As predicted:

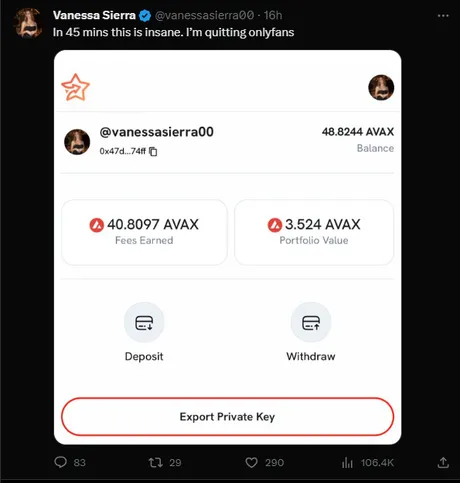

Stars Arena is blowing up and getting a huge amount of attention on Twitter. Why? Because anyone can sign up and immediately get free money. This is especially true for any account that has a lot of followers on Twitter because the platform is intrinsically linked to Twitter. In fact this is currently the only way to sign up as far as I know.

Crypto Twitter users that are also AVAX supporters end up getting a ton of speculation and trading volume on their token, generating massive hype during this opening phase of the platform.

I have... so many things to say!

First off let's address the last two Tweets in the list. If you're looking for an alt to go long on AVAX probably is a good bet. All of the TVL for Tickets exists as the AVAX token, which is quite nice because AVAX is the native gas token for the entire network. Normally we'd see some kind of new shitcoin pop up that fills this artificial niche, but not with this new and "exciting" model. Of course I think both Friend.Tech and Stars Arena are talking about airdrops going forward, which does mean that such a shitcoin is on the horizon... I'm just not sure what utility it would have. Governance maybe?

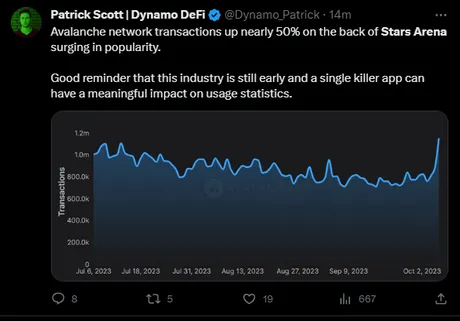

Speaking of TVL

Crypto users (especially DEFI) make a big deal about Total Locked Value. This metric is considered a good way to measure success of a platform. After all: more TVL means more liquidity and more liquidity is gooder.

Let me be one of the few to say that TVL is an ABYSMAL metric for measuring success. It's even worse than Market Cap itself, which is also extremely flawed. Want to know why so many people focus on TVL? Because it's a big number and it tricks the human mind into thinking, "Wow, big number good." That's legit the only reason.

TVL is always going to be bigger than market cap because market cap is a subset of TVL in many cases. For example during DEFI 2020 all the tokens were earning absurd yields. In order to get these yields they had to either be locked in an LP or locked in a single-staking pool. Either way they were locked and counted as TVL. There was ZERO incentive for any defi token to exist outside TLV because there were no timelocks and thus "locking" tokens within a single staking pool incurred zero risk (no 'impermanent loss possible') and could be removed at any time.

Then DEFI tokens had the "brilliant" idea of allocating a massive amount of emissions to liquidity pools that did not benefit the ecosystem. Pools like BTC/ETH or BTC/USDT. This was a one-trick pony that only worked for the very first DEFI tokens. These pools lured liquidity away from BTC and ETH holders, got in their heads, got them excited, and tricked them into buying into the bigger risker pools (IE the ones paired to the actual DEFI token). This strategy was copied by subsequent DEFI tokens because of survivorship bias. It was thought that by copying the token before them they'd also be successful. They were wrong. It was a terrible terrible short-term unsustainable strategy.

