For those of us who are old enough to remember or care:

Operation Shock & Awe was the military strategy employed by the United States Government during the invasion of Iraq. Although it wasn't really much of a strategy at all. They might as well of called it a Blitzkrieg, but that probably would have sounded a bit too Nazi-ish for their delicate sensibilities.

The goal of both strategies is to strike hard and fast, overpowering the enemy quickly and demoralizing the ones who have not been overrun by the current onslaught. Of course when you're the USA and your opponent is a third-world country... it's pretty easy to get the desired results without risking an overextension and possible counter-attack.

There are a few parallels to be made here.

Operation Shock and Awe was initiated under false pretenses. The USG purposefully fed the public lies about "weapons of mass destruction" and the obvious need to "spread democracy" to the 'backwards barbarian' nation of Iraq. Saddam bad. America good. Simple.

Of course the actual geo-politics of these situations are never simple, and a lot of the previously gullible children (high-school graduates) we sent into the country often found themselves stationed guarding an oil field. Go figure.

The war against crypto is also fought under false pretenses.

There were a lot of major escalations going on today right after Powell announced that the FED would not back down and continued to raise rates by 25 basis points. Coinbase has been issued a Wells Notice. Banks are refusing to send money to exchanges.

Even the government itself has publicly stated that crypto is basically worthless and should be avoided like the plague. They are pulling out all the stops in the middle of this crisis. The ladders to the lifeboats are being destroyed. Get to work and bail out the Titanic, peasants.

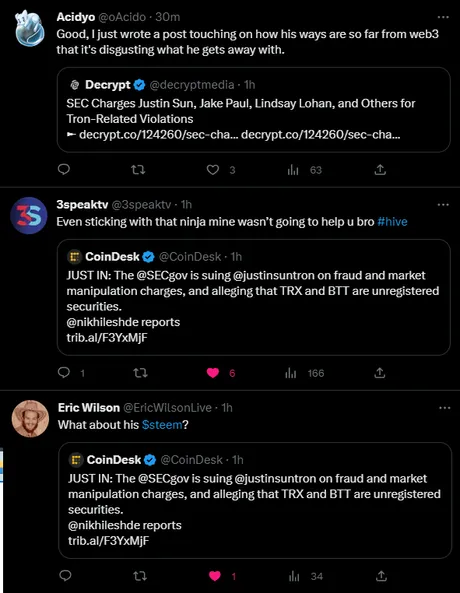

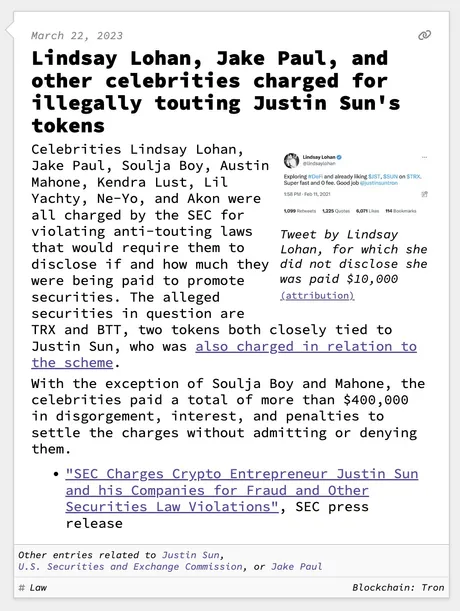

Oh yeah... and Justin Sun is being sued too.

Along with all the other shills he paid to promote Tron and Bittorrent token.

These accusations are actually all above board.

It's perfectly in line with the research I did weeks ago within the context of being sued for financial advice. When you are shilling a token like this you must declare how much you were paid or face the consequences. Oops. Looks like the $12k they were paid isn't going to make up for the $400k fine. Too bad they aren't a bank otherwise the fine would be less than the amount of money they made, amirite?

