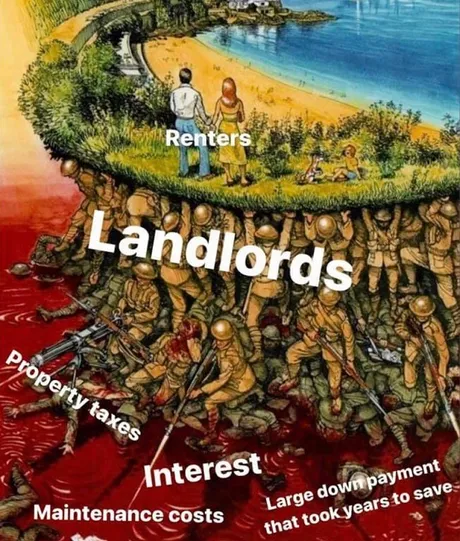

I saw this meme on Twitter and I just couldn't ignore it.

Some people would see this and immediately knee-jerk react to it as if it wasn't true. Perhaps @scaredycatguide could come in and give us his take on the matter. He is a real-estate guy after all.

My personal experience with this topic is likely similar to many others.

For my entire adult life (and some of my childhood as well) I was always told that buying property is better than renting it. After all, when you rent property: poof the money is gone and you have nothing to show for it. However, if you buy property you're creating equity in an asset that you actually own. Clearly buying is always better than renting, right? This is the narrative I've been hearing my entire life.

Very few people actually do the math on this.

I'm a bit of a scrapper myself and even though I've lived on the West Coast for most of my life (high cost of living) my rent has been between $400-$500 for the last twenty years. I've always had roommates or a girlfriend to split the costs.

I've never lived alone, and honestly I don't know if I'd ever want to considering certain agoraphobic and addictive traits that seem to set in when I'm left to my own devices. Have you ever smoked pot and played video games for 16 hours a day, months at a time? Yeah, me neither. Totally.

So assuming an average rent of $450 per month (which is probably high) over twenty years yesterday I calculated that to be $108k in rent I've paid over two decades. Wow! $108k down the toilet and nothing to show for it! What a fool I've been, I thought, as I calculated this number and came up with six figures gone that I can never get back.

Time to do the other side of the equation.

Okay so I've lived in California for most of my life. I did a few Google searches yesterday and found out that property tax in Pennsylvania is around 1.5% while California is closer to half that at 0.75%... OUCH! Does this mean that CA is a better deal than PA? Actually it's a bit of a wash because property is way more expensive in CA than PA. In PA I could easily buy a house for $250k, while that same type of house might cost $500k or more in CA.

In both of those cases property tax is $3750 a year.

- Are we seeing the problem here?

- $3750 a year is $312.50 a month.

- I was only paying $450 a month total rent in the other scenario.

- That $312.50 a month is only property tax.

- It does not include all the other things we need to worry about.

- Overhead opportunity cost of down payment.

- Loans & interest rates.

- Maintenance costs.

OMFG THE MATHS!

Remember in high school when you learned about the magic of compound interest rates? Well they are only magical if those ROIs are being paid out to you. When you take a loan from the bank and they are sucking you dry it's a bit of a different story, isn't it?

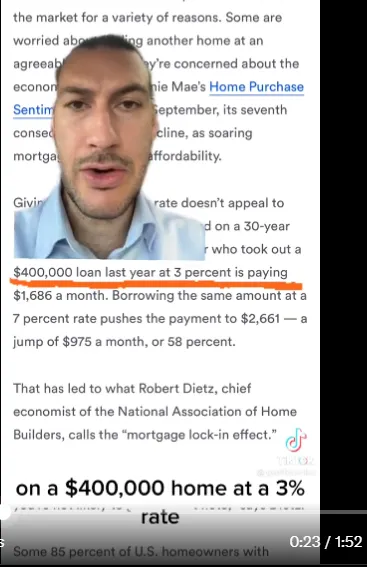

Seriously look at how insane that is:

- A $400k loan at 3% interest is $1686 a month.

- After 30 years this comes out to $607k total.

- A $400k loan at 7% interest is $2661 a month.

- After 30 years this comes out to $958k.

WOW WHAT AN AMAZING DEAL

So after 30 years you pay the bank $958k for a property that was worth $400k when you bought it. After 30 years we would obviously hope that the $400k house we bought was worth around a million dollars or more, but again there are no guarantees. It's a gamble, albeit real estate is considered to be one of the safest gambles and stores of value out there in the legacy economy.

If the property accrues a +10% value every year then after 30 years it would be worth $7M. Obviously in this case the investment becomes a bit more worth it... except then the process starts all over again when someone else has to buy the property from you for $7M using a loan from the the bank.

Getting back to the real point

The interest rate on the loan makes a HUGE difference in the long run. That TikTok video shows how just a 4% increase on interest rates jacks up the monthly cost by 58%. And that's just money going straight into the banker's pocket. Insanity!

One thing that this real estate TikTokker isn't taking into consideration is that he is assuming that everyone who sells their house needs to buy a new house (presumably at these higher rates). That is wholly inaccurate. I've already stated why I think hedge funds will start unloading their property.

