What is stability?

Is it the foundation of:

- a house?

- the economy?

- a family?

- a country?

- an activist group?

- a wildlife ecosystem?

- a currency?

- a guy riding a unicycle?

The definition of "stability" depends on context.

Stability is whatever we need it to be at the time. Balance is key in almost all aspects of life. Too much of a good thing can often lead to permanent reliance on that state of being. Weak men create hard times. Hard times create strong men. The cycle of life is endless and immortal, and the business cycle is an extension of this concept.

What is the most stable asset on Earth?

Unfortunately for now that would be USD. As much as we hate to admit it, everyone in the world knows what USD is and how to price goods and services in that denomination as a unit-of-account. Thus far no cryptocurrency has even come close to achieving this level of solidified foundation. In fact (as far as I can tell) no cryptocurrency is even attempting to achieve such stability. USD may currently have the stability market cornered, as all stable-coins simply opt to copy and piggyback off of the world reserve currency instead of inventing their own monetary policy.

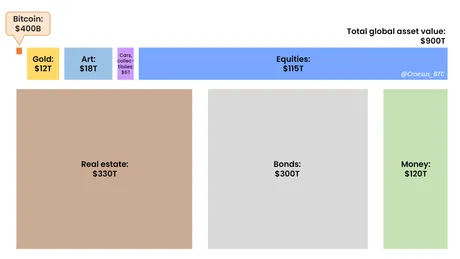

Many try to claim that crypto in general will become more stable with a higher market cap. Of course the logic being employed here barely makes sense at all. It will be more difficult for the value of crypto to fluctuate wildly because the market cap of the underlying asset is a higher percentage of global wealth? Hm, yeah... no. That doesn't track.

This logic only makes sense given the assumption that global wealth is static in nature; completely unchanging. It only makes sense if we assume that number will only go up if USD is pumped into the market. This is a foolish ideology to anyone that understands orderbooks.

If everyone in the world suddenly refuses to sell Bitcoin at the current price, the spot price will go up and the market cap will inflate without any USD being put into the market whatsoever. The only thing that matters is liquidity on the books. If that liquidity changes then the price will change. These values can change on the whims of whoever controls the untraded assets sitting on the books.

Imagine a new city gets built that only uses Bitcoin and the lightning network (or even Hive and HBD). Citizens get paid in Bitcoin. They pay for everything with Bitcoin. Value cycles in a mostly closed loop inside the city's borders with little need to trade BTC for USD. It's easy to see how the spot price of BTC could go up here without any USD being pumped into the market whatsoever. USD is no longer needed as much and thus not as many people want to trade their BTC for it. No one is selling; price-go-up. Not to mention all the value being built inside the city walls.

The simple truth of the matter has many overreaching implications.

It means that value within the cryptosphere doesn't need to come from the outside. We do not need USD. We do not need the legacy economy. We build our own value from within, which is the entire reason people on the outside want a piece of the action in the first place. Value is being developed "out of thin air". And by out of thin air I mean from the blood, sweat, and tears of everyone in the ecosystem working their ass off to make crypto a better place.

Think about it:

Is there the same amount of value in the world today as there was 100 years ago? What about 100 years before that? What about 100 years before that? Obviously value within the economy is created by builders creating utility. That utility is the value. The unit-of-account (USD) that we use to measure that value is often mistaken for the real value that other people built across a million different economic sectors.

Money doesn't have value if society doesn't have value. The value of money is a derivative of what one can extract from the money. Money by itself is completely worthless. Anyone would trade a million dollars for a loaf of bread if they were starving to death on a deserted island. The million dollars is only worth one loaf of bread because that is the only thing it can be traded for.

So imagine how ridiculous it is to hear someone talk about Bitcoin becoming more stable just because it gets a bigger market cap. Are you telling me the value that Bitcoin creates from within is reaching a logarithmic asymptotic soft-cap? It's so obvious not though. If a hundred years of innovation have taught us anything it's that tech has a habit of breaking through those glass ceilings that tend to slap down other more physical markets that have physical limitations. Crypto has no limit.

