Market sentiment in crypto shifts with the wind.

One day everything is looking bullish and the next... not so much.

I've recently gone on record telling everyone to defend the 44.4 cent level on Hive. It looked like we could hold support at the 200 day moving average. However, after a few rounds of FUD and a 5% Bitcoin dip later, this was not the case. Still, Hive is at 43.5 cents, which is only a 2% loss if we capitulate here and hope for a lower price. I believe that lower price has a good chance of coming now and I'm targeting the 35 cent area with this prediction. I expect that another 20% dip is on the table for sure. I give it at least a 30% chance.

It's really in the greater market's hands at this point.

Bitcoin's volume has dropped off a cliff and continues to struggle in this new lower range. The pattern playing out before me is a textbook head-and-shoulders pattern. There's a CME futures at $20k in addition to $20k being a seriously significant confirmation support. I've been talking about this gap since we spiked up to $21k in mid January. Won't be surprised if that plays out as expected. The market is trading scared once again.

FUD!

A lot of the FUD is coming from the regulators. I hear lots of rumors of a coordinated attack against crypto. Banks cutting off access and whatnot. On/Off ramps under threat. The biggest piece of news was the SEC and Gary Gensler slapping the crypto banks telling them it was illegal for them to stake user funds as a service, with Kraken getting slapped by a $30M fine.

This is kind of ironic considering it is bullish that centralized agents are not allowed to stake client money. We don't want exchanges to have that kind of power, especially on Hive. The speculators don't care about any of that, and they just dump instinctively. It's truly a sight to behold.

Gary Gensler even said things on camera like "not your keys not your crypto"; a surreal experience to be sure (and his Twitter presence and production value is surprisingly professional). I know he's a snake in the grass but every time he speaks and justifies his actions (and the actions of the SEC) he seems perfectly reasonable. Again, how can someone so boring and methodical be such a threat? I have to conclude that in the long run he's doing us a favor. Buy the dip, as they say.

"Gary Gensler: Not your keys not your coins" was not on my bingo card

Hive finds itself to be in an interesting predicament.

We are currently wedged between the MA(200) and the MA(25). The breakout likely depends on what Bitcoin does... and what Bitcoin does largely depends on what the stock market does. It's like a double nested derivative.

The CPI report comes out on Valentine's Day the 14th. Safe to say that if "inflation" is lower than expected the markets should react positively, and vice versa. The FED has signaled that there may be "multiple" 25 point rate hikes in the months to come, but I interpret "multiple" to mean "two", which actually puts the FED fund rate at the exact level they said they were gonna put it over six months ago. You really have to wonder if this is all just a well-rehearsed dance they have choreographed in advance. Insider traders gonna insider trade.

With both the MA(50) and the MA(100) right around 35 cents, this is the target I'm aiming for. With the high potential of HBD spiking in combination with the chance for further dipping, I've set my buy orders around there on the internal market, priced in HBD bids for Hive. I'd really like to go full degen and just buy now, but the money I am gambling with was supposed to pay my bills for a couple months. So I guess I'm only half degen at the moment. Baby steps.

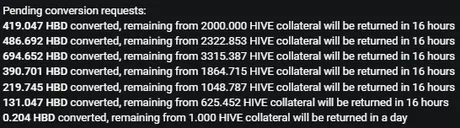

My Hive collateral will be unlocked in 16 hours from my HBD conversions 3 days ago. Looks like I'm in the green and will make a little bit of money. Not sure exactly how much, but at best it's gonna be something like 700 Hive. Not too bad. Can't complain, although I am slightly disappointed because I really thought Hive was going to spike from the MA(200) baseline and I'd be in the green a lot more. I may or may not sell that profit back into HBD just in case we get an HBD pump or a Hive dip (or both). Again, that 0.35 HIVE/HBD ratio is looking pretty good right about now on the internal market.

It is a bit busy to be looking at four moving averages, but when it comes to trying to figure out Hive I find that the 25, 50, 100, and 200 day moving averages all have a story to tell. Out of these four lines, the MA(50) seems the be the least useful, especially when it comes to golden/death crosses. In fact we can see that price actually crashed right after the golden cross between MA(25) going above MA(50). What price did it crash to? Exactly to the MA(100). This signaled a very good buying opportunity as the angle of the MA(25) pretty much guaranteed another golden cross over the MA(100) around 10 days later.

So anyone who bought at the MA(100) after the dip would have liked to see the price go to the green line at MA(200). It got close but not quite so it would have been hard to sell before it crashed, especially considering that pump on Jan 17th where the price pumped and dumped to that exact level in a single wick/day.

And thus the price proceeded to crash from that missed selling opportunity back down very close to the MA(25) as it golden crossed above the MA(100). We all saw what happened after that.

That massive pump was pretty exciting, was it not?

Of course when these things happen we know they have a 90% chance of crashing back into the dirt, so I tried to rally everyone into defending the MA(200). No dice, that support was cracked from the Bitcoin dip. Too bad so sad. But still the position that we are in isn't too terrible considering the circumstances. You never know... maybe that CPI report will be shockingly good and everything gets pumped up again.

Conclusion

With volume this low I'm going to be shocked if Bitcoin doesn't dip lower. When Bitcoin moves up on gutter volume like this it's usually a sign that there are zero sellers left and we're about so see some kind of crazy pump. I'd give that ten to one odds of happening. Makes a lot more sense if we just complete the head-and-shoulders, return to $20k and fill the futures gap to fill the liquidity void, and wake up the bulls to buy low. If Bitcoin dips 10%, unfortunately I expect Hive to dip 10%-20% as well. Brace yourselves.

Of course I do have a tendency to be wrong about these things, so there is that. Inverse @edicted strong. Also the market is running scared after a 5% dip as everyone gets PTSD from the FTX contagion flashbacks. The regulatory FUD could be a big nothing burger and this bull trap can continue on into summer. Of course I still maintain that a support confirmation at $20k is still a bullish pathway, and the time extension that a dip gives us actually makes sense when combined with a summertime run. Obviously it's all conjecture, but it's fun to try.

Posted Using LeoFinance Beta

Return from Refactoring Market Sentiment to edicted's Web3 Blog