and think "damn I should have bought" but honestly I maintain that waiting for the lower level was correct for a couple of reasons, especially for my personal strategy (which may not apply to my readers).

Now is a good time to mention that you can not look at the outcome of a gambling event in retrospect and figure out what you "should have done". This is a Fool's Errand. A slot machine that hasn't paid out for a thousand rounds has the exact same chance of not paying out on the next round. If you flip heads ten times in a row, the chance that you flip heads again next time is still 50%. Previous outcomes have no affect on future outcomes.

With this in mind I can still claim that buying at 40 cents was a bad idea even though we can clearly see that was the local bottom over the last week up until now. I can say this for a couple of different factors.

- The chance of HBD spiking is higher than usual.

- The money I'm gambling with is Bitcoin that I sold at $16k as a destressed seller during the Binance FUD and will likely end up paying bills in the coming months.

With these two variables in mind, it makes a lot more sense for me to simply hold my 2000 HBD and not gamble with it unless there happens to be a very good deal available to me.

DCA tactics

Ask yourself how much money you want to make as a trader. In crypto this number is usually absurd because crypto is absurd. In the stock market 100x is absolutely out of the question and you look like a lunatic, but in crypto we see this happen all the time.

So say your goal is to 10x your stack (in USD terms). How much should you sell right now at 44 cents after a 10% gain? Honestly probably only like 1% of your bankroll. This sounds stupid but is especially true for inexperienced traders. You should DCA and trade small unless you have a VERY good reason to believe the price will move in a certain direction over the short term (and as we see even when people are convinced: the market will often do the opposite thing seemingly out of spite).

So yeah the best move would have been to buy a little bit at 40 cents (maybe 1%) and then sell a little bit now at 44 cents. We have to assume that the MA(200) line will act as resistance here, even though it very well might not. That's why we only gamble a tiny amount on that outcome happening. Making a lot of small DCA trades as an inexperienced (or unprofitable) trader will help you get comfortable with gambling while being much easier to remove the emotional attachment we have to our money. A small amount like 1% isn't going to make or break the bank but it will give you experience instead of trying to time huge moves like a wannabee pro.

Example #2

What happens if Hive spikes x2? Well then you can easily justify selling more into that pump. Again if your goal is to 10x your stack and Hive just went x2, you're 20% of the way there already. However we've all seen what happens 95% of the time on a Hive pump. It will dump right back to where it was before just as quickly. By selling the 20% you miss out on further pumps a little but capitalize on the much more likely dump if and when it happens.

Another strategy that some traders employ with success is simply always maintaining a balanced position. Say you have $1000 worth of HBD and $1000 worth of Hive ready to trade. That's a nice and balanced 50/50 position and whatever the market does you'll have flexibility.

Say Hive pumps x2.

Now you have $2000 hive and $1000 hbd. You can sell 25% of your stack to balance it back to $1500/$1500. This is a nice and simple way to go about DCA so you don't have to worry about the math. You just keep both sides of your stack relatively even during key opportunities where you want to trade.

Interestingly enough this is exactly what Automated Market Making yield farming is all about. Not only does the AMM rebalance your position constantly by design, but you can also earn yields while you're doing it. Of course this bear market has crippled 99% of all defi products, so there are still a lot of bugs to work out before this strategy is definitively more viable than manual trading.

Competition vs Cooperation (Player vs Environment)

So far I've talked a lot about PvP, zero-sum game, and DCA trading strategy, but what about cooperation? The PvE side of crypto is why most of us even have money to gamble with in PvP in the first place. The PvE side of crypto is often ignored, even though it is exponentially more important in the long term.

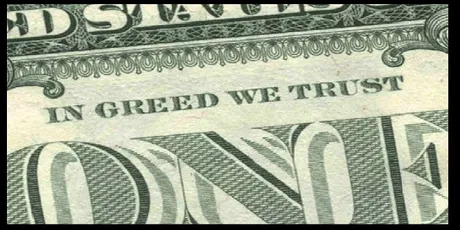

We are trying to rebuild the entire economy from the ground up. We are trying to create systems that are fair and inclusive with a gigantic middle class, during a time in which the middle class is under constant attack. Most people lose sight of this and fall into a blackhole of greed. They don't want to be middle-class, do they? They want to ironically subjugate the poor just like the previous leaders in charge did. New boss same as the old boss.

Fighting greed head-on is a bad idea.

Redirecting that energy into more productive outcomes is what crypto is all about. We create a system that is actually fair and has proper incentives, and the greed that fuels us makes the world a better place rather than destroy it. That's the theory anyway.

Conclusion

While many focus on the PvP aspects of crypto, PvE is far more valuable, especially in the long term. Why slay your opponent in the trading game when you could be building your reputation and forming groups to slay dragons? I guarantee that the dragon has more treasure than the player, even after splitting it 40 ways between all your teammates.

Posted Using LeoFinance Beta

Return from PvP vs PvE to edicted's Web3 Blog