Measuring Volume

How does one go about measuring the volume of an object that has curved or jagged edges? This task can be very difficult without the proper tools. We can always measure the total length, width, and depth of the object, but that only leaves us with a cube-like outline that will always have greater volume than the object placed within it. Using this tactic, we could probably make a decent guess as to how much dead space there was within this 'cube', but depending on how accurate the measurement needs to be this may or may not be an acceptable way of going about it.

Water Displacement

Whenever we want to know the true volume of an object (including a person) one way to get a near-perfect measurement is to fully submerge the object in water. If you drop a rock into a measuring cup filled with 500 milliliters of water and the water line goes up 100 milliliters to 600 milliliters total, we can be quite certain that the rock has a volume of 100 milliliters. The water flows around the object and becomes displaced, resulting in a higher line level. The difference between the line before and after displacement must be assumed to be the volume of the object.

Bruce Lee on Becoming the Cup

Fluidity is even more important within the context of the economy than it is within the context of hand-to-hand combat. Some assets are much more liquid than others. For example, currency is extremely liquid and billions of dollars could be dumped onto the markets with very little slippage in value. Property, on the other hand, is notoriously illiquid. Within the context of crypto, Bitcoin would be the best currency and NFTs would be the property that is much more difficult to sell at market price in a short amount of time.

What is the point?

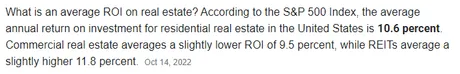

The point is that real-estate is considered by many to be a very solid investment. This sentiment has been constant for over a hundred years. Even as far back as the 50's we see this concept of having a wife, 2.5 kids, and a house with a white-picket-fence as the standard for stability and the ultimate life-journey with a happy-ending.

But something... changed... didn't it?

Something has happened after the last few decades that has stripped the middle class down to the bare bones, and with it all the opportunity that comes along with being middle class. Technology has ascended to godlike levels as the gap between the rich and the poor breaks record after record each and every year. Recessions make the gap even worse, with the elite clocking record gains even in the middle of a "deadly pandemic" amid forced economic shutdowns.

We can even see that this asset (real-estate) that was meant to be the crown-jewel of all investments is actually complete trash. In order for 99% of the population to get ahold of real-estate, they must qualify for a bank loan. That right there is enough to argue that debt-slavery is essentially a requirement to capitalize on one of the best investment classes the world has to offer. Is that acceptable? I must conclude that it is not!

What is the solution?

Well first of all let's fully flush out the problem:

- Interest rate on the bank mortgage cuts into 11% ROI.

- Inflation of USD cuts into 11% ROI.

- At best your house is only a store of value.

- We would prefer to generate value with our investments.

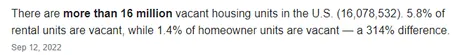

- Hedge funds have aggressively moved in and cramped the trade even further (and they don't need a regular bank loan which means that normal people can not compete with these Goliaths).

These hedge funds buy up property and are more than willing to let the property sit empty if that's what needs to happen. At the same time, if there were no vacant rental properties that means every time you tried to move: there would be nowhere to move to... so vacant properties create that much needed liquidity within the rent-seekers market.

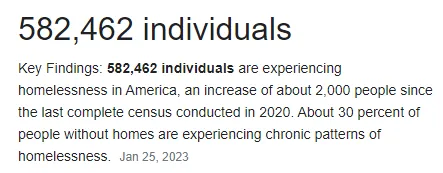

Guess how many homeless people are in the USA?

GAH!

So let me get this straight... there are 16 million vacant properties... and half a million homeless folks? Aren't those numbers... kinda fucked up? Well of course they are... and we left-wingers are always quick to point out this blatant hypocrisy.

You know what we are not quick to point out? That if we owned property we absolutely would not allow a homeless person to stay there for free (because duh). Having tenants that actually pay you is already a huge pain in the ass as it is, just ask @scaredycatguide. So this entire argument is ironically just more hypocrisy. This onion has many layers, folks!

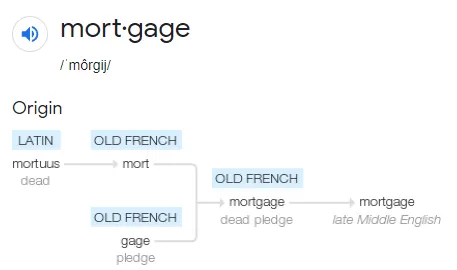

And as @builderofcastles was kind enough to point out to me years ago:

The origin of the word itself ['mortgage'] literally translates to...

YUP

Mortgage literally means "death pledge". As in you're going to be paying this loan until you die. As in, "Haha, we got you by the balls now!" As in literal debt slavery. Even the term "he bought the farm" DIRECTLY translates to "HE DIED". lol? da fuk? Not cool bro. wtf is happening here? It's engrained in the very language we've been using for generations.

So what is the solution?

I bet you already know what I'm gonna say! Obviously crypto is the solution. Look at HBD! My god! 20% yields on a FULLY LIQUID asset.

HBD:

- Does not require a bank loan.

- Is liquid on demand.

- Settles in 3 seconds.

- Is a substitute for USD itself.

- Pays 20% yields... twice as much as real-estate.

- Is sustainable even though people think it isn't.

- This is absurd across all metrics.

And if we are just looking at crypto in general (especially Bitcoin) all of them are basically superior to real-estate as a store of value.

- Bitcoin's yield is 100% on average every year since 2013.

- Yield was even better before 2013 (very volatile).

- Alts can give higher yields but at the cost of higher volatility/risk.

- Hive is oversold.

- Privacy coins are oversold.

- DEX tech is undervalued.

- AI coins will be the next degenerate scam.

- We've already suffered the standard 12 month bear market.

Of course this isn't to say that we wont suffer another non-standard bear market due to the flailing economy, but the result is the same: anyone who can HODL (and even buy more) during the bear market without becoming a distressed seller is going to see a guaranteed bigger return than anything the legacy economy has to offer. Including securities.

Hands down.

Bitcoin is pristine collateral and pristine property. Your Bitcoin is never going to have a leaky roof. Your Bitcoin is never going to have a cracked foundation. The same cannot be said (figuratively) about alts, which is why Bitcoin should always be a very significant part of every crypto portfolio no matter what. It took me years to learn this the hard way. Learn from the mistakes of the people that came before you and you'll do just fine.

Conclusion

It is guaranteed that crypto is going to displace real-estate as the world's top store of value (just like dropping a rock into a glass of water). On a percentage basis, the world is simply not ready for this to happen, but it is going to happen anyway. A vacuum is going to be created that sucks value away from home-owners and into the cryptosphere. There's really no doubt about it.

Be on the lookout for signs of this to come. This transference of wealth will no doubt be fueled by the greedy hedge funds that bought up all the property and drove prices up for everyone else. As they unwind those positions a lot of that value is going to find itself parked within Bitcoin. I specifically say Bitcoin here because it's pretty unlikely that any other asset will have the liquidity to accommodate such a transfer of wealth... as even Bitcoin doesn't have nearly enough volume to handle it either. No matter what happens: prepare for volatility. Always. This is crypto after all.

Posted Using LeoFinance Beta

Return from Real Disruption/Displacement: Real Estate vs Crypto to edicted's Web3 Blog