Once we put TVL into the proper context, it's easy to see that a high TVL can actually be a REALLY BAD SIGN. And yet no one interprets them this way. 99%+ of crypto users think high TVL is a good thing. It is not. At least it's not when the incentives in play are totally unsustainable and the mechanics imposed on the network are short-term cash grabs at best and outright scams and rugpulls at worst.

Origin story

I like Coop and have been following him for a while. He's super into both WEB3 and gaming and is a strong AVAX supporter. He's also just a very hardcore WEB2 gamer (if there is such a thing: you know what I mean). In any case over the last few days he's made over $1000 worth of AVAX simply by existing on Stars Arena.

He didn't premine his own tokens or anything; mostly just 'organic' speculation on a new platform with a lot of hype. He's done very well so far because of how active he is on both AVAX and Twitter. In fact it would be foolish for anyone in his position to not engage with Stars Arena. It's literally just free money sitting there waiting to be picked up like any other airdrop.

Coop and I have had a few interactions and he seems receptive to the things I say (or at least very polite about it). Surprisingly he even knows about Splinterlands, which I view as a pretty good sign that we are doing it right if someone can know about Splinterlands but not really know about Hive. Hive falling into the background is likely where we want to be. Let the frontends market the operating system. It is known.

LoL yes... "pretty wild" indeed!

Pretty wild that people on Twitter are acting like protocols like Friend.Tech and Stars Arena have been around for years and have proven themselves to be sustainable platforms. Even the most seasoned of crypto veterans fall into this same comical cycle of believing a platform like Stars Arena is magically more popular than Twitter after being in operation for less than a week. Just kind of mindblowing honestly. We can count on users to make this same mistake over and over again. In fact this literally just happened with Friend.Tech a month ago. Notice how nobody from Friend.Tech talks like this even a month later? Duh!

But what does any of this have to do with reflection tokens or DESO?

Actually I guess we are calling it SocialFi or SOFI now? Whatever. Semantics.

14 hours ago I realized something about this up and coming tech stack. Protocols such as Stars Arena are actually just repackaged reflection tokens back from the DEFI 2020 craze. Remember reflection tokens? Yeah, me neither because they all failed instantly.

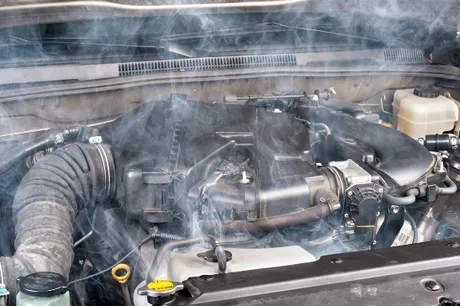

Whereas most cryptocurrencies are designed to be as frictionless to the user as technically possible, reflection tokens spin off in the opposite direction, charging users massive fees to make basic transactions. This strategy can create an insane amount of hype and huge pump at the start of the project, but is always doomed to seize the engine of commerce and fade into oblivion after only a short time.

I intrinsically knew this when I first started my research on Friend.Tech and labeled it a gross abomination doomed to failure, but I didn't actually realize how I was able to make this assessment so quickly and easily at first glance. It's because we already saw it happen during DEFI 2020 during wave after wave of worthless tokens crashing to zero.

In fact, this SOFI business model is even worse than regular reflection

So it is clearly a misnomer to even call it Reflection 2.0. While it is clearly an evolution of DEFI into SOFI, it's an obvious devolution in terms of actual economics. Why? Because reflection tokens at least siphon the lion's share of rewards back into the hodler's pockets.

Meanwhile protocols like Stars Arena only give users a tiny slice of the pie while the lions share of the rewards are funneled into the centralized pockets of the entity hosting the service. This is a recipe for disaster in which the house always wins and doesn't even have a chance of losing like an actual casino would.

And yet the model would be a lot more viable with some small changes.

This unsustainable business practice can make a lot more changes toward sustainability. Will it ever become actually sustainable and a circular economy? I doubt it, but I won't discount the possibility.