Property is a cramped hedge and not a very good investment anymore, especially when compared to Bitcoin. Hedge funds will eventually unwind these ridiculous illiquid positions and find something better. At the same time homeowners may realize what I'm realizing as well: buying property is a pain in the ass. I expect a lot of these people are just going to sell and start renting again, or perhaps just sell vacation homes or other vacant assets without the repurchase. Of course this begs the question: "who's buying?"

Let me tell you a little story about the early 90s

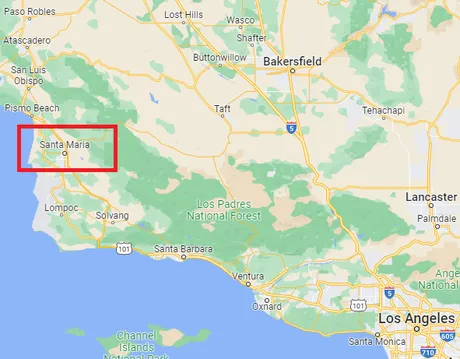

When I was just a wee lad my parents bought a nice place in a small town on the coastline called Santa Maria. Everything was going good. The backyard was mostly sand but my dad didn't mind much. He even did a ton of landscaping by himself on his own dime. Handy guy, my dad.

Of course I'm just now realizing that my dad doing landscaping on top of our sandy backyard was probably illegal... because we had an endangered species back there called "glass snakes"... which as it turns out are actually technically "legless lizards". Pretty weird, huh? Look it up.

Actually my dad is an insufferable rule follower... which is probably why I'm the opposite way... so what he did probably wasn't illegal and I do remember we left a big chunk of the backyard as sand for our legless friends (although I honestly can't remember ever seeing one when left to my own devices). I did catch like 1000 regular lizards though. Trap and release. Tried to make them my pets a couple times but turns out wild lizards don't take to captivity well. They wouldn't eat so I had to release them every time. Ah memories!

Yup it's a flippin lizard bro; I don't make the rules.

Yup it's a flippin lizard bro; I don't make the rules.

The point of this dumb story...

There was a gigantic tech facility that got built in Santa Maria. I don't even remember what kind of tech lab it was. Probably something to do with computing and the Internet. I tried to look it up yesterday but I couldn't find it.

In any case what happened is that this tech facility went out of business and shut down. Because it was providing a massive number of jobs for the small town of Santa Maria (like 30%-50%) property values in the entire area took a huge shit when that happened, and my parents were totally fucked financially. Talk about centralization, amirite?

Again, this was another situation that could have easily been avoided by simply renting property. Most people don't think about this stuff because like me they were told to buy property and build equity ASAP no matter what. It's seriously not a good idea in a lot of situations. Now that Bitcoin exists... I get the feeling it's a TERRIBLE idea. Bitcoin is so much better for all the reasons I went over in my post earlier this week.

LOL and we haven't even talked about the other 3 factors.

Maintenance costs

What happens if your backyard floods?

What happens if your roof starts leaking?

What happens if there's an electrical problem?

What happens when you need new paint?

What about the foundation?

What are you gonna do? Call the landlord?

When you own the house you are the landlord so you have to pay for every single problem that goes wrong, so that's fun. Speaking of landlords: when your tenants don't pay you rent and squat on your property and won't leave... it can take up to six months to legally kick them out... all the while they're not paying rent. And you can be damn sure when you do get the property back it's going to be trashed and you'll have to pay even more to get it cleaned up and ready for the next customer that may or may not pay you. Fun times.

We already talked about interest rates...

So what about the last variable? It costs a lot of money to afford a down-payment on a house loan. How long does that take? It can be anywhere from 5%-20% of the total price. If you're buying a $500k property in California a down payment might cost $100k upfront. OUCH! What? The silver lining is the more you pay upfront the lower your total interest payment is going to be.

Conclusion

At first when I calculated that I had spent $100k over the last 20 years on rent I felt like I had somehow swindled myself. However, after doing the math it becomes quite clear that it's very possible I dodged quite a few bullets in avoiding home ownership. There are a vast number of advantages to renting even though if we rent we are building up zero equity for ourselves and 100% of what we pay is a completely sunk cost.

I keep telling my girlfriend that when crypto goes x100 I'll basically be forced to take long-term capital gains and buy us a house straight up. This avoids the need for a bank loan and interest altogether, which eliminates a lot of the problems with homeownership. I asked her if I could take out a loan against the house during a bear market to buy back into the market and she said... "no". LOL, that's fair I guess. Safe play is safe.

I would never recommend buying property as an investment anymore. The only reason to buy property this day in age is if you're actually going to use it. For the most part I believe hedge funds and these chronically low interest rates have ruined the market. However, there very well may come a time in the near future where crypto pumps and real estate dumps, creating the perfect opportunity to trade crypto back into real estate. If this occurs it would be foolish not to jump on such a happenstance.

Posted Using LeoFinance Beta

Return from Renter || Buyer to edicted's Web3 Blog