The boring phase of crypto is officially over.

The volatility coming over the next few months is going to knock a lot of traders on their ass, and I would like to capitalize on that. It's been a very long time since I've gambled on the markets, and I'd like to get a win during this period (or maybe just break even). This might be a lot to ask considering my track record, but if there's one thing about professional gambling (poker) it's that being afraid is a stupendous way to completely undermine yourself. It's an attitude that almost guarantees failure.

Back in olden days when I was first learning to play poker I definitely tended to play scared. I was known as what they call a Weak/Tight player. I folded a LOT of hands. I got bluffed often and rarely (if ever) performed bluffs myself even in limit games where the success rate only needs to be 1:4 win:loss ratio to maintain profitability.

The reason I played this way is because I HATED volatility (that and I had a small bankroll). I couldn't stand losing a lot of money all at once and digging myself into a hole that seemed insurmountable to climb out. Getting into a position like that just put me on tilt and made me play even worse, so I tried to avoid it at all costs. This created a lot of situations that resulted in missed opportunities. These opportunity costs pushed down my EV (estimated value) quite a bit.

As I improved my game I learned to get a bit more aggressive. So I still folded a ton of hands preflop but once I committed to a pot I was much more likely to stick with it and try to edge out more wins. Luckily limit poker fell out of favor and it was all about no-limit from there on out. This was great for me because it heavily favored my particular playstyle and allowed me to punish the noobs and action junkies calling every hand.

- Tight/Passive (weak/tight)

- Tight/Aggressive

- Loose/Passive

- Loose/Aggressive

Standard advice dictates that the best players are tight/aggressive. Although once you start playing at higher stakes your opponents can wise up to that and put you on a hand much easier so sometimes you have to loosen your openers to shake things up.

Definitely the worst way to play in all situations is loose/passive. Those guys lose a ton of money and always give away their hand when they actually start betting. Loose/Aggressive players lose a ton of money as well, but they are terrifying and will often bully people and go all in with nothing to push people off their hand. These people are action junkies and love the huge pots and high stakes atmosphere. It can be pretty demoralizing to get unlucky against those guys, but on the flipside are cash cows given enough hands played.

Perhaps I've done the poker angle for too long.

My experience with the crypto markets tells me that Q4 is definitely the best time of year to get back into the game, so I am. Q4 2021 marked the peak of the bull market, and Q4 2022 marked the bottom of the bear market. This upcoming Q4 could go either way, but I'm definitely betting on up for a couple of different reasons. Even if I'm wrong I think there will be signs to this effect and I can bow out relatively unscathed.

Uptober.

October is usually a pretty low risk month that somewhat points in the direction of where the market is going. If price is down or sideways in October there's a pretty damn good chance that Q4 is not going to yield any kind of positive result. Given current spot prices that means I'm expecting BTC to be trading at least above $30k by the end of the month. Anything above $28k is fine, as that's where the long moving averages rest. On the flip side if we were grinding at $25k at the end of the month I would certainly bail. Considering that's only an 11% range I can contain my bets in a very low risk environment with stop-losses.

MA(50)

The fifty day moving average is about to golden cross with the MA(25). This is a largely meaningless move a lot of the time but my experience with the MA(50) is pretty weird so I'll make a small bet on it. Basically a lot of the crosses with the MA(50) are total psych-outs. A golden cross is supposed to be bullish, but golden crosses on the MA(50) often result in weird poop-and-scoops; flash crashes into immediate pumps. This cross is coming to both BTC and Hive within 2 days, so I'm waiting for a dump before shoving in my stack.

This also seems to line up with a potential government shutdown, which the markets seem to be showing little to no respect. It's hard to imagine markets reacting positively to a potential government shutdown tomorrow. Of course these things are often such puppet shows maybe people are just over it. Guess we'll see.