For starters, obviously most of the rewards should go to the users themselves. It is the users who are building all the value and creating a brand, and a centralized vampire is sucking up that value for themselves at an obscene rate. We can expect that as new clones of this tech launch more and more money will be passed down to the user to compete with the older platforms.

It's also ridiculous that users have zero options in terms of how they choose to run their business and brand. In order to get access to content or chatrooms behind the paywall someone must own 1 share/key/ticket of that particular user. Well... what happens when a ticket for a popular account costs over $1000 and that user doesn't want consumers to be forced to pay $1000 just to get behind the paywall? It's painfully obvious that the user should get to determine the height of a paywall, and yet this feature does not exist. Expect this option in future iterations.

Also the type of content users can generate behind the paywall may be lacking. There's a lot of room to build out more infrastructure here and create some really interesting mechanics, especially on a gaming chain like Avalanche.

For example, imagine a new game gets launched on AVAX and the devs incorporated Stars Arena social media into their product. Imagine players could create skins in the game and then put those skins behind SA the paywall. Want to use that particular skin? Well you need to own x amount of tickets from y user (the owner of the skin). A feature like this would be amazing and exactly the kind of thing I've been talking about for years on Hive.

It's quite ingenious how this model works, because it completely circumvents securities law.

How does it do this?

- An investment of money,

- In a common enterprise,

- With the expectation of profit,

- To be derived by others.

This is the Howey Test, a metric from the 1930's to test if something is a security or not. Unlike most tests this is one you don't want to pass, otherwise the SEC has jurisdiction over the asset you created.

SOFI reflection tokens fail every single one of these tests except for the "investment of money" bit. It is not a common enterprise to be derived by others because the entity shilling the token and building value for it is actually the end-user, not the development team. The expectation of profit test is also hacked by the smokescreen of 'utility' by implementing the paywall and giving users access to a product even though most of them are simply degen gambling within the shitcoin casino. Number go up.

How should Hive react to this development?

It is going to be VERY FRUSTRATING to watch all these completely unsustainable pieces of trash rise and fall while Hive is just sitting there sidelined wondering why people are so 'stupid' and not flocking to our network when the literal narrative for the bull run is SOFI.

Yes, well... new accounts can't come to Hive and get paid $1000 within the first few days now can they? We have to be patient and understand what is actually happening here.

No matter how hard we try:

Shilling Hive within a tidal wave of completely unsustainable pump and dumps is simply not going to work. I was earning pennies per post for over a year on this network before I actually started making significant rewards. Even if we get someone to check out the platform they're going to leave within a week when there are all these other options out there paying out money instantly. This is what people gravitate towards: instant gratification. We can't change human nature.

What we can do is keep building and position ourselves well during the fallout of these networks. I highly doubt protocols like Friend.Tech & Stars Arena will even survive another year, let alone into the bear market. The next bear market will annihilate any and all reflection tokens that exist within the ecosystem if they somehow even make it to that point. The math isn't mathin any other way.

That means there will be a lot of people that potentially know that SOFI is important but also disillusioned by their recent experience. The only advice we should give people who participate in SOFI reflection tokens is to extract as much value as they can without taking any risk. Meaning they shouldn't be speculating on the tickets or keys from other users. Only reason to buy a ticket is to get behind the paywall, and even that is a stretch in the vast majority of instances.

Conclusion

I often talk about the narrative for the last bull run being DEFI and yield farming, but what I don't often mention is that NFTs were also a huge part of the narrative. How many narratives will we get during the next bull run? I don't know, but I am pretty sure these SOFI reflection networks are one of them. They are simply too addictive to not generate the kind of hype we'd expect.

All we can do is ride the wave and try to pick up the pieces after greed has cannibalized itself once again. I think Threadcasts on LEO may help us in this regard. I participated in a WEB3 Twitter Space last night that was thread-casted and @l337m45732 (0xNifty) was on the mic talking about the importance of owning one's account and positing what would happen if Twitter just disappeared. There seemed to be some receptiveness to the idea. Baby steps.

Return from Reflection Tokens 2.0 to edicted's Web3 Blog