25 Points Later

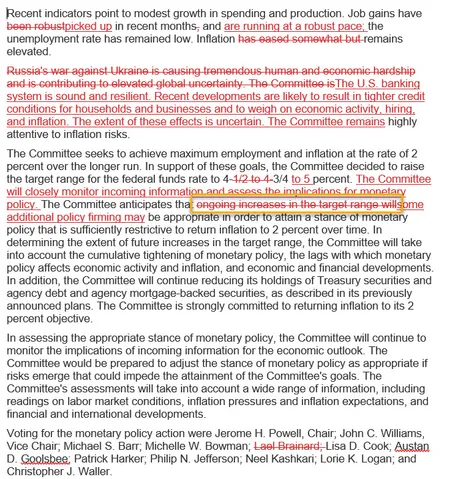

So Powell raised rates 25 points today, but one very noteworthy redline stood out above the rest:

ongoing increases in the target range

willbe appropriate

changed to

some additional policy firming

maybe appropriate

This distinction is being interpreted by many as an obvious sign that hikes will end soon. I'm guessing by the next meeting on May 3rd that the pause will start immediately or (more likely) the very last 25 point hike will go through and they will announce a pause after it. It's almost like they planned all this in advance and they were gonna do what they were gonna do no matter how bad the situation was. No matter though because it doesn't matter if there is a hike + pause or just a pause, both those forks lead to the same outcome: the market getting FOMO over the FED's fabled "pivot".

Interestingly enough the Full Moon will come on May 5th and the New Moon on May 19th, giving the crystals girls something to celebrate in anticipation of number going up. Coincidentally enough, mid May is right around the time I've been thinking I need to start taking gains if we are indeed repeating a 2019 bull market situation on the 4 year cycle.

Of course none of this would be complete if someone didn't bring up Matt Damon and his "Fortune Favors the Bold" crypto ad campaign. "Wen Matt Damon jail!?!?" they exclaim.

Seriously I didn't realize the law so baffled people who consider themselves intellectuals. Matt Damon didn't break the law. Lawyers signed off on everything. He declared how much money he made. Funny how people suddenly think that shilling crypto is illegal no matter what the circumstances are. Kind of embarrassing actually. Everyone's an "expert" these days; On every topic of discussion without fail.

https://www.coinbase.com/blog/we-asked-the-sec-for-reasonable-crypto-rules-for-americans-we-got-legal

After being served their Wells Notice, Brian Armstrong went on quite the rant and basically claims he's ready to absolutely destroy the SEC in court. I think it's pretty obvious they have an even better case than Ripple, as Coinbase has done nothing but bend over backwards for the regulators since day one. It's all documented and will be a damning indictment against regulatory overreach. Good times.

Conclusion

Justin Sun is being sued by the SEC and it's kind of hilarious. Too bad there's no mention of Steemit in there. Hive community gets ignored once again. Business as usual.

Bitcoin will likely reconfirm support at $25k over the next few weeks. That's what I'm hoping for anyway. The 25 point increase is not nearly as hawkish when we look at the redline revisions that go from WILL HAPPEN to MAY BE APPROPRIATE. I'm guessing the FED will pause in May, which is exactly when I've been expecting the market to peak (or at least be high enough to justify taking a tiny bit off the table just in case).

USG continues the crusade against crypto under false pretenses, in the middle of a banking crisis that in all likelihood can and will get worse. The onramps to crypto are being purposefully blocked by overzealous regulators. We very much need to question their motives right now considering how many "coincidences" are being stacked on top of one another at this juncture.

Will this Blitzkrieg cripple crypto like it was designed to? It's very much looking like not. I'm guessing these vipers are going to be sorely disappointed when Bitcoin doesn't crash into the mountain like they hope. Or maybe this is all part of the plan to scare people away while cronies secretly fill up their bags. Who knows.

Posted Using LeoFinance Beta

Return from Regulatory Operation Shock & Awe to edicted's Web3 Blog