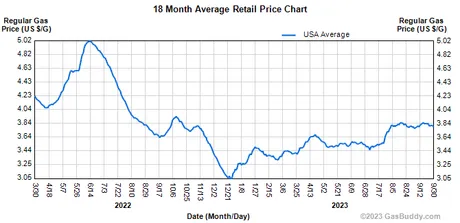

Petrol

I see all these reports about inflation being out of control but I don't remember it the way they do. They say things like gas prices being up 40% over the last year. Yeah I don't know about you but in summer 2022 gas pretty much followed the national average: $5. Gas is the EXACT same price now as it was a year ago.

Also petrol has WILD supply and demand swings every single year. Gasoline is in very high demand in the summer and much lower demand in winter. After Christmas and the New Year demand drops off a cliff. The fact that the peak summer price this year was less than $4 is pretty significant. It's only going to go down from here for six months straight. Or more accurately: we can see that the bottom last year was basically Christmas 2022. I expect to see the same pattern play out: at least a 20% price reduction over the next 3 months.

Some economists think that the price of oil is inversely correlated to the markets (just like DXY) so a low price of gas is good for the market. I don't know enough to agree or disagree with this, but it fits the narrative I'm building so I'll just roll with it.

Leverage and Margin trading

Now that I've been forced off of Mandala and Biannce Cloud liquidity pools I've been tinkering with MEXC exchange. Unlike Mandala, this exchange provides margin trading options. The last time I messed with leverage was May 2022 and I got wrecked going long at $30k. Looking to get set up some positions that are much less safer than the ones I set up last time.

The level of maniacal gambling one can engage with on centralized exchanges is a thing of legend. MEXC offers up to x125 margin trading, which means if you max bet and go long you'll lose everything if the spot price drops less than even 1%. Wild. Personally I'm looking at something more like an x2 long because the liquidation level would be a 50% drop in price. Personally I don't think this is possible even if the legacy economy is in piss poor condition. At least the chance is low enough to risk it (less than 1%).

Doubling Curve Trendline

Bitcoin's exponential trendline is absolutely towering above the current spot price at $86k (2^9.75 x 100). The last time we traded at the trendline was May 2022. I made a bet that the line would hold, and I get pretty wrecked. Lesson learned.

Considering that BTC has never been in a legacy bear market or recession, it stands to reason that perhaps when legacy liquidity is poor this trendline acts as a resistance, while it only acts as a support when the legacy market is bullish.

It's also important to note that many traders believe we could easily crash back down to local FTX lows at $16k. I think this is a complete fallacy. The reason? Time. It's obvious that Bitcoin is still growing in value exponentially over time. Is a 100% gain on average (the current trendline) too high? It could be. But even if it was 50% this would still be exponential (1.5^x instead of 2^x).

In my opinion we have absolutely no reason to believe that the doubling trendline needs to be retired. Such a thing can only happen after a full 4-year cycle has been completed, and it's only been 16 months from the last time we were at the 'curve' (linear on the log scale).

If we look at the graph, we can easily see that Bitcoin's price is almost exactly the same distance away from the trendline now as it was during the FTX fallout. I believe BTCs price is just as bottomed out now as it was back then, and we have simply been following the trendline x3 below (which is basically the opposite of a bull market peak; x3 above).

If I'm right, this means that BTC is comically oversold and the idea that it can easily crash from here is false. Considering the market flash-crashed to $25k and immediately pumped out of it on 9/11 reinforces this concept. There are simply too many buyers of last resort at this level especially with Blackrock lingering in the background.

Halving event hype.

If November ends up being bullish I believe the momentum of such a run can last into January. Not only could a spot ETF be approved in January, but also the halving event will only be 3 months away. All these events on top of bullish FOMO could easily create an extremely intense SELL THE NEWS event. If everything goes to plan this is where my gamble ends and I will unwind all my long positions and cash out.

I think best case scenario if this ends up being a win for me I should make enough money to basically pay my bills for an entire year. This would allow me to continue grinding on Hive without having to sell tokens, which ultimately is the goal. I really hate selling Hive. It's so cringe. Ew. Hard pass.

Conclusion

Looking for an entry point within the next couple of days.

Q4 is here and hopefully it will not disappoint.

I'll try to keep the speculation posts to a minimum,

but also will give at least one update per month.

Return from Remember Remember Goodbye September to edicted's Web3 Blog