These people (maximalists) believe that Bitcoin is going to be used for everything and gobble up every last bit of value from the legacy system (which is inherently centralized and scarcity-based rational). Then, after fiat is dead, Bitcoin is going to give a voice to the voiceless. Bitcoin is doing to allow every person on Earth to provide their maximum value to society unhindered by the previously corrupt economic system. Oh yeah... and it's also going to be stable the entire time that it upends the entire planet.

Seriously... What?

It's moronic logic.

Okay so let me get this straight...

Bitcoin is to absorb this entire system... a quadrillion dollars worth of wealth... then it's going to continue on creating its own value out of thin air... and it's going to maintain stability... within a deflationary environment. I seriously. I just can't. It's so stupid. They can't be serious! And yet they are 100% serious.

Delusional to the core, those maximalists.

Living in some fantasy realm where they're the smartest group of people on the planet and Bitcoin will become the Utopian centralized arbiter of everything, and it's totally gonna be decentralized too! But only Bitcoin, you see! lol. I can't. I'm dead.

💀

It's quite obvious from the last 2000+ years of economic history that no matter how hard we try the business cycle will always exist. There will ALWAYS be booms and busts. We can try to add elasticity to our economics to lighten the boom/bust cycle, but we will never eliminate it. We can only make the waves smaller, if anything. Believe me when I say that not a single cryptocurrency in the world is even attempting to solve this problem. As long as USD "works as intended" there is absolutely no reason to reinvent the wheel.

"Working as intended"

The other day someone asked me what happens to HBD if USD no longer exists or becomes completely unstable and volatile. To answer this question we must ask ourselves what the definition of stability is within the given context. We must understand how pegging HBD to USD through the oracle system of price feeds is much different than actually holding USD.

The ideal state of USD is a 2% inflation-rate target.

Clearly we are nowhere near that, which is why the FED is so aggressively hawkish these days. They are playing the politics game within an environment they have no control over but pretend like they do. Business as usual.

So what if inflation was actually 20%?

This is called 'galloping inflation'. It's a lot better than hyperinflation, but still pretty bad. Notice how if you hold USD during this period of time for 1 year then the value of it goes down 20%. But what if you held it as HBD within the savings account? HBD offers 20% yield. The 20% yield would completely offset the 20% galloping inflation and HBD would then become the most stable asset in the world.

With this logic in mind we can see that the definition of 'stability' required for the HBD peg is different than we would normally assume. Stability in this case is simply USD losing value at a consistent pace. If USD was losing 48% of its value a year, the HBD peg would totally be fine as long as USD was CONSISTENTLY losing 4% a month. All we'd have to do is jack up the savings account yield to 48% (or even extend this yield to all HBD in existence).

The problem would be if this loss of value was completely unpredictable in nature. For example, if USD was down 30% one month and then up 15% the next month and then down 20% the month after that... this would be a completely unacceptable scenario. At that point we might have to look for another asset to peg HBD to.

Perhaps by that time another asset in the world would be definitively more stable than USD and the decision would be an easy one. We could even consider our own economic policy and try to maintain some semblance of stability without a peg. Best to let some other network figure out a template for this equation first though. I don't want to be the guinea pig. Do you?

Conclusion

Stability and predictability are a key foundation of any economy. Maximalists think Bitcoin is stable because the inflation rate is predictable. As we can see from 2000 years of economic history, predictability and stability are not always the same thing. Stability requires elasticity, and Bitcoin will never have that.

Crypto has a lot of work to do before it can even imagine competing with the stability of fiat. Until then we piggyback off the old system until the old system fails us and we're forced to react to that happenstance. No sense in reinventing the wheel until the axle breaks. It would be nice to hit the ground running given such failure, but I doubt that will happen. No soft-landings for us.

Either way HBD is in a good position. The peg is enforced by oracles and the price feed. Our ability to allocate an interest rate to it can counteract all the inflation that comes our way. It is possible that one day HBD becomes a more stable and trusted asset than all fiat currencies on the planet. Obviously a lot of work needs to be done and many markets need to be made, but the future is looking good for Hive.

Posted Using LeoFinance Beta

Return from Redefining Stability to edicted's Web3